Security of supply during the energy transition

Evaluating the adequacy of the Dutch energy system during the transition to a zero carbon energy system in a realistic scenario

Master Thesis. By: B.C. van Nobelen. Date: 2022-09-23

Popularity: 15 info

Academic Rigor: 7 info

547 views. 381 downloads. 14 likes. 6 bookmarks. 2 citations.

Advanced Statistics...

Pitch

The renewable energy transition is coming! Which capacity remuneration mechanism would deliver the highest level of security of supply? Multiple simulations are ran. The results show 0-carbon emissions won't be reached in 2050 without government interference; No shortage hours will occur in an energy-only market; The basic strategic reverse is the cheapest and sufficient; And the best option for security of energy supply is a yearly capacity market.

Keywords

Author

Electrical Engineering, Mathematics and Computer Science, Pattern Recognition and Bioinformatics

Research output: 7; Citations: 4

- Skills (via linkedIn):

- Python

- Dutch, (Native or Bilingual)

- English, (Full Professional)

- German (Professional Working)

- Experience (via linkedIn):

- Energietalenten: Ambassador of the energy transition september 2020 - Present (2 jaar 1 maand)

- Skischule Serfaus: Ski instructor december 2021 - april 2022 (5 maanden)

- UniPartners Delft: Junior consultant mei 2020 - juli 2020 (3 maanden)

- Berenschot: Intern september 2019 - januari 2020 (5 maanden)

- KlasseStudent: Substitute Teacher 2018 - 2019 (1 jaar)

- Education (via linkedIn):

- TU Delft: MSc, Electrical Power Engineering februari 2020 - september 2022

- TU Delft: BSc, Electrical engineering september 2015 - november 2019

- TU Delft: Minor, Ondernemerschap: Technology-Based Entrepreneurship september 2017 - januari 2018

Contributors

Electrical Engineering, Mathematics and Computer Science, Pattern Recognition and Bioinformatics

Research output: 7; Citations: 4

Electrical Engineering, Mathematics and Computer Science, Pattern Recognition and Bioinformatics

Research output: 7; Citations: 4

Electrical Engineering, Mathematics and Computer Science, Pattern Recognition and Bioinformatics

Research output: 7; Citations: 4

Abstract

The climate change is evident and a big contributor to the negative effects of the climate change is the energy production sector. Therefore, the energy production must shift towards a more environment friendly mix. Changing our energy sources to mostly renewable energy sources comes with many challenges.

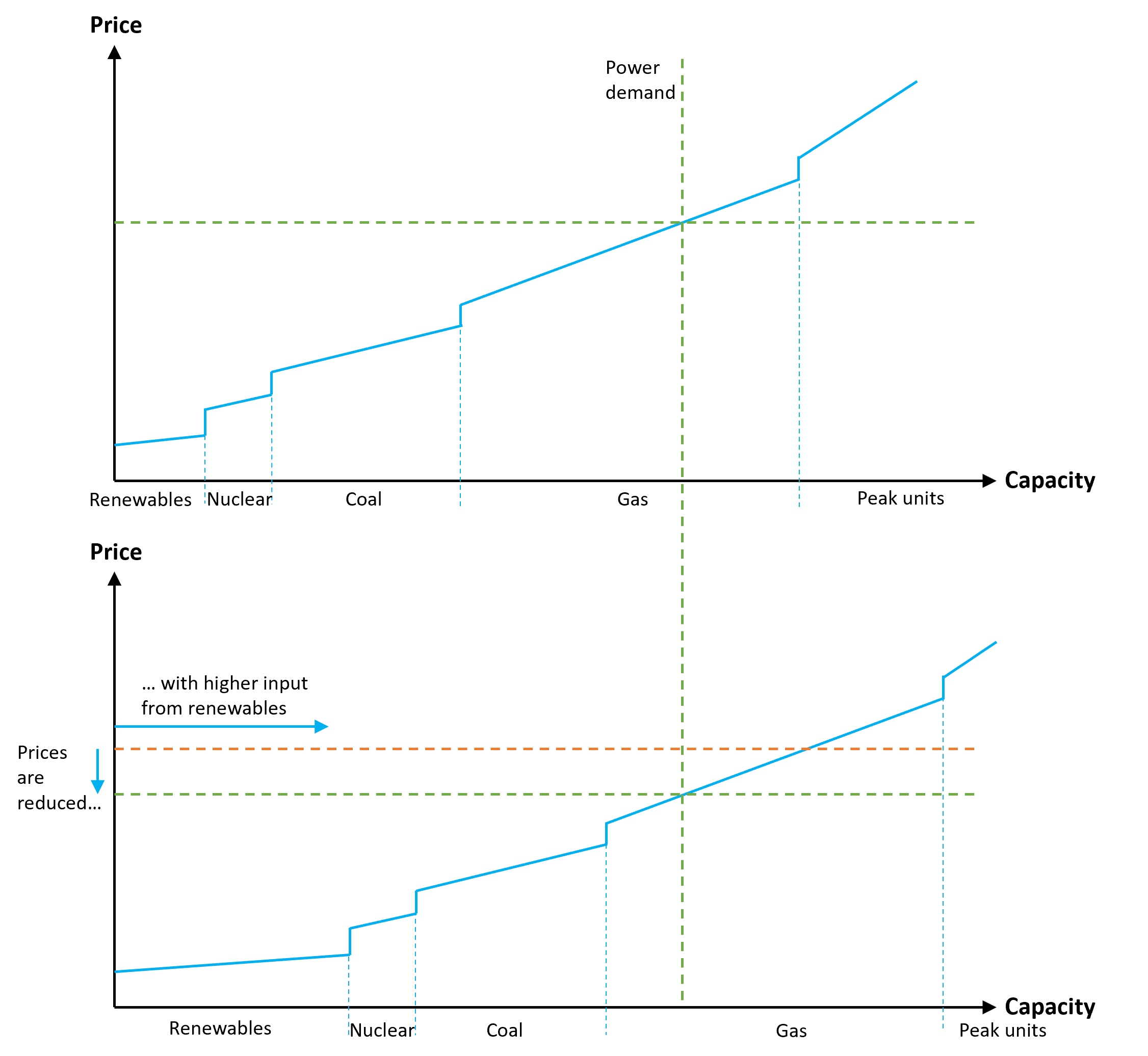

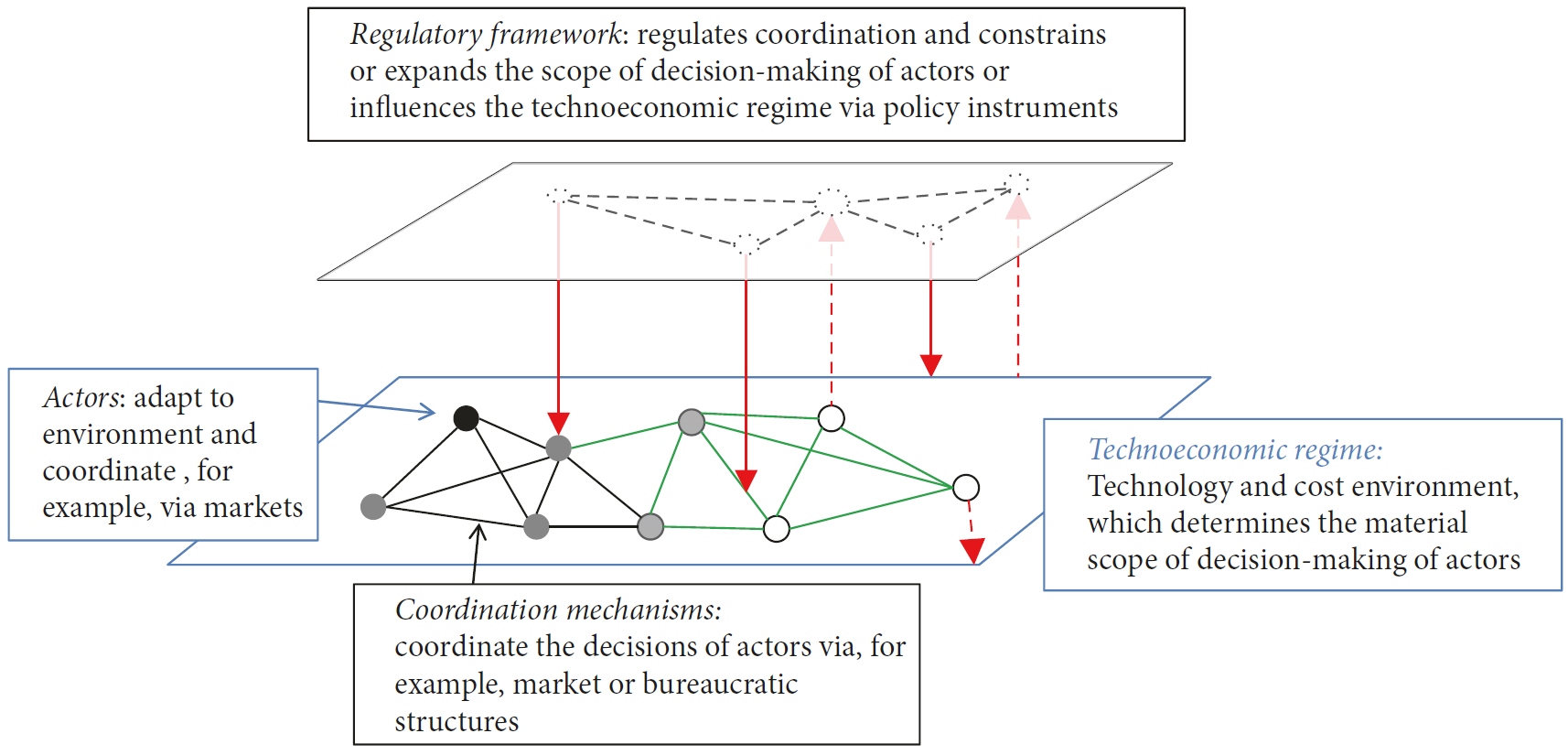

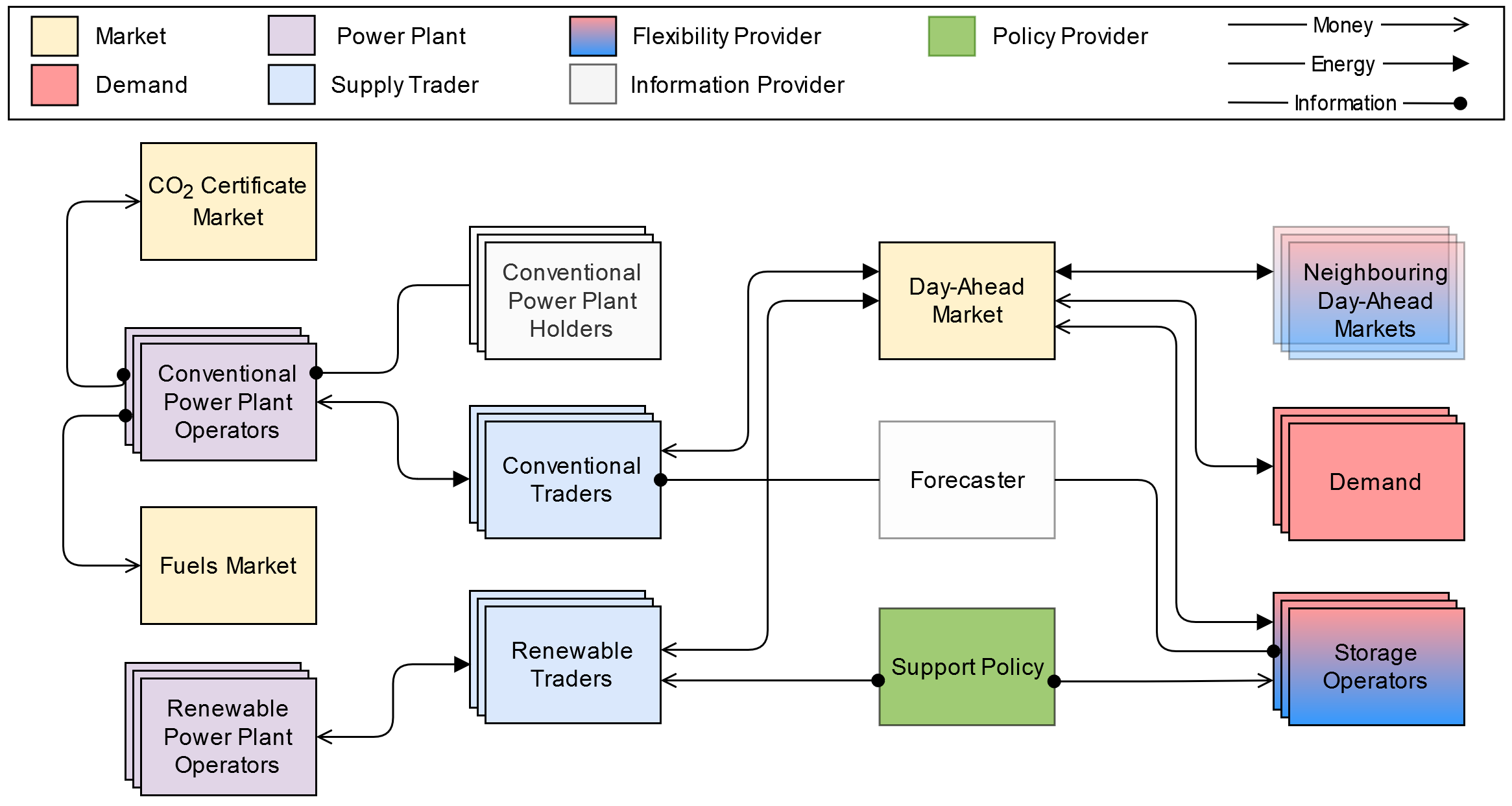

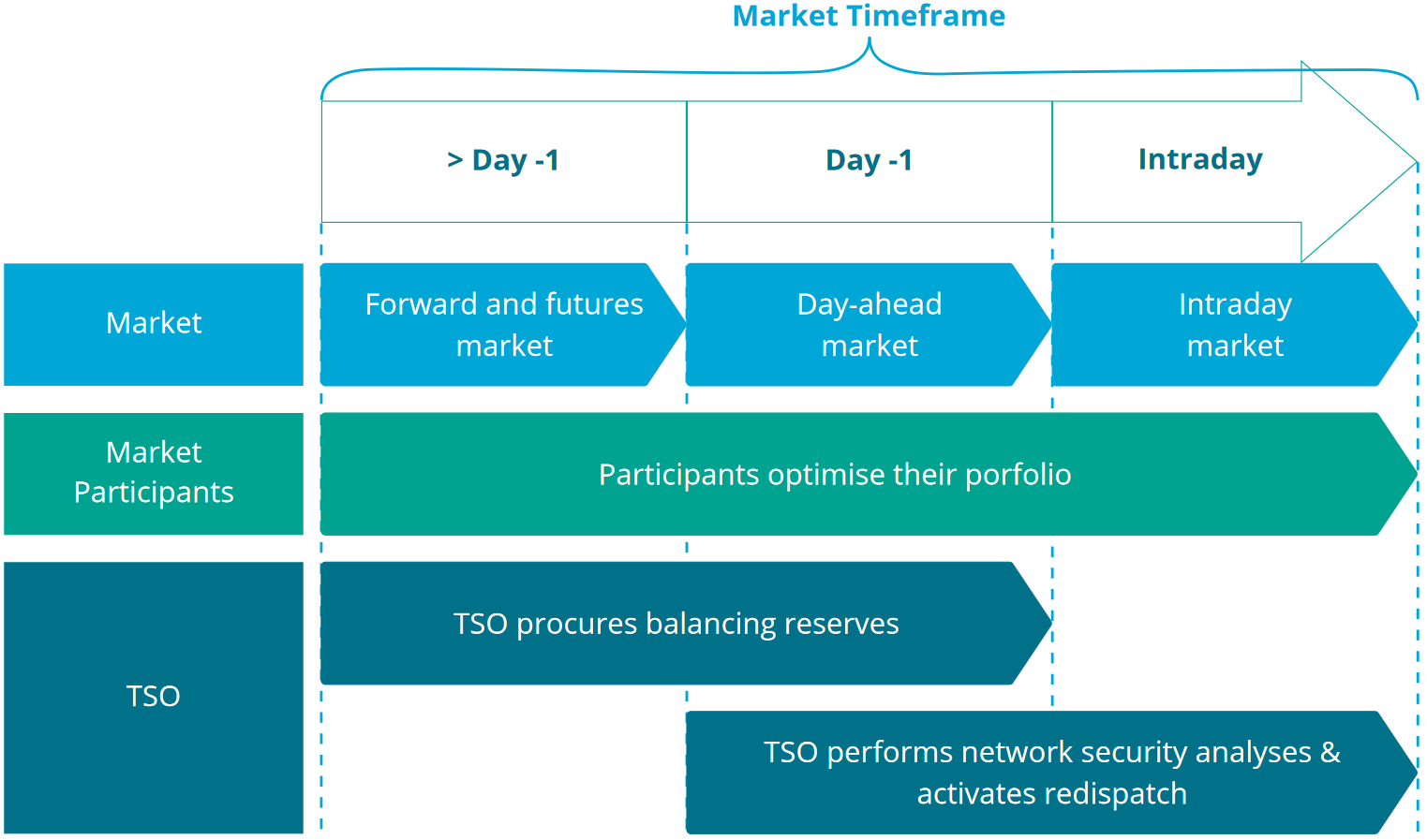

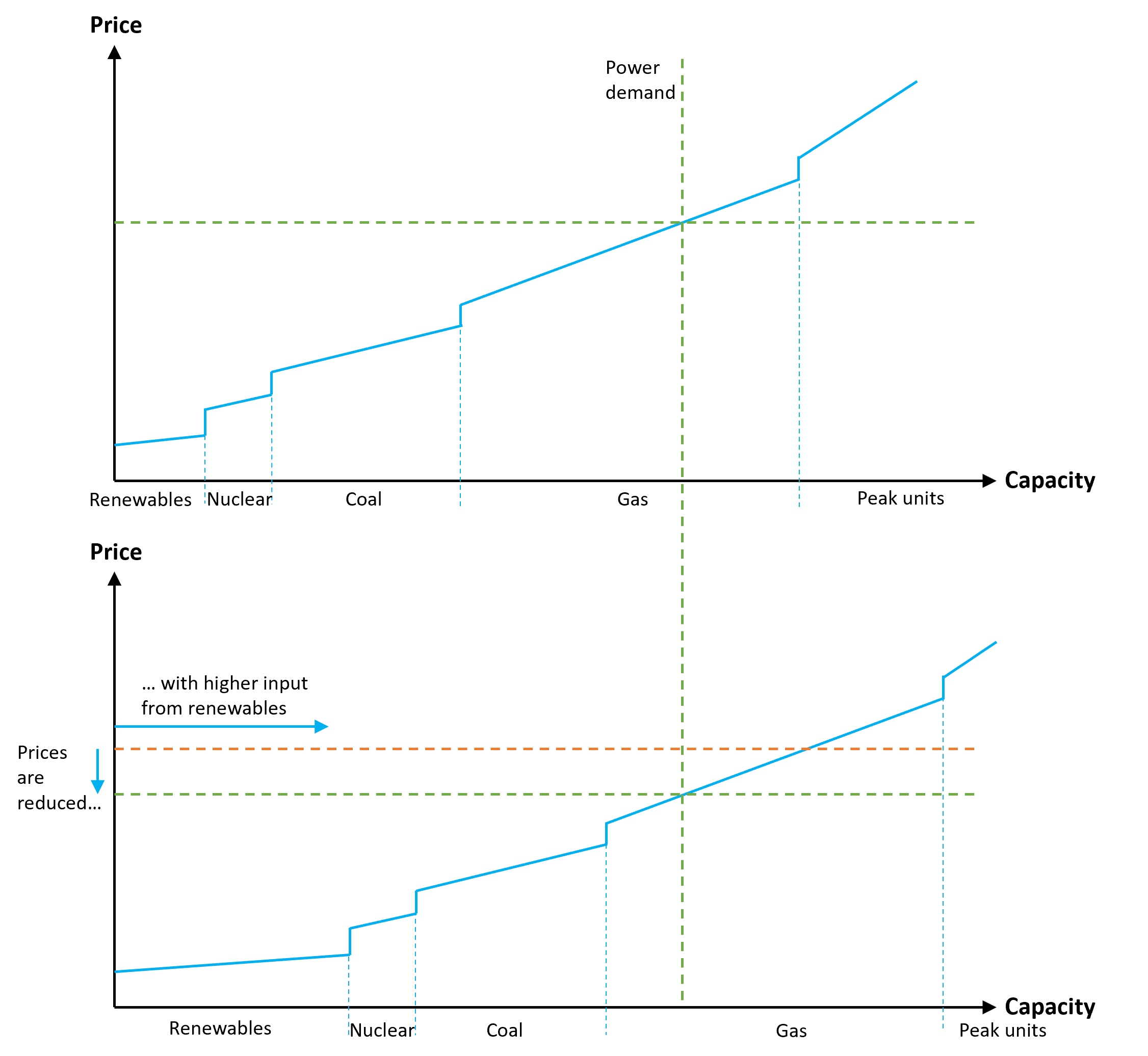

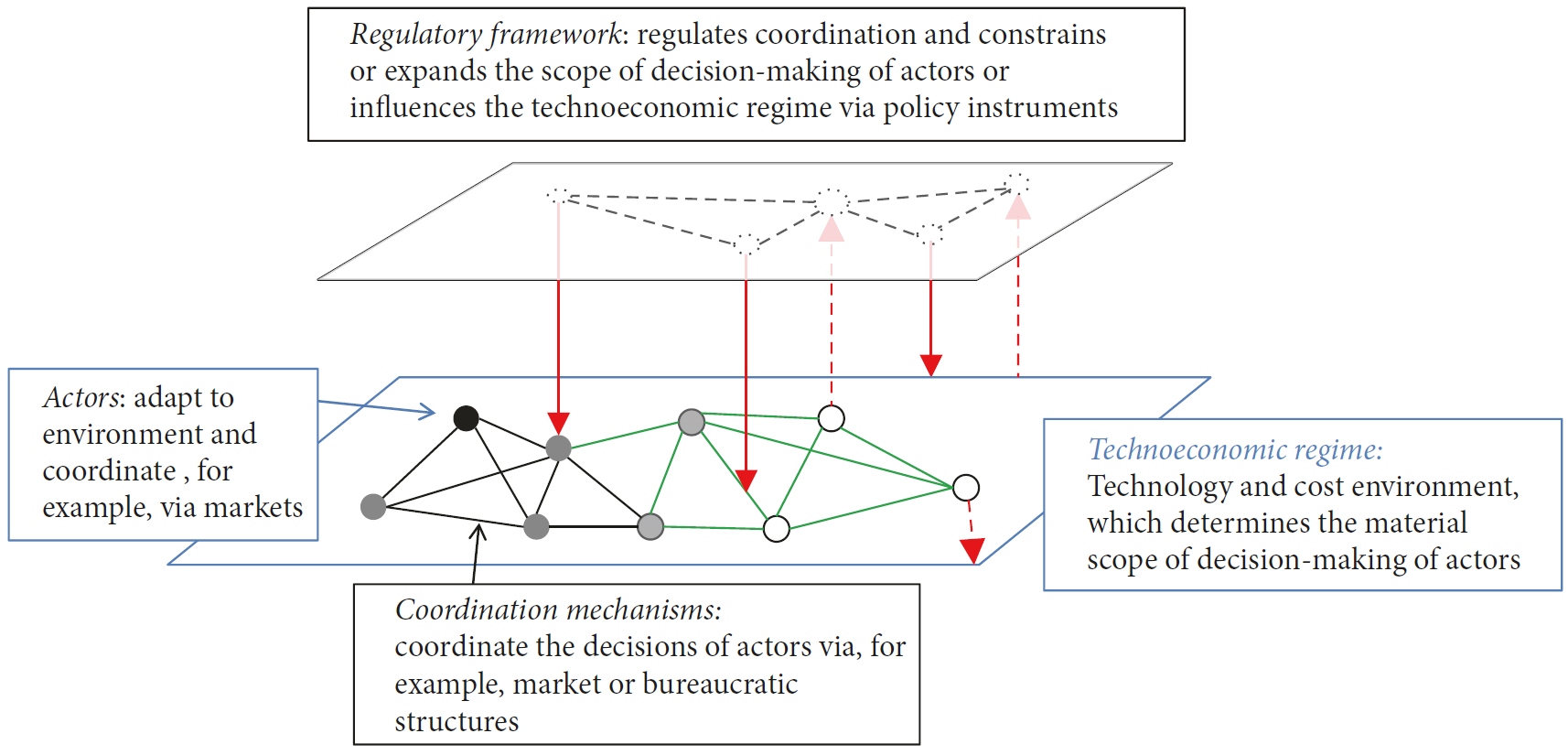

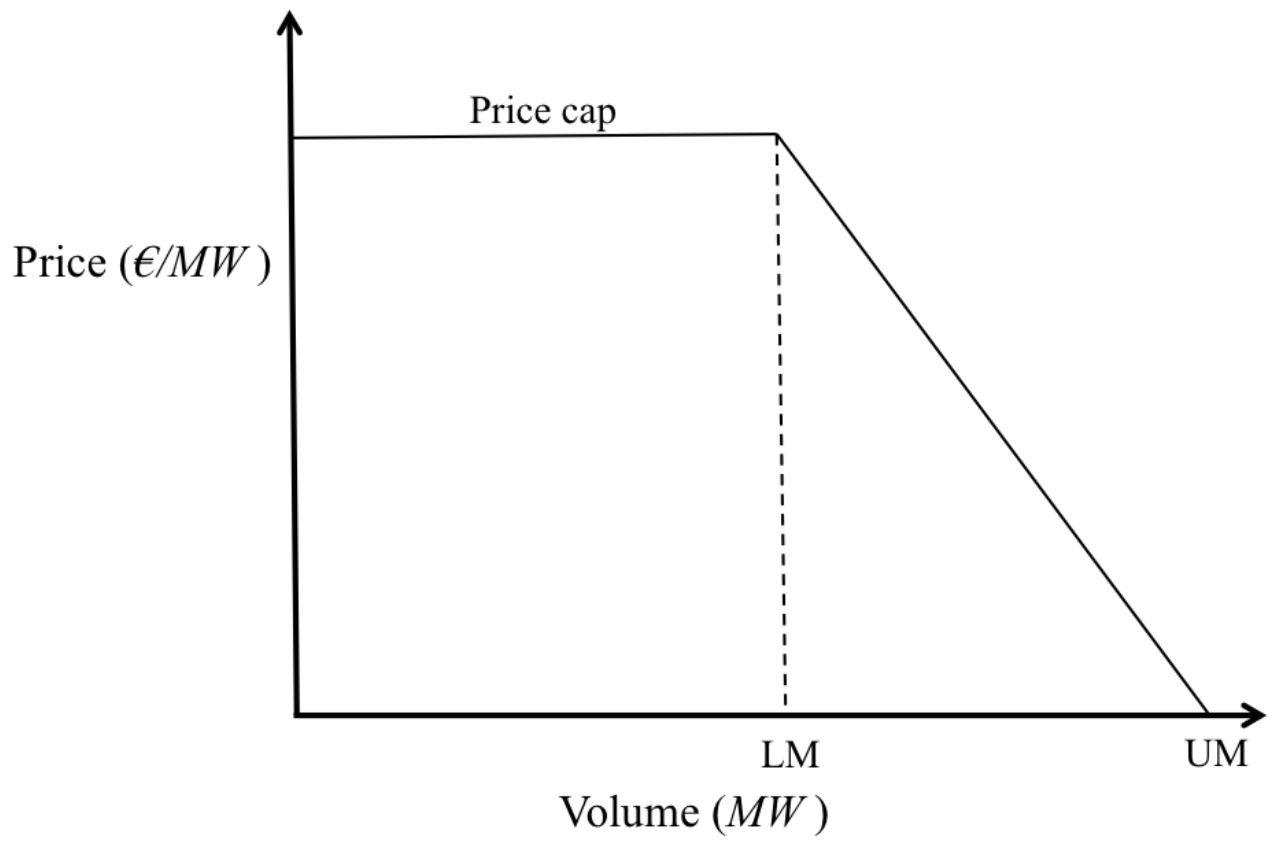

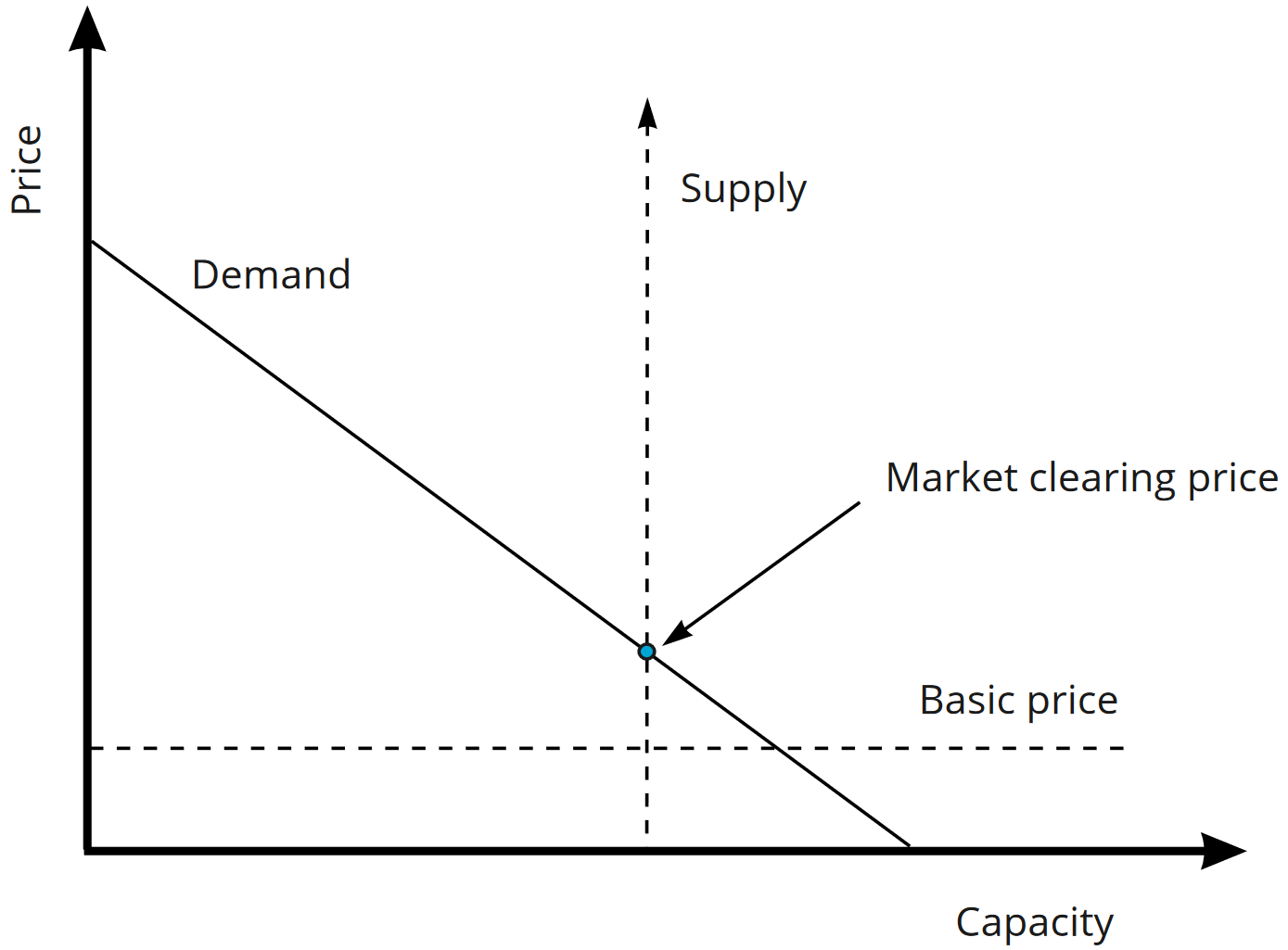

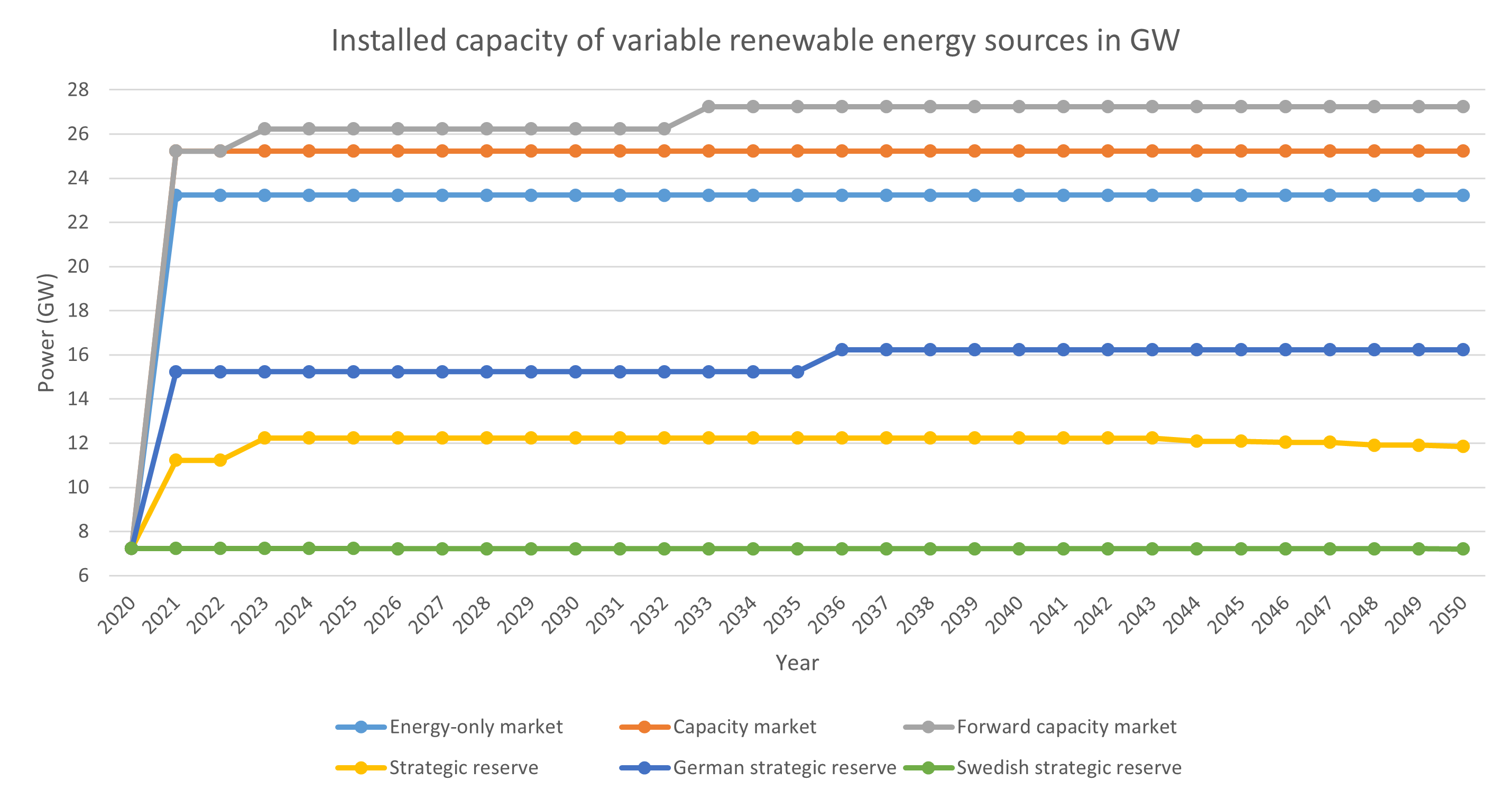

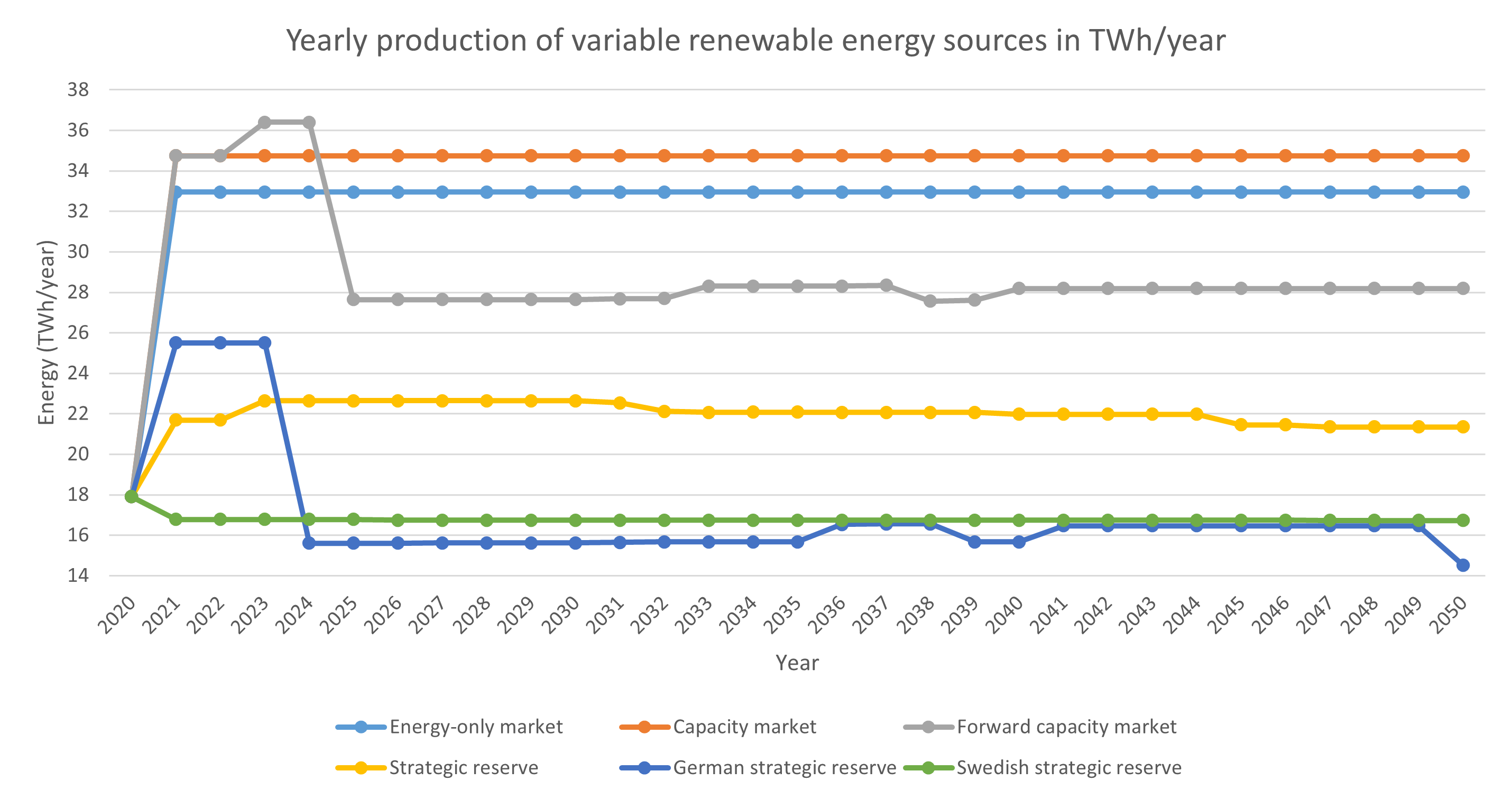

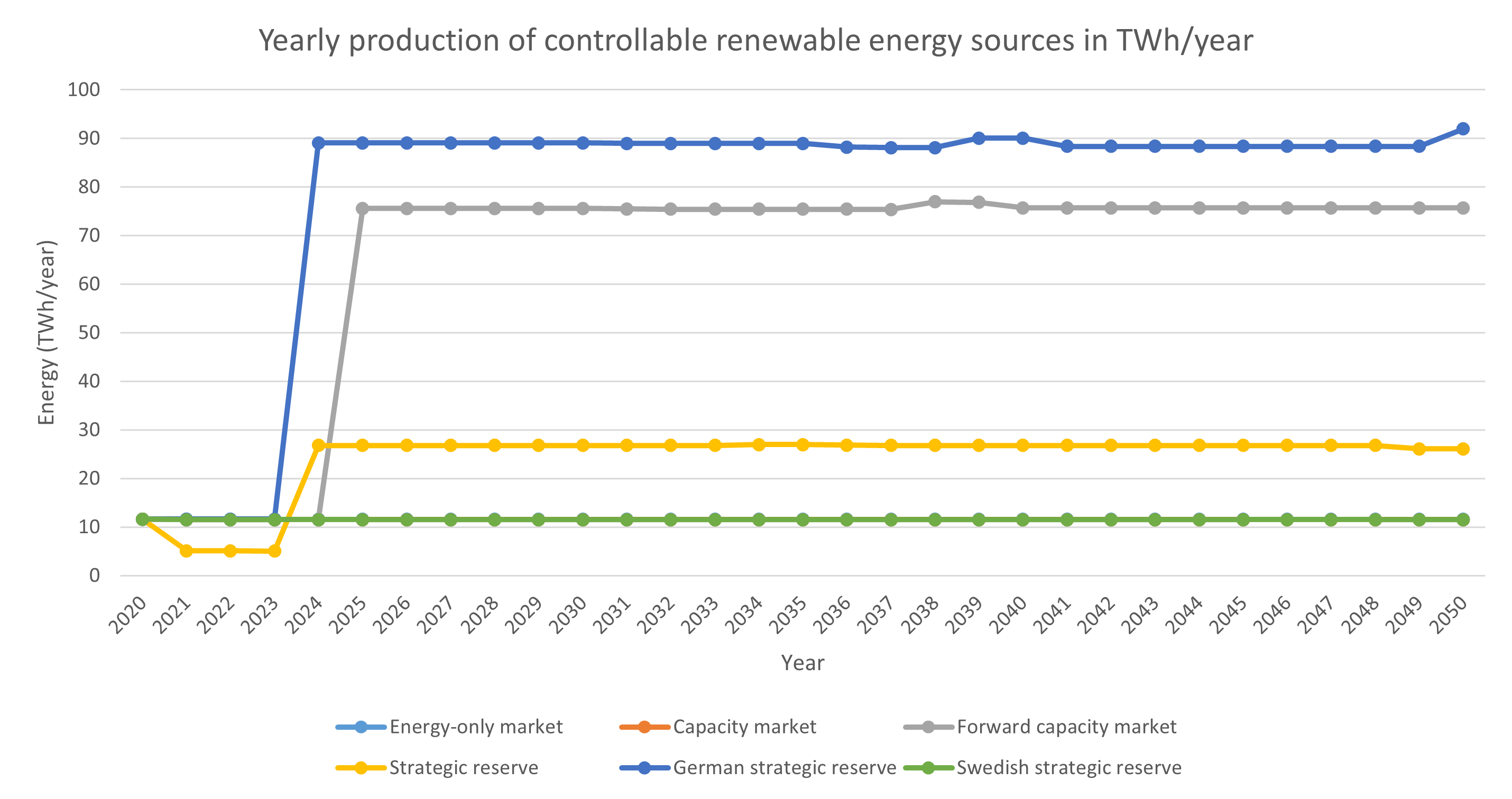

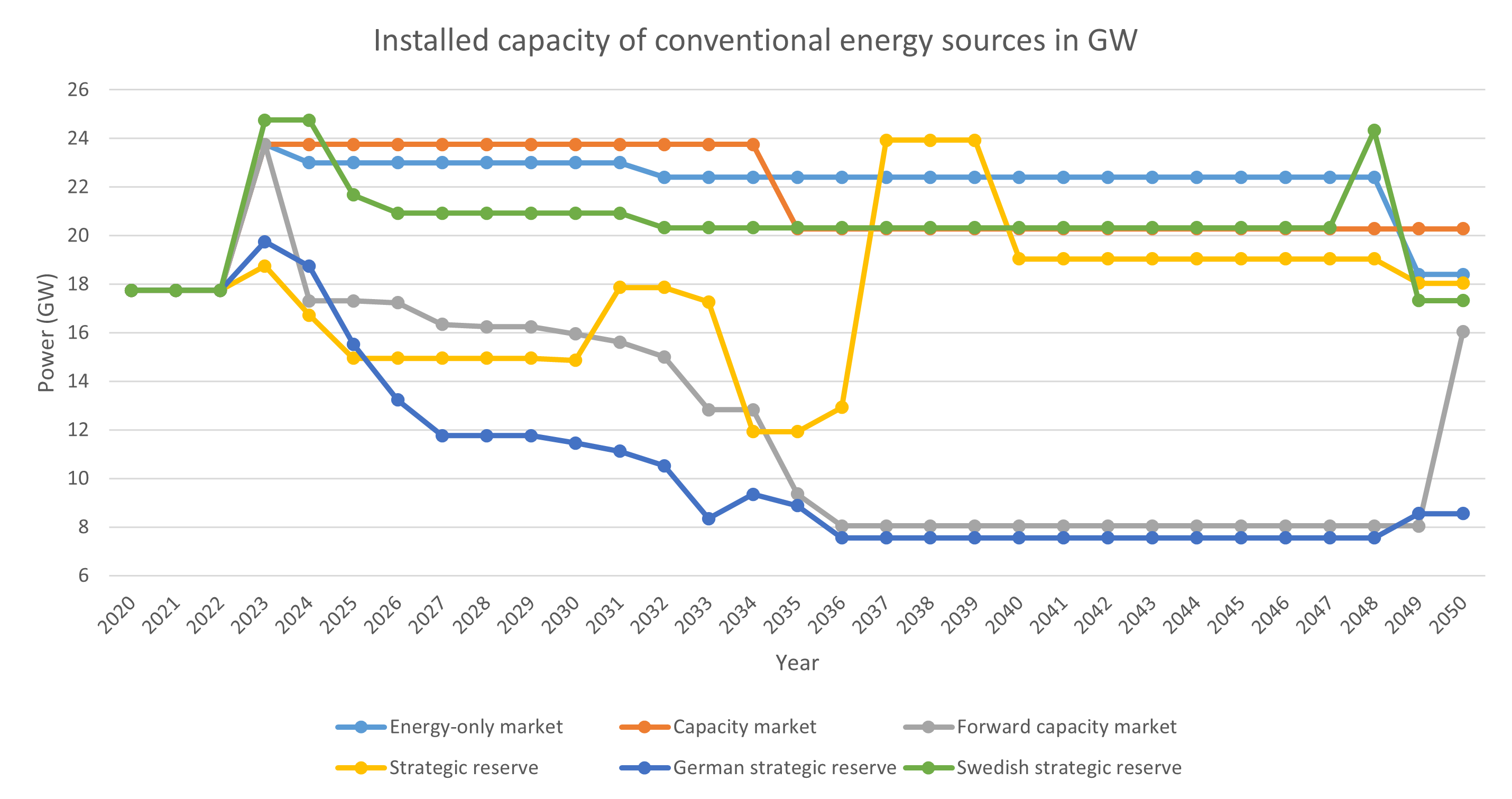

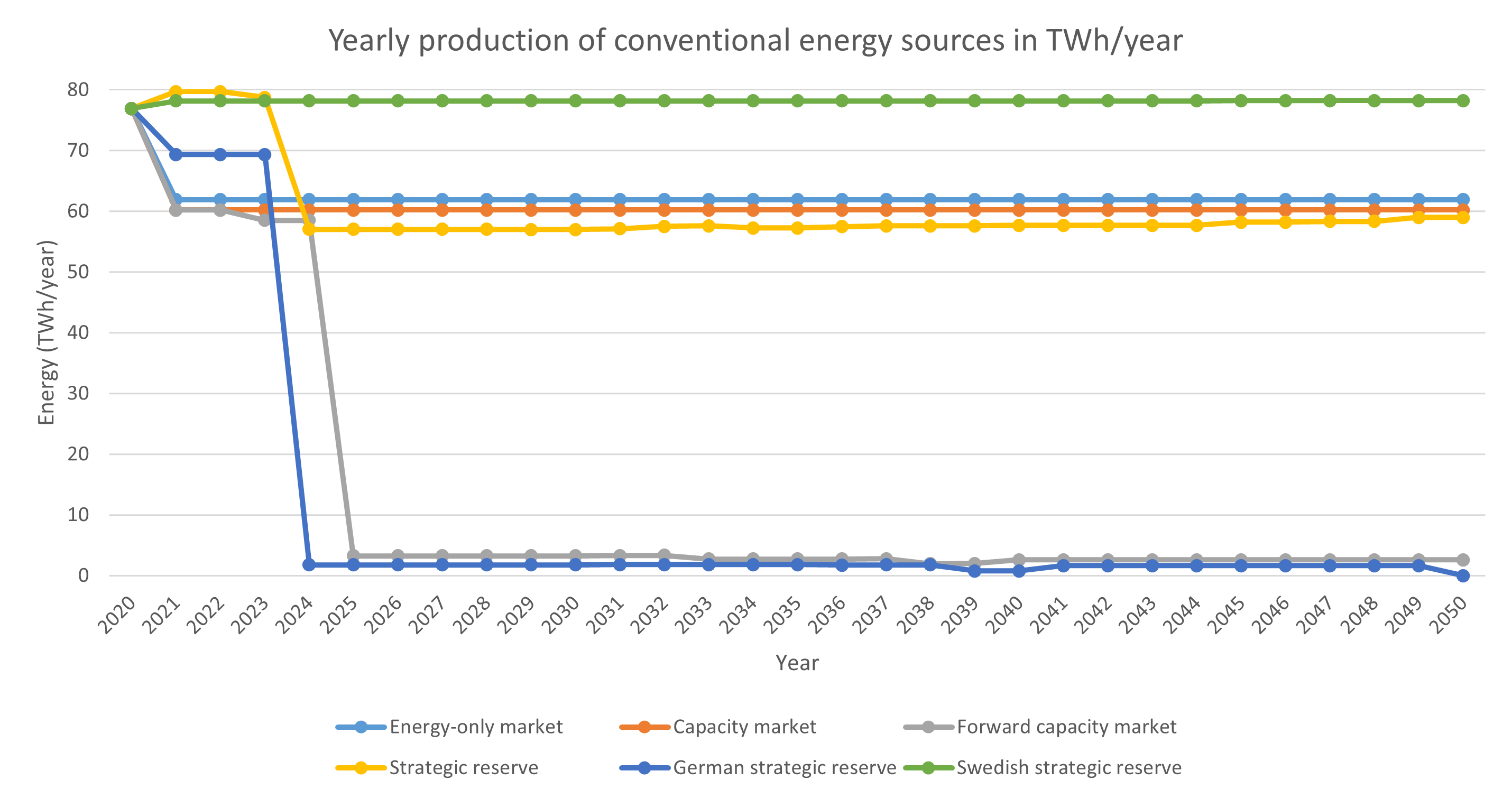

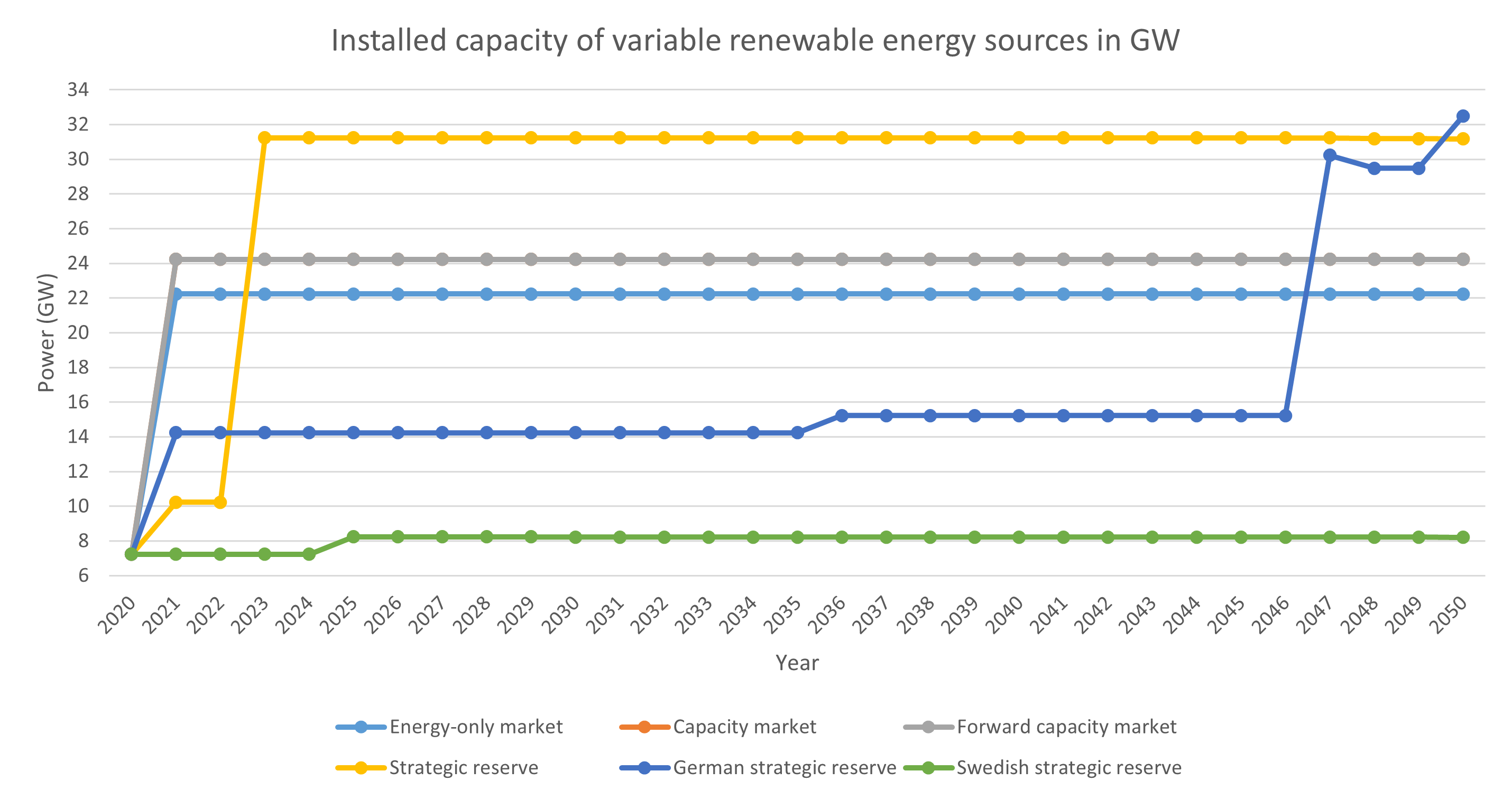

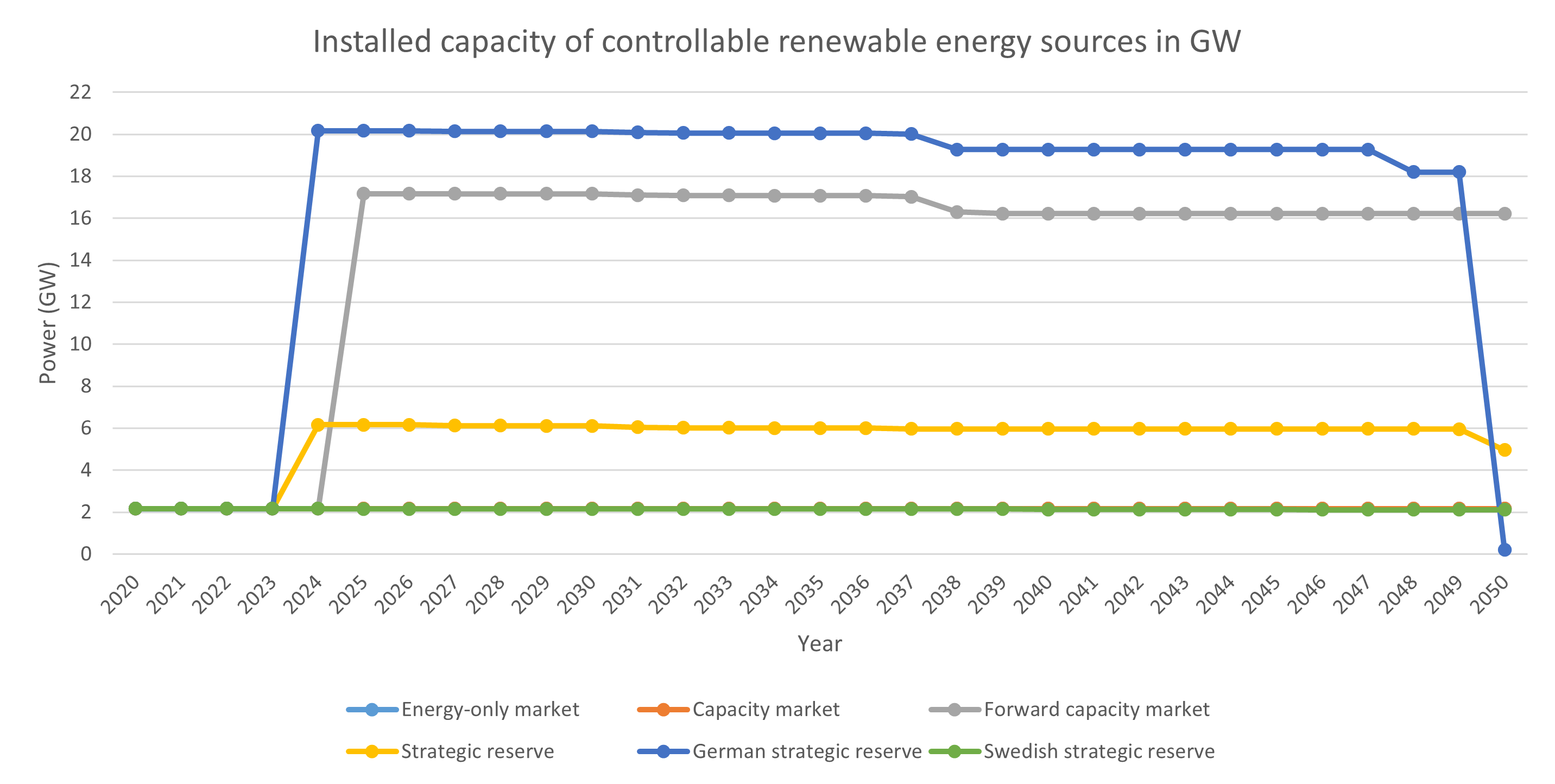

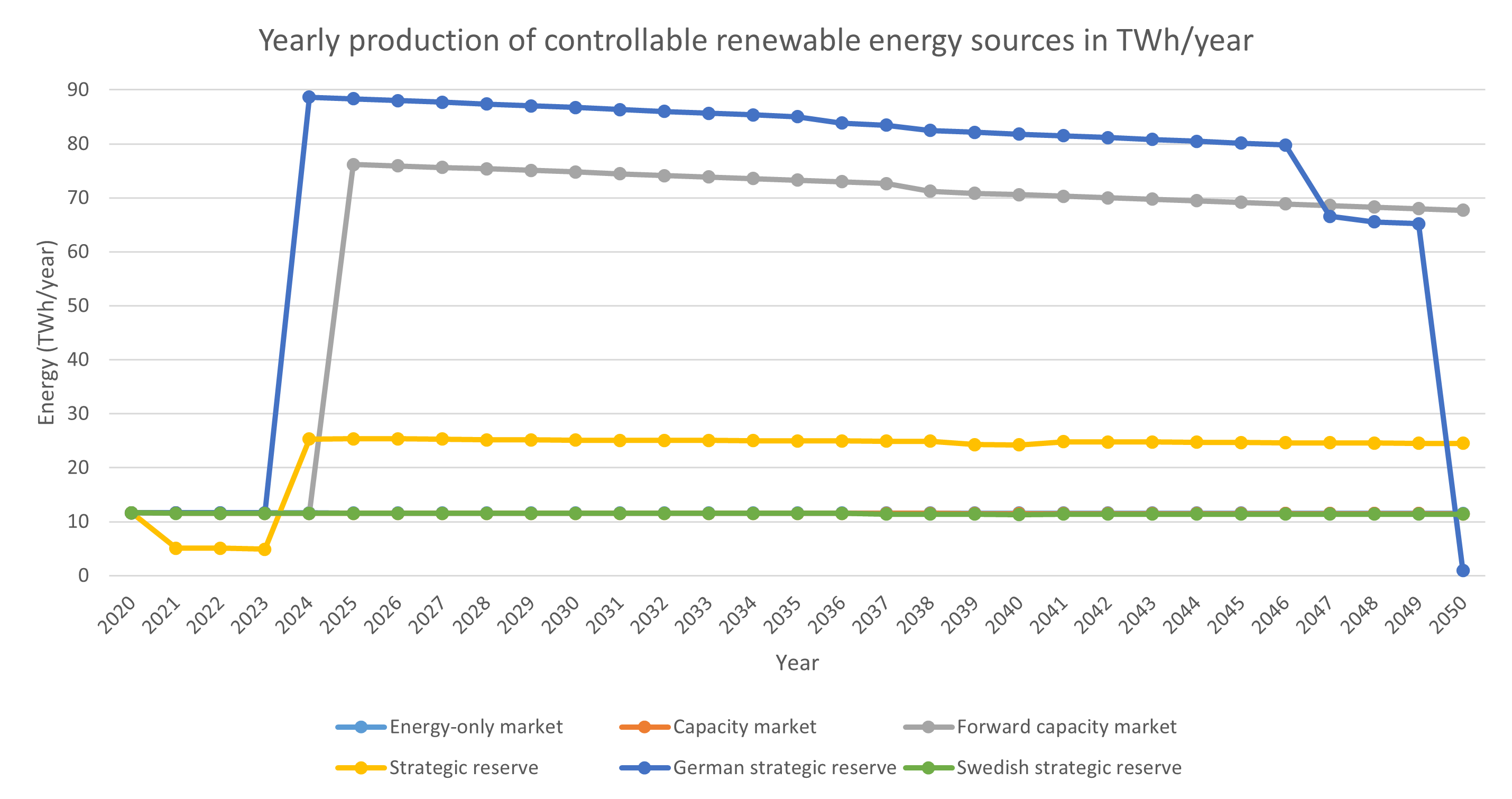

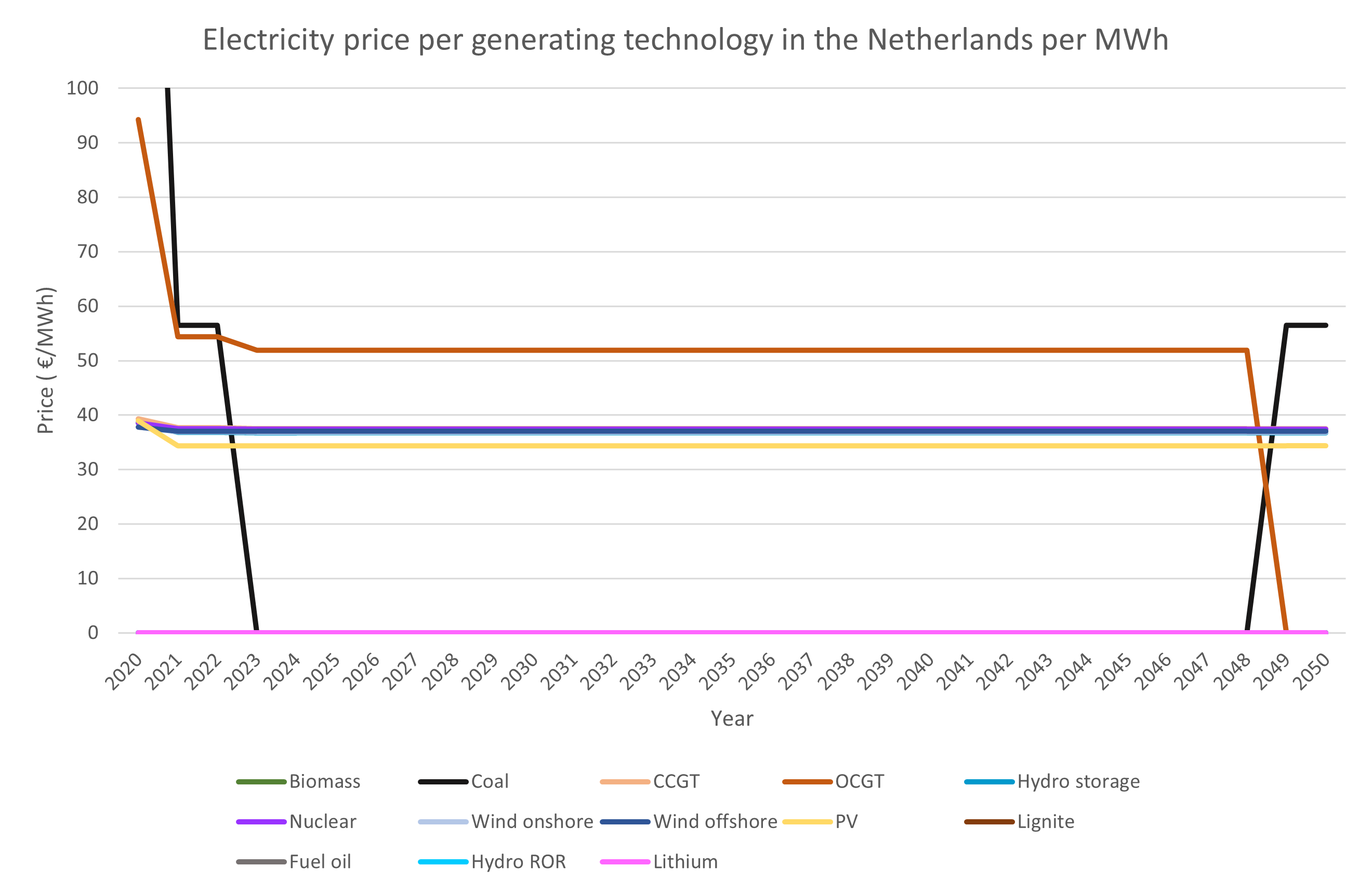

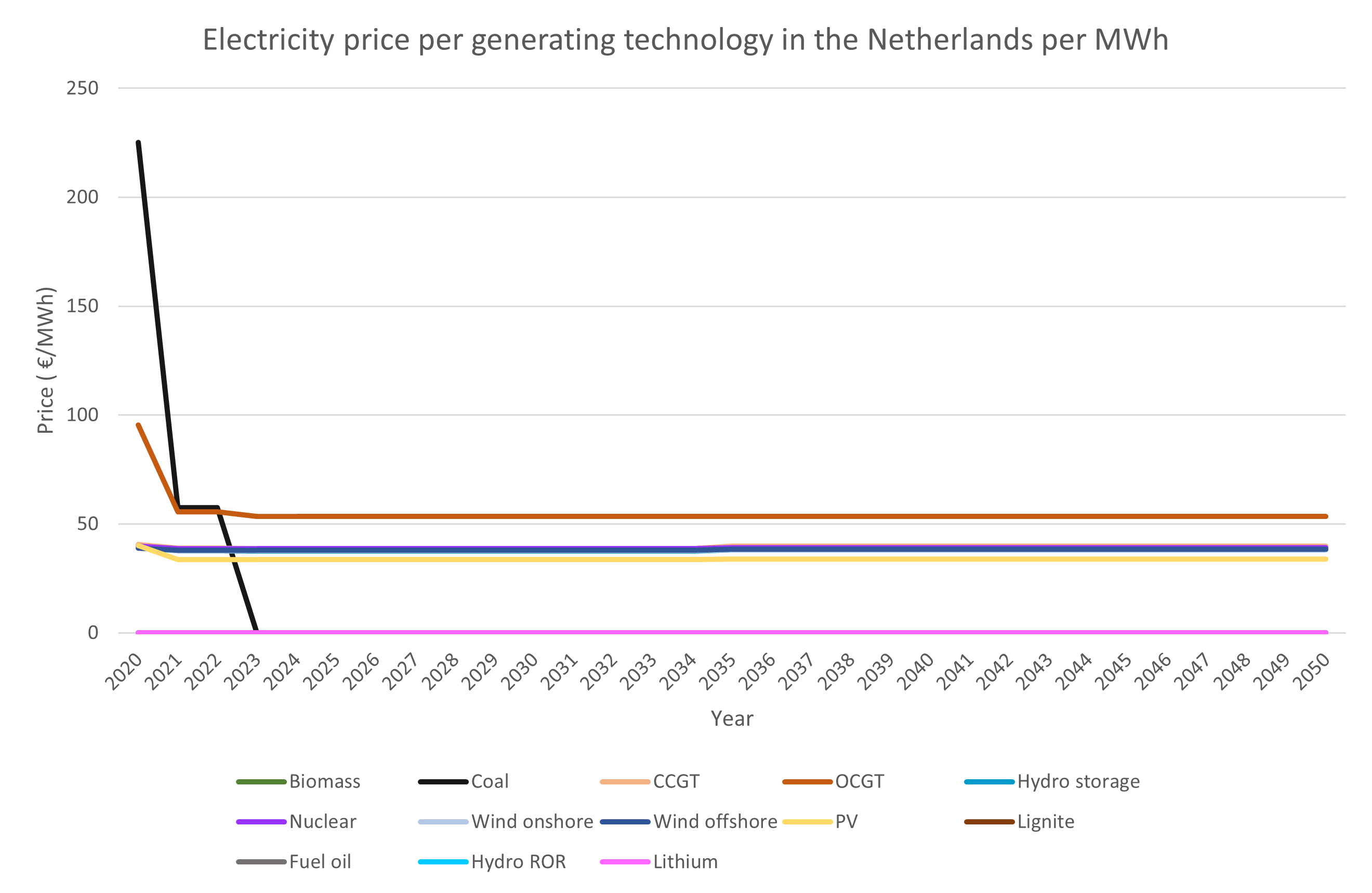

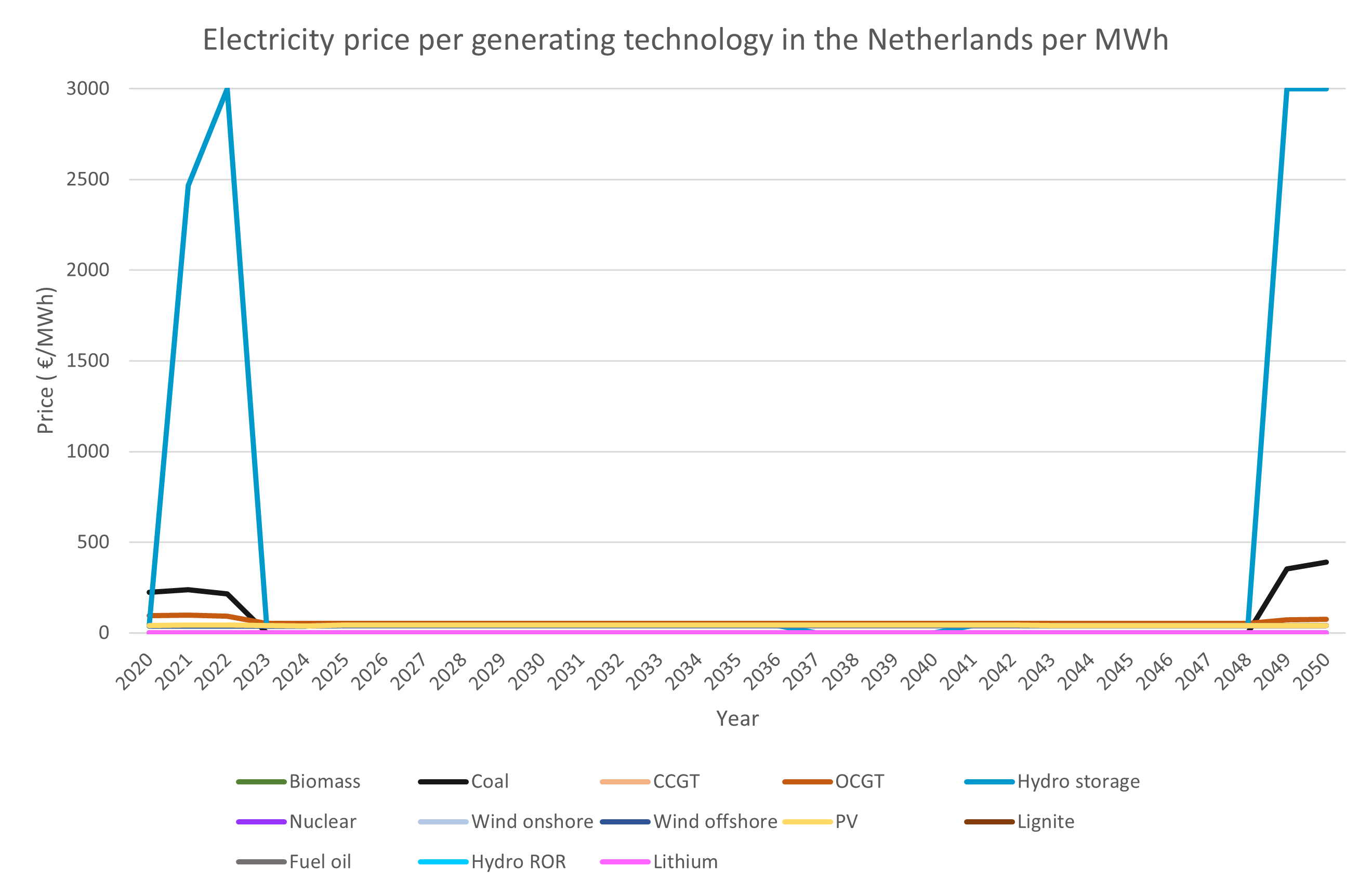

the market is penetrated with a high concentration of renewable energy sources. So the electricity market mechanism needs to be reformed to have a price determination system better suited for energy sources with low marginal costs. Furthermore, a capacity remuneration system needs to be implemented to create enough investment incentive in controllable energy capacity to maintain a high level of security of supply in the Dutch energy system during the energy transition.

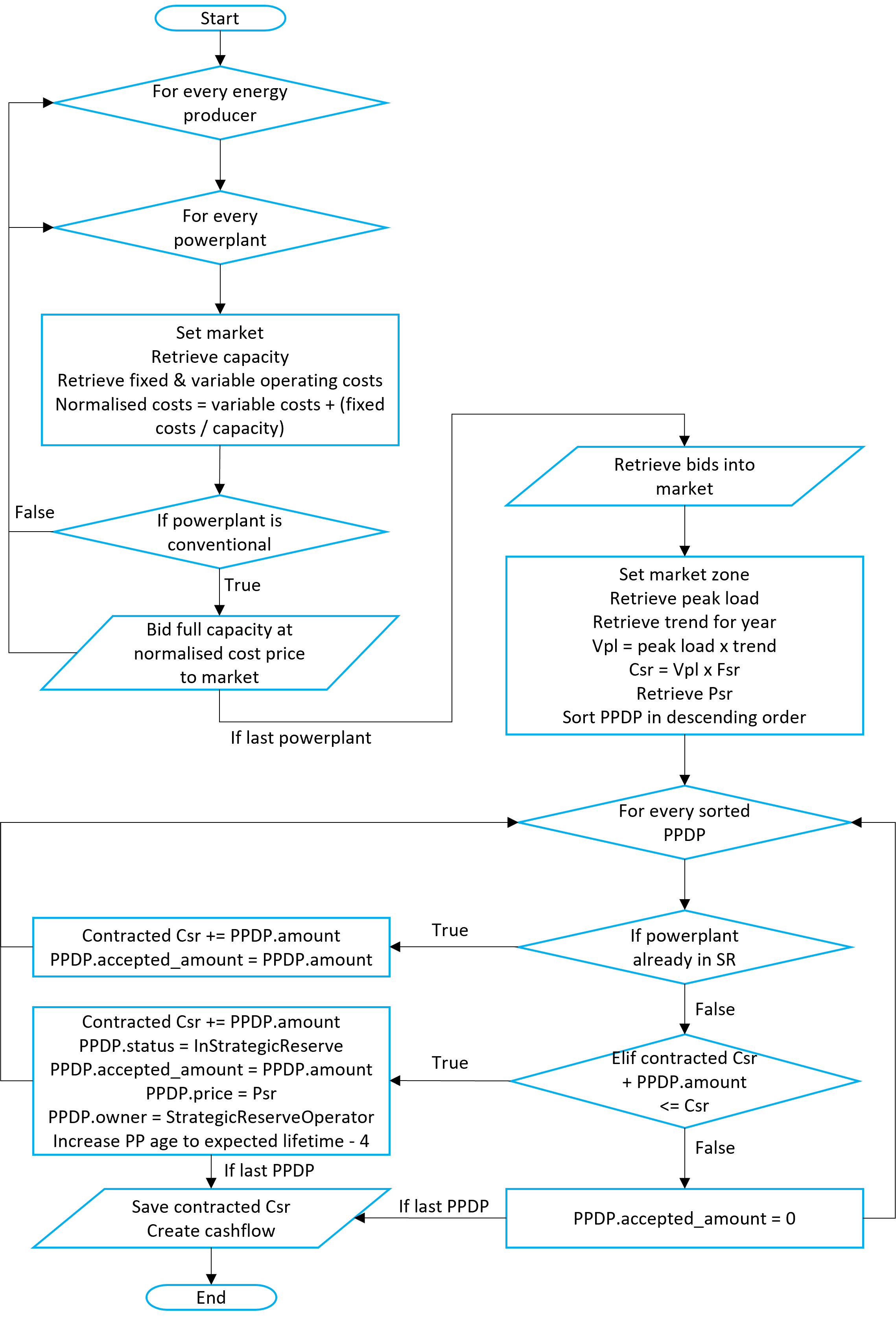

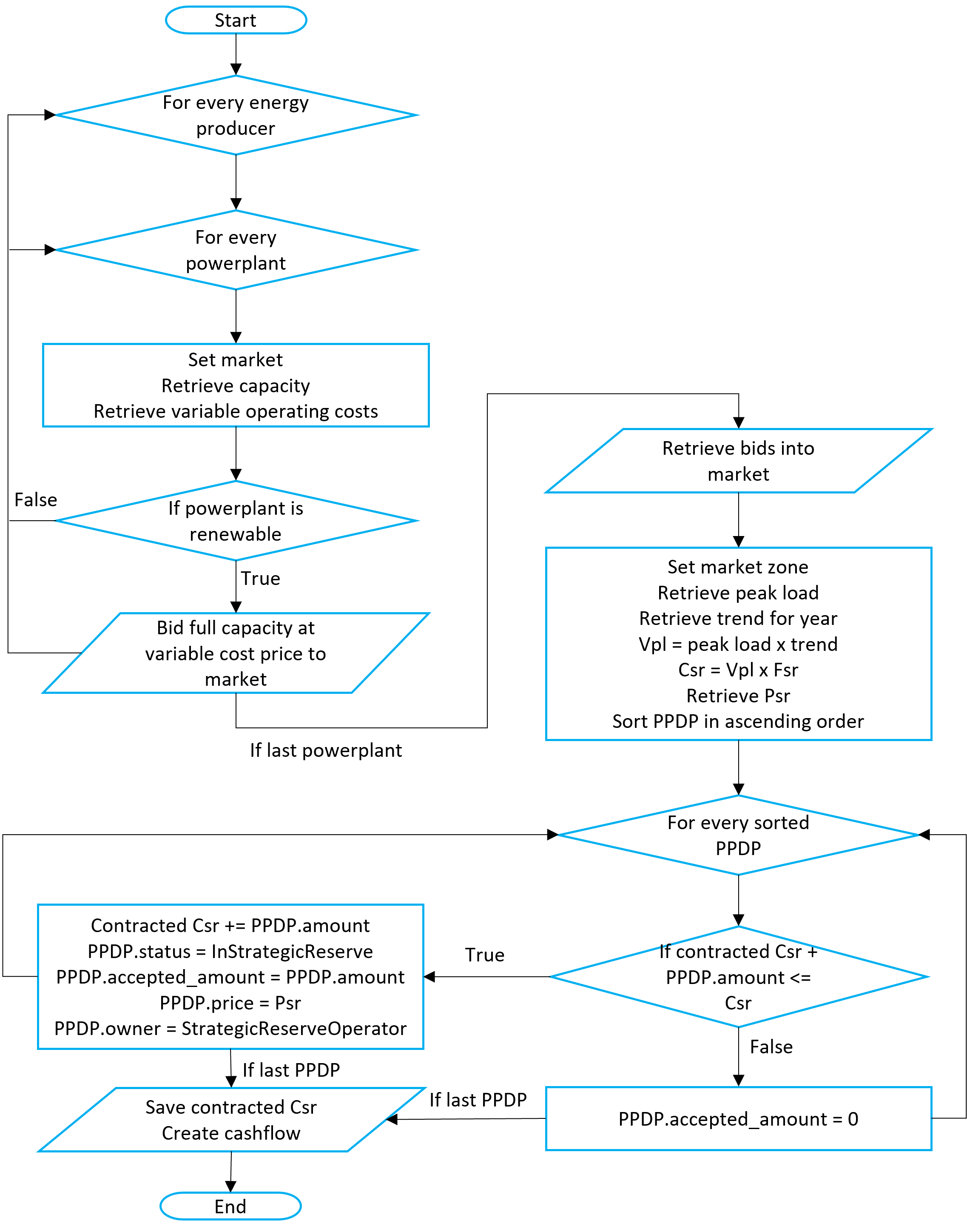

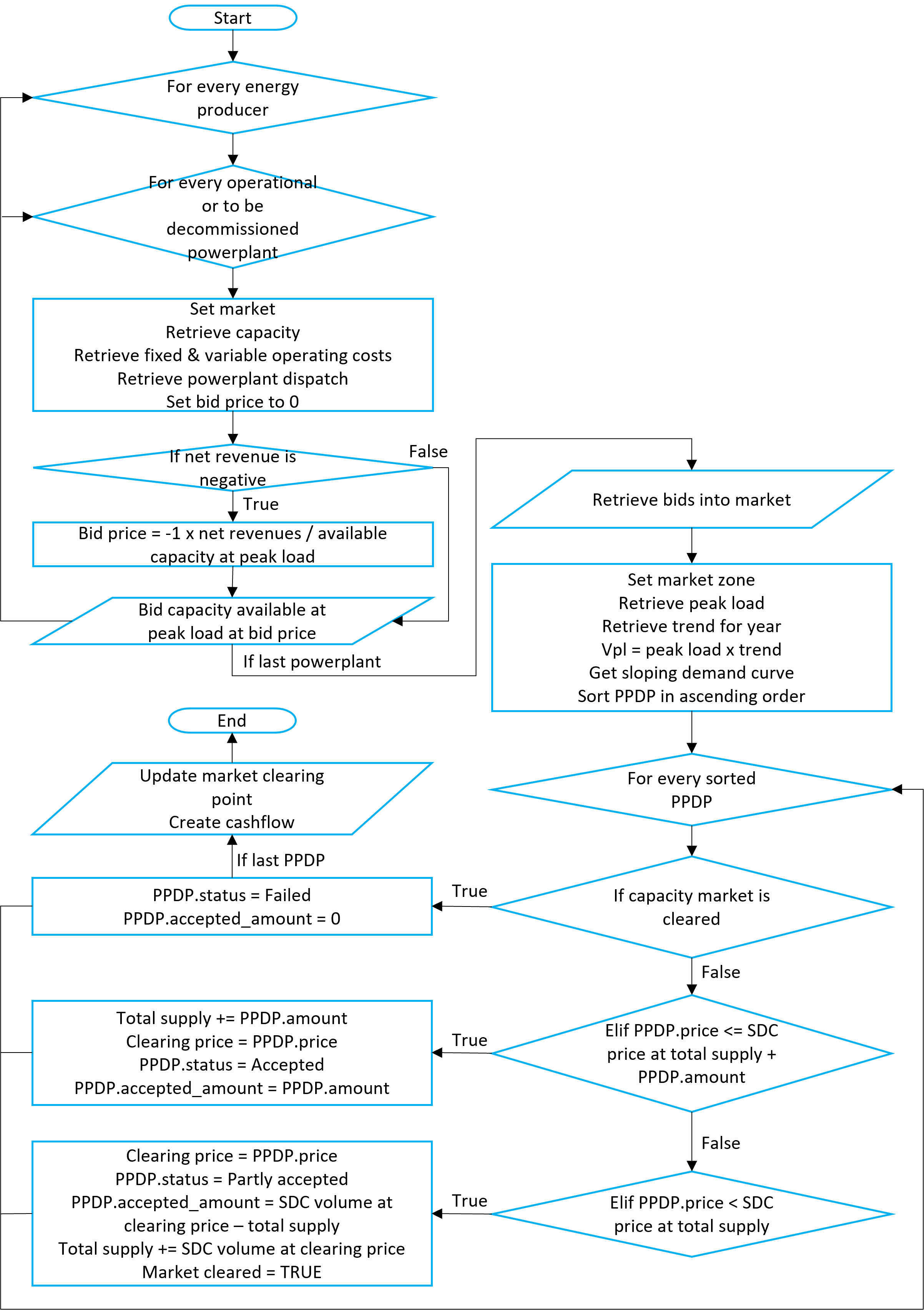

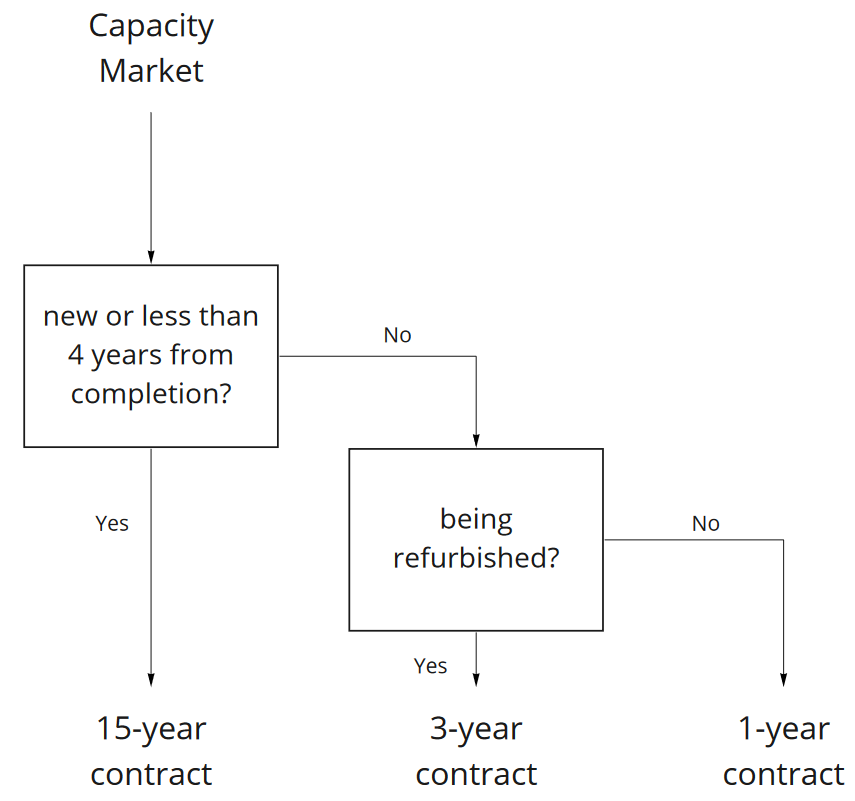

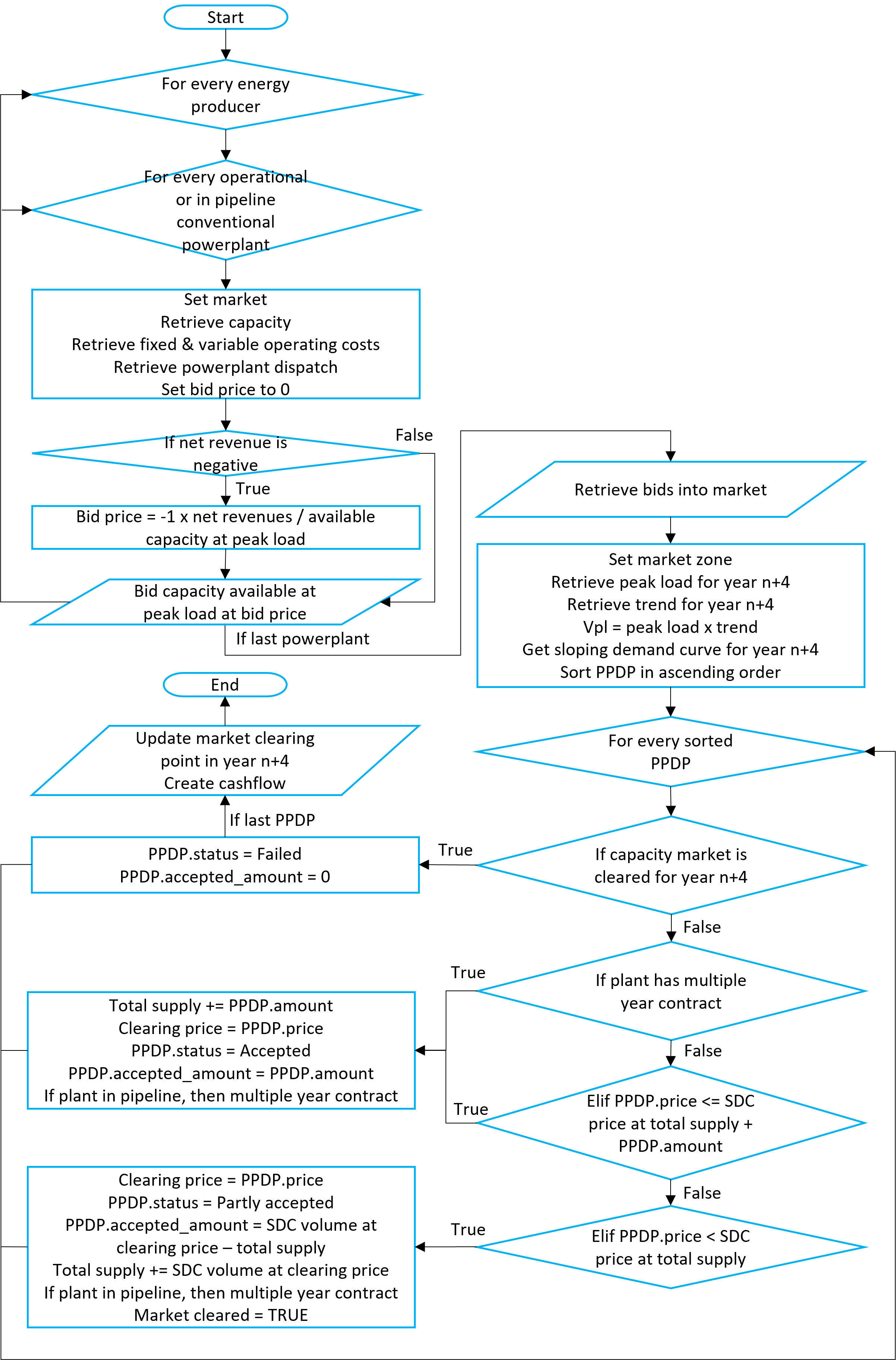

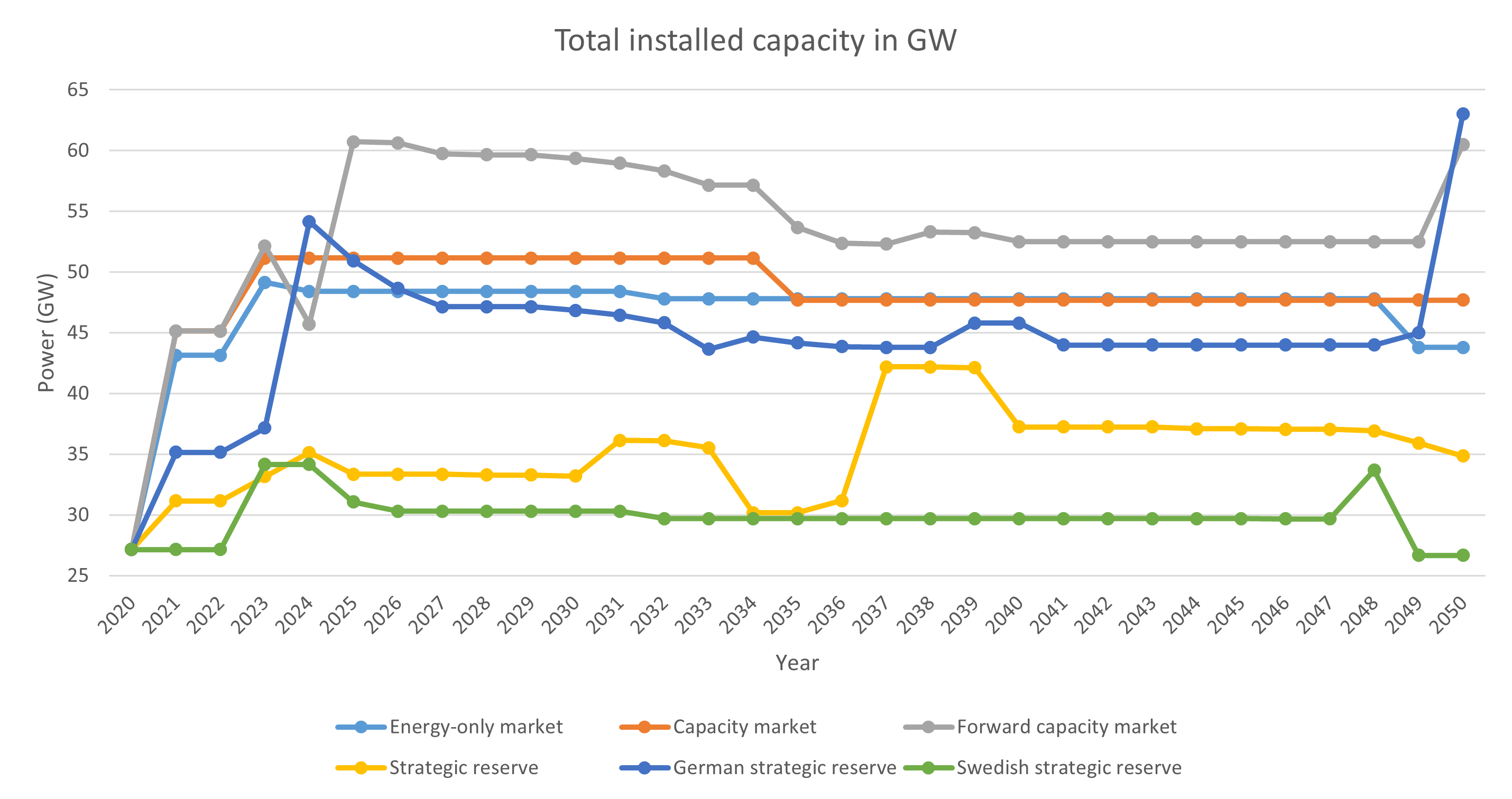

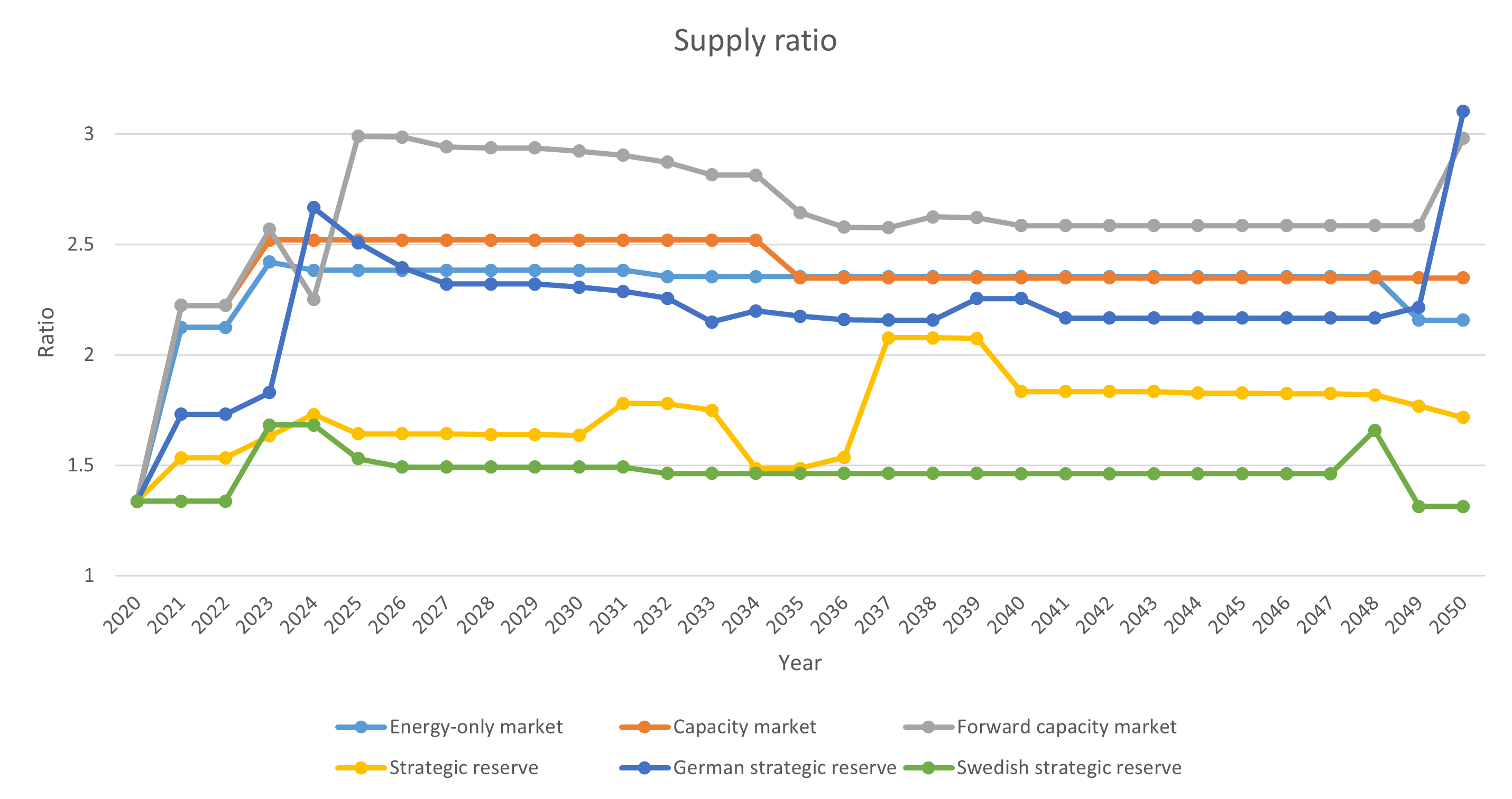

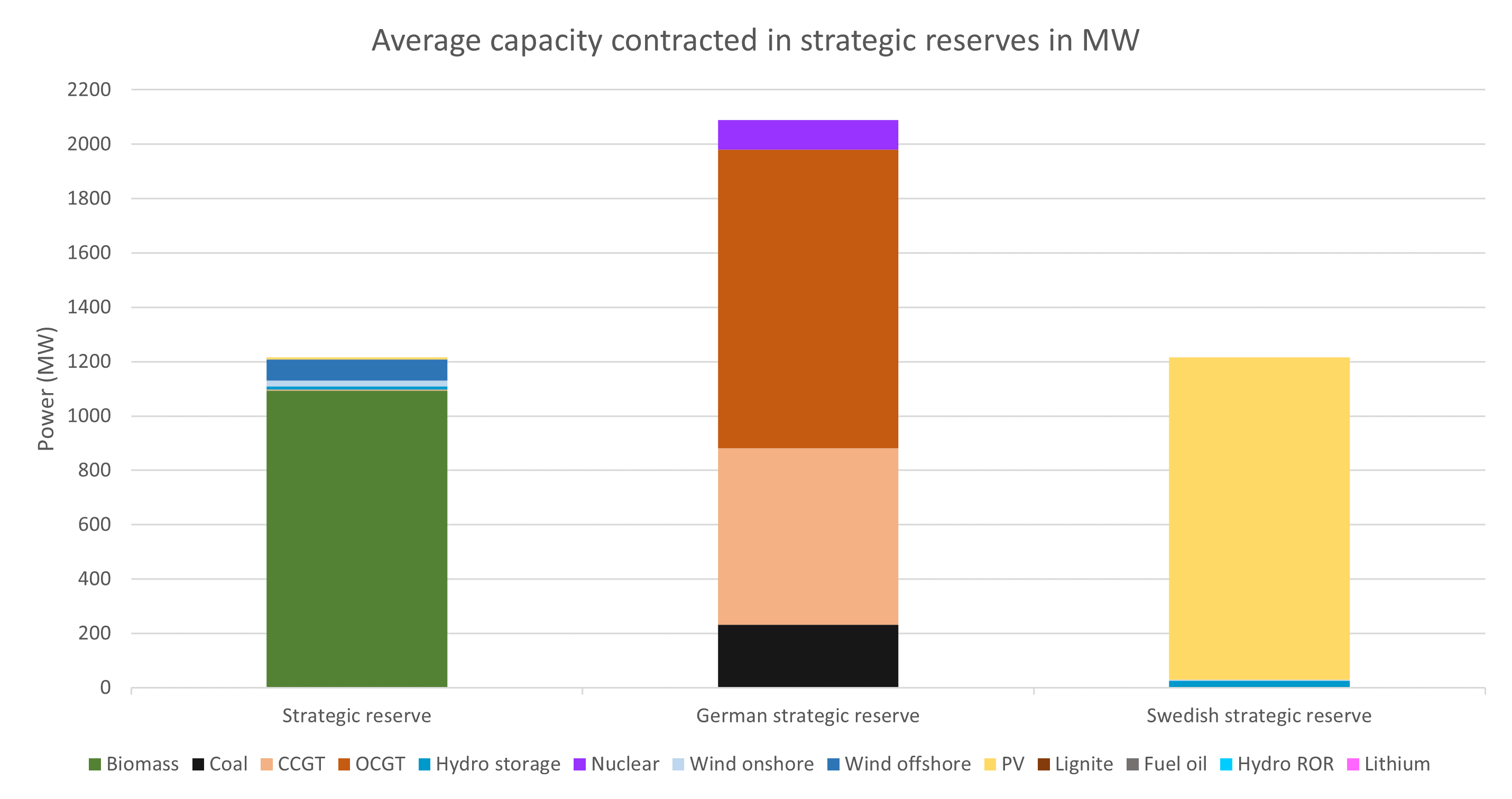

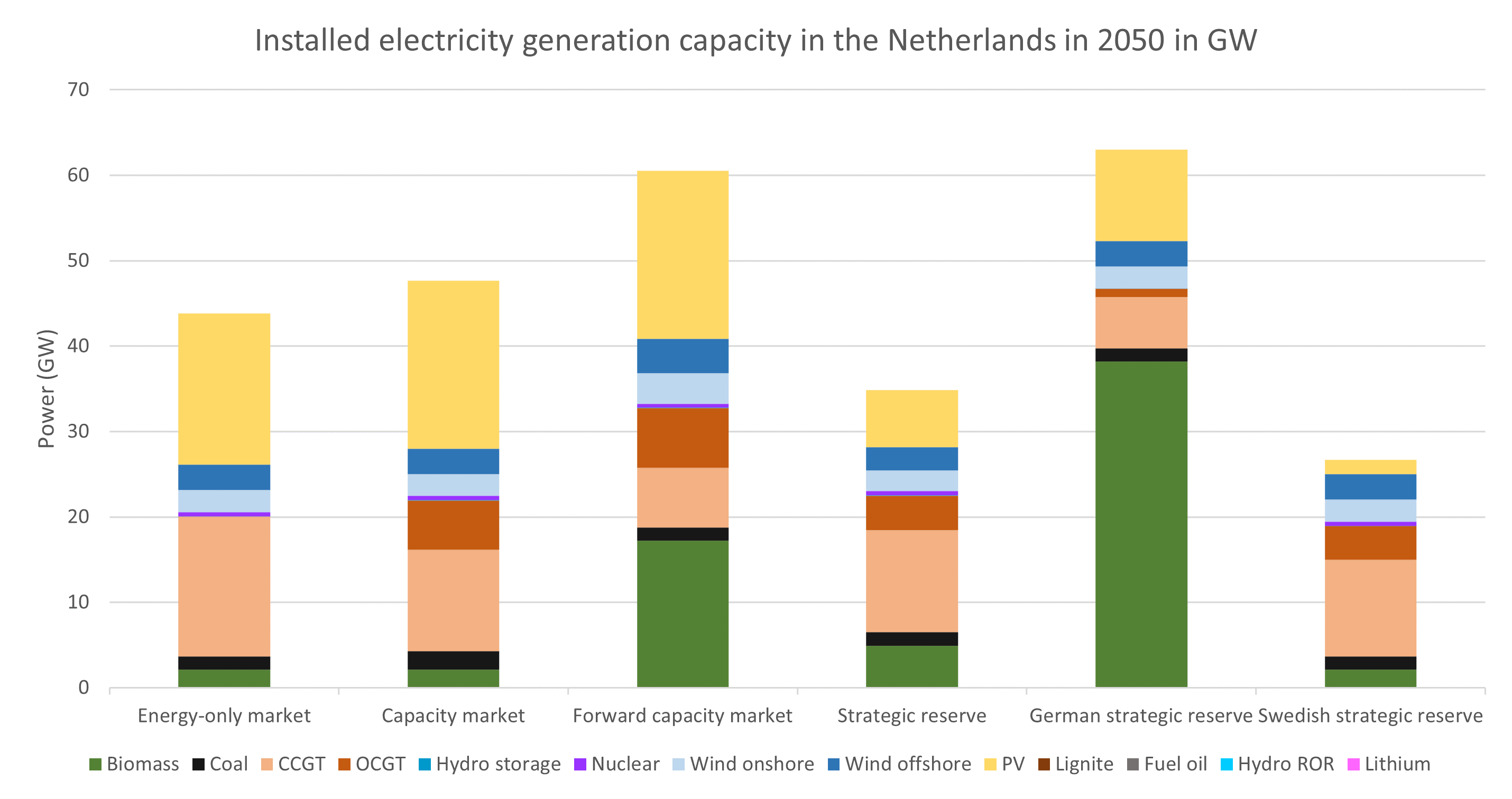

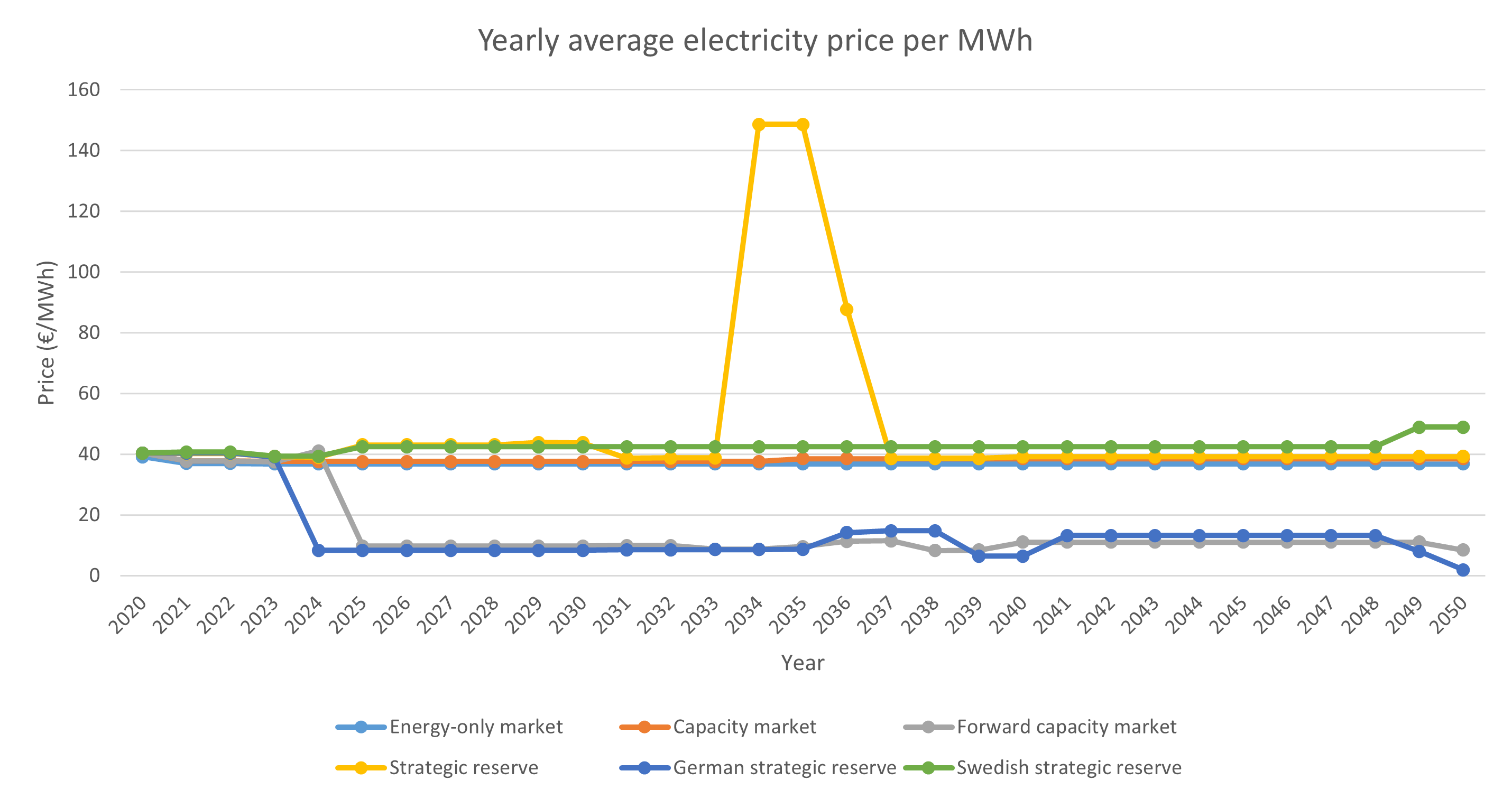

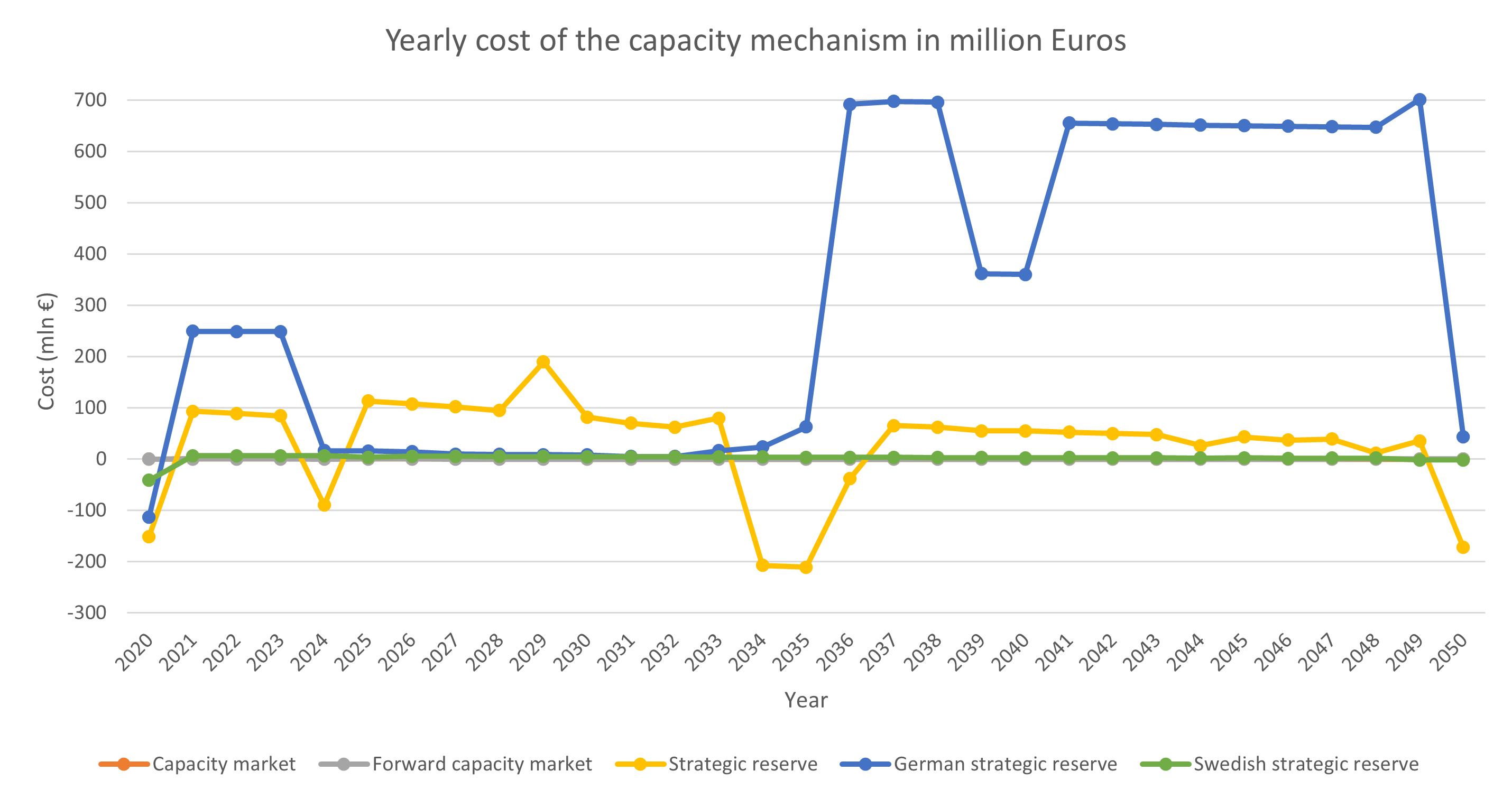

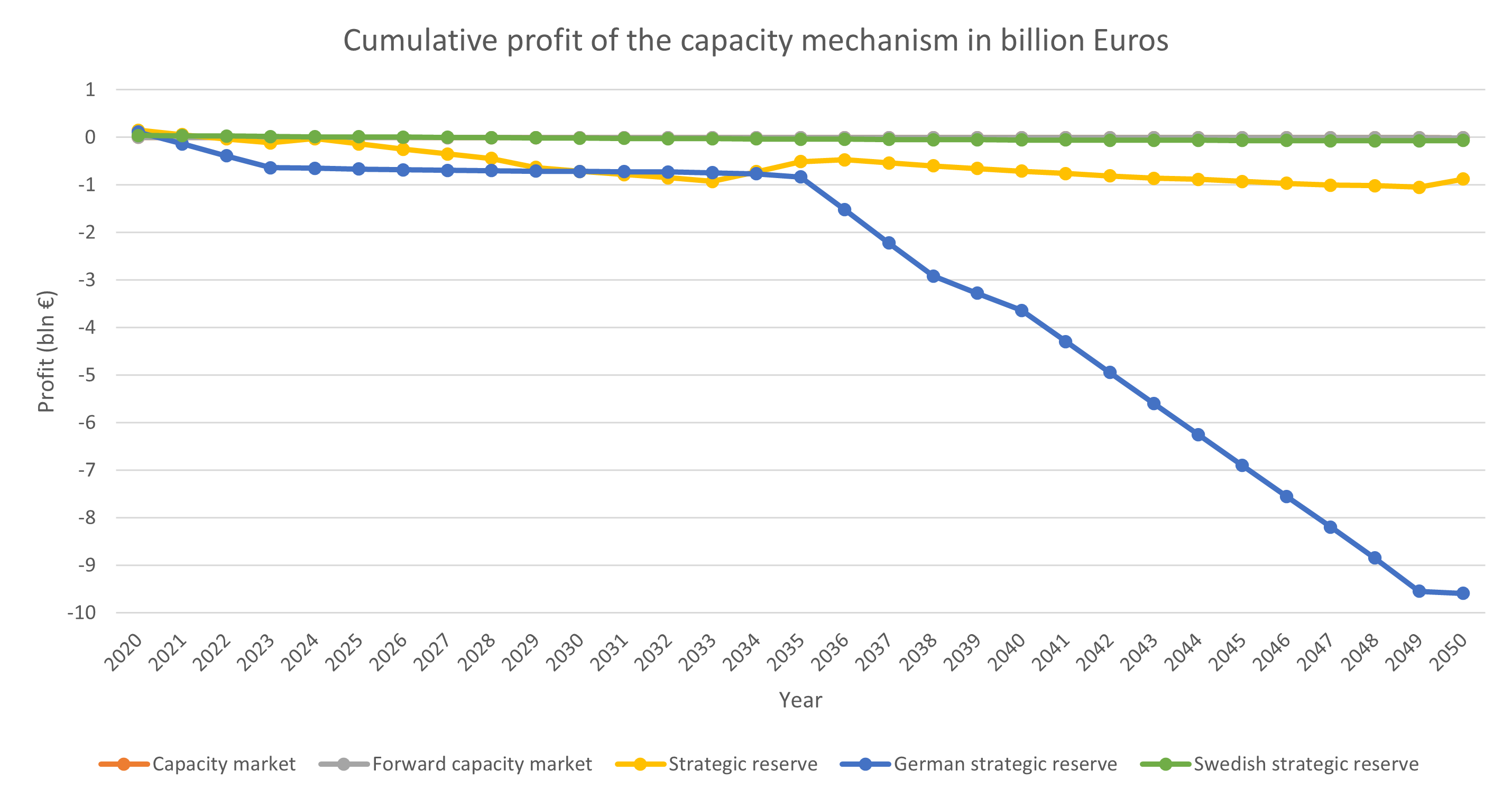

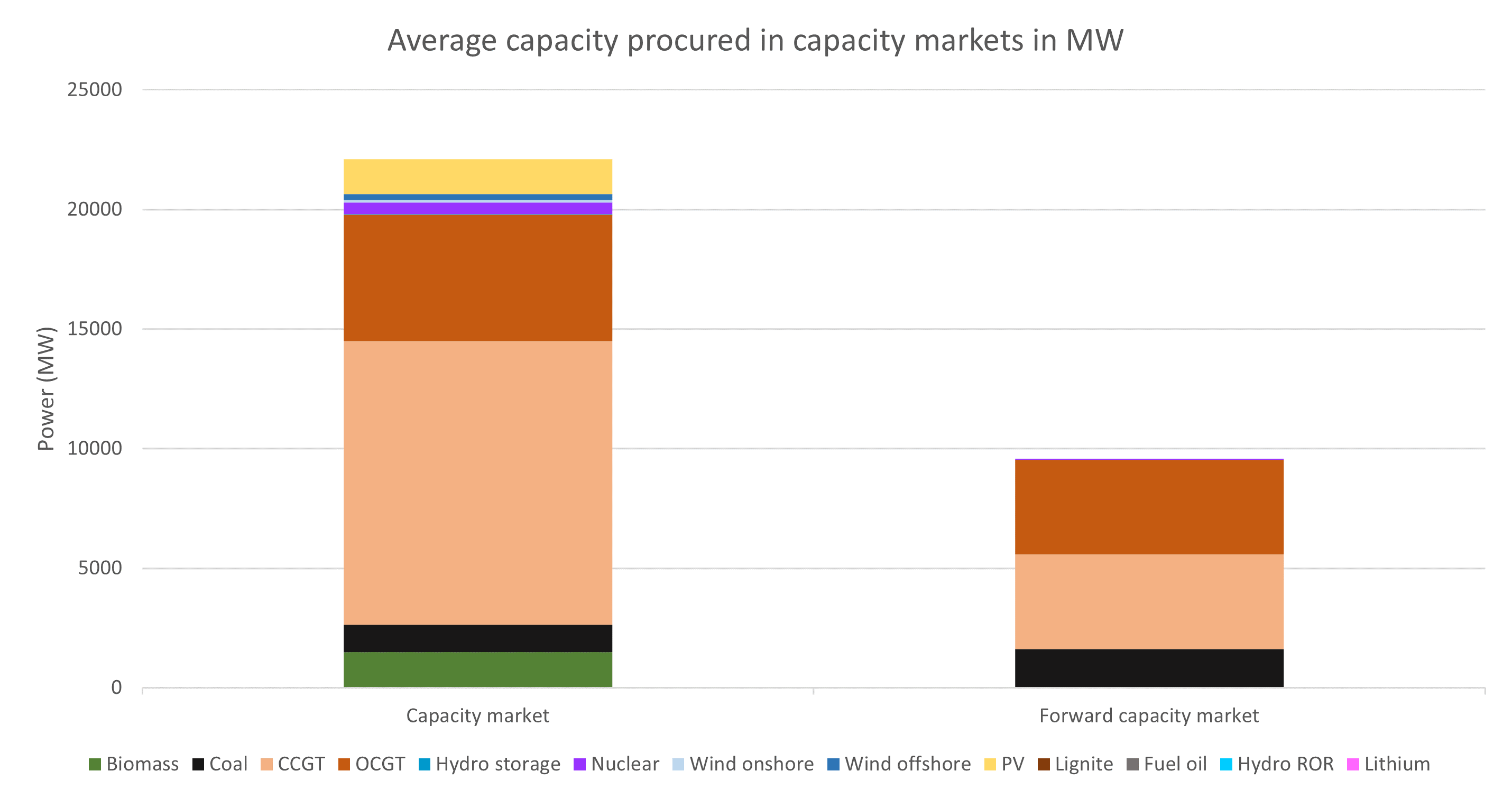

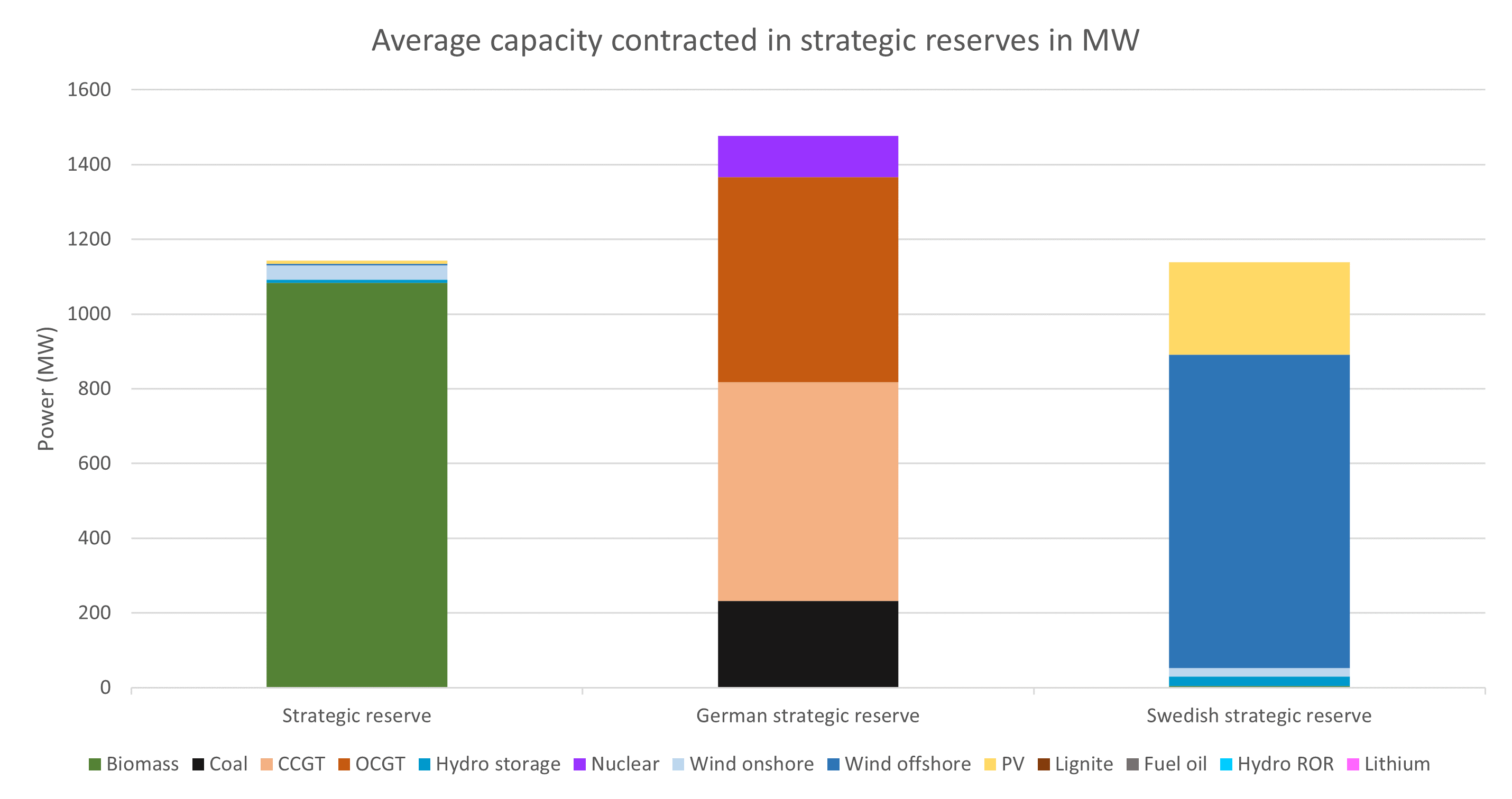

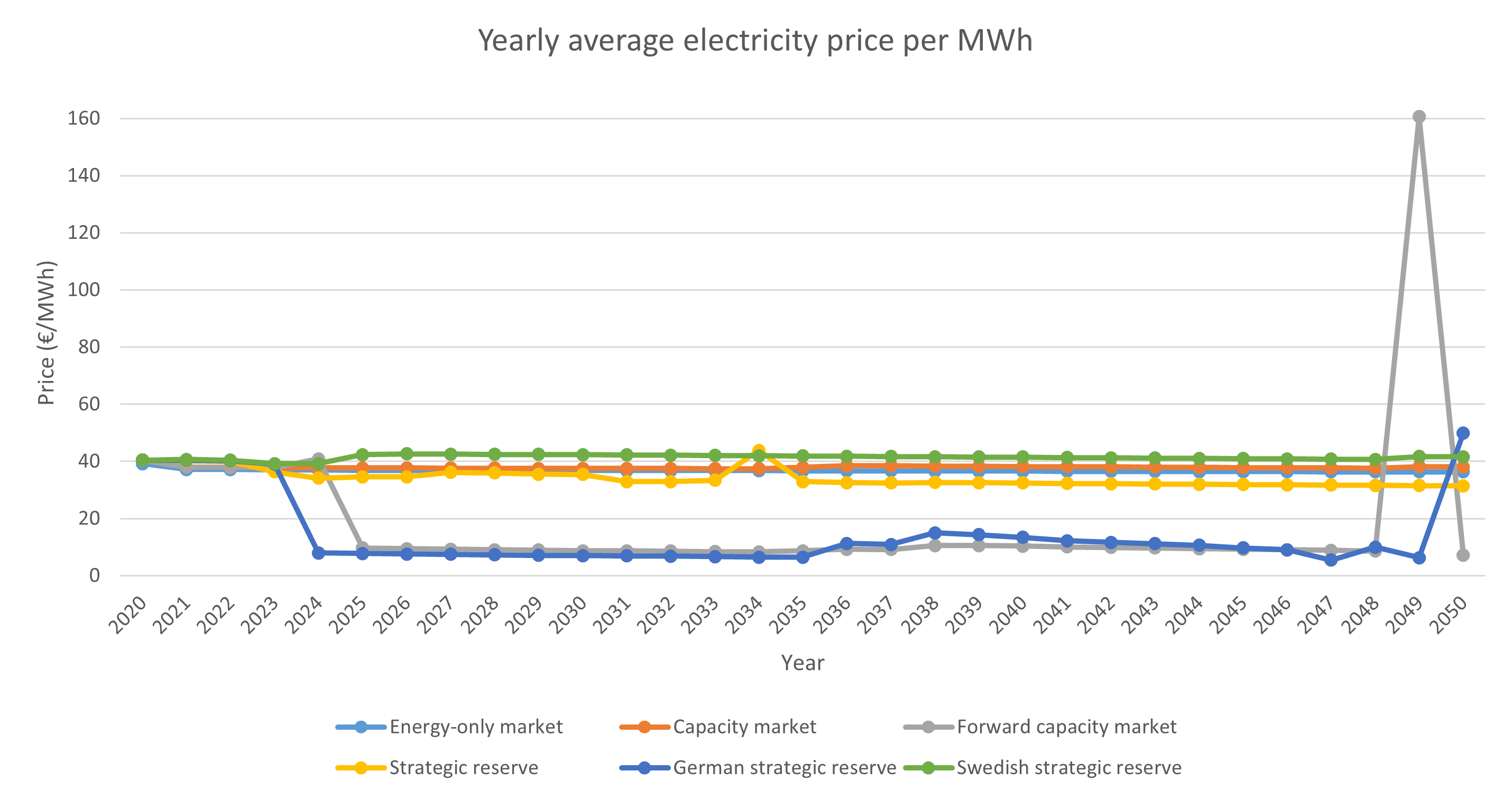

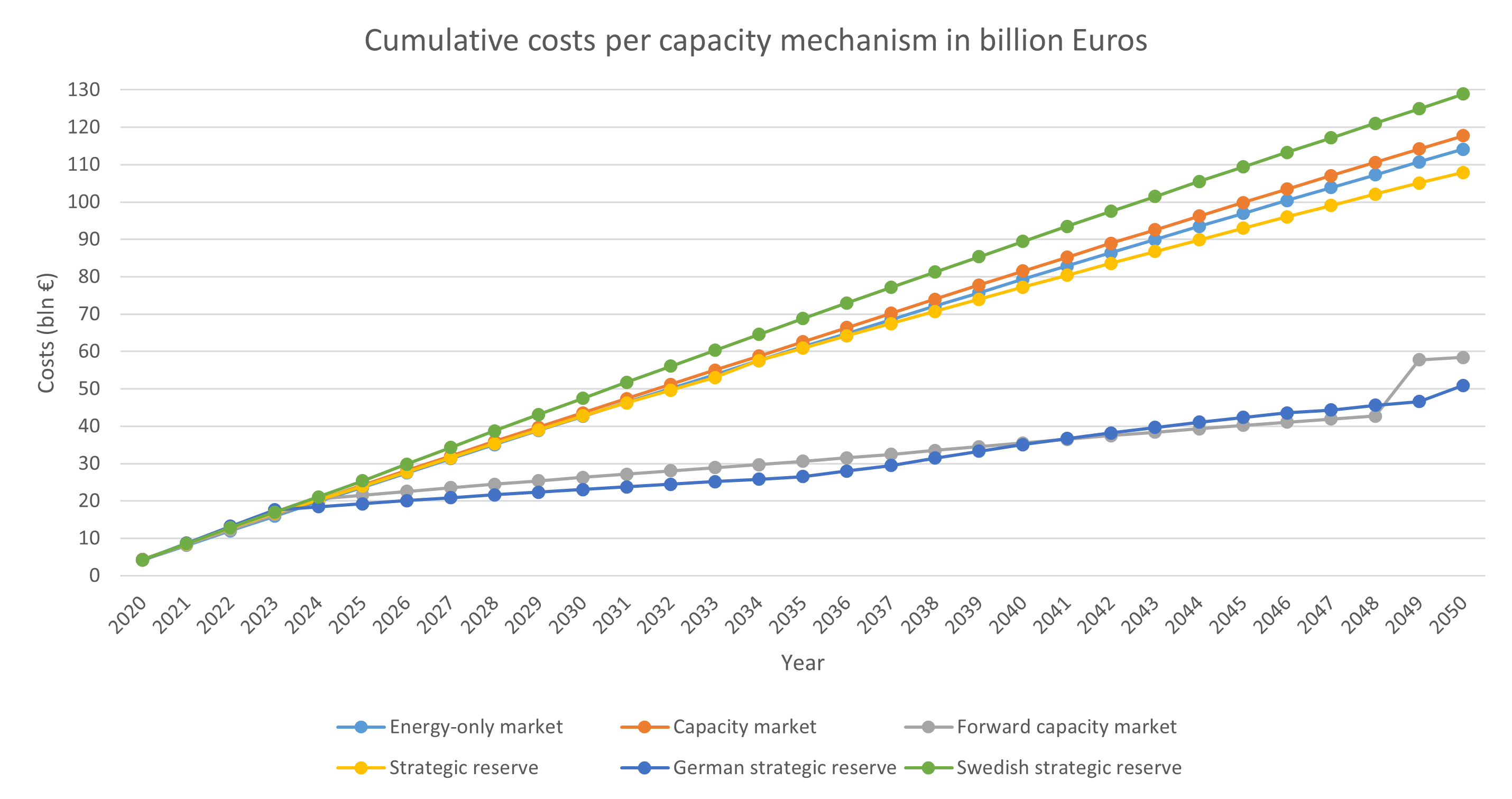

There exist many different forms of capacity remuneration mechanisms, but the strategic reserve and capacity markets are examined to check which one would work best in the Dutch energy system. In a strategic reserve a central authority sets the capacity volume, which will be contracted by an operator. This operator will dispatch the contracted capacity when needed. In a capacity market a central authority determines the amount of capacity each consumer should acquire through buying capacity credits on the market.

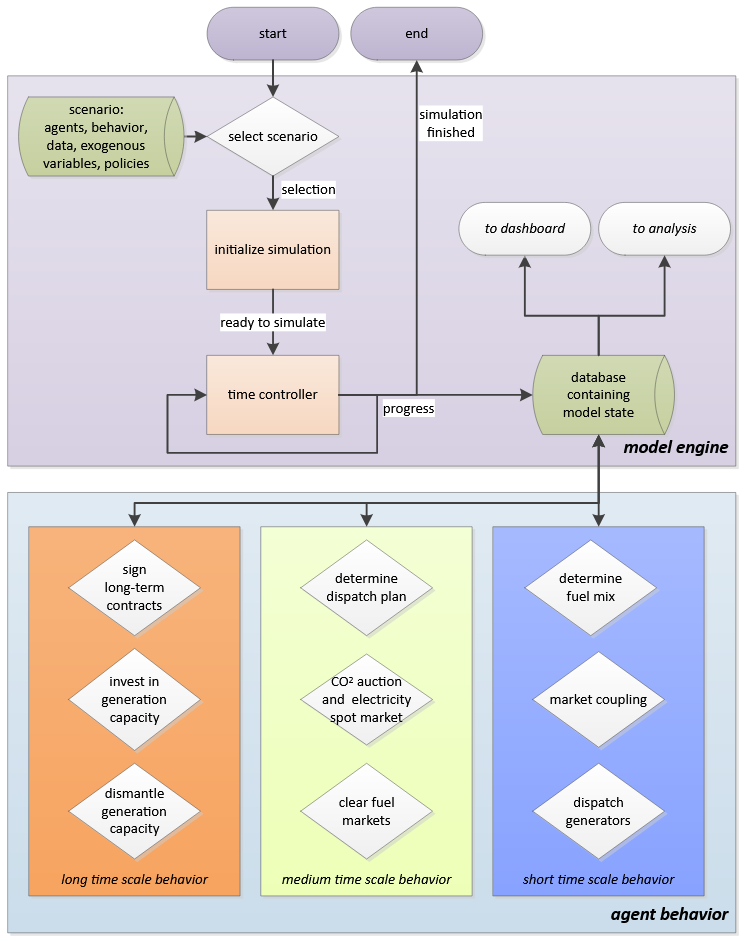

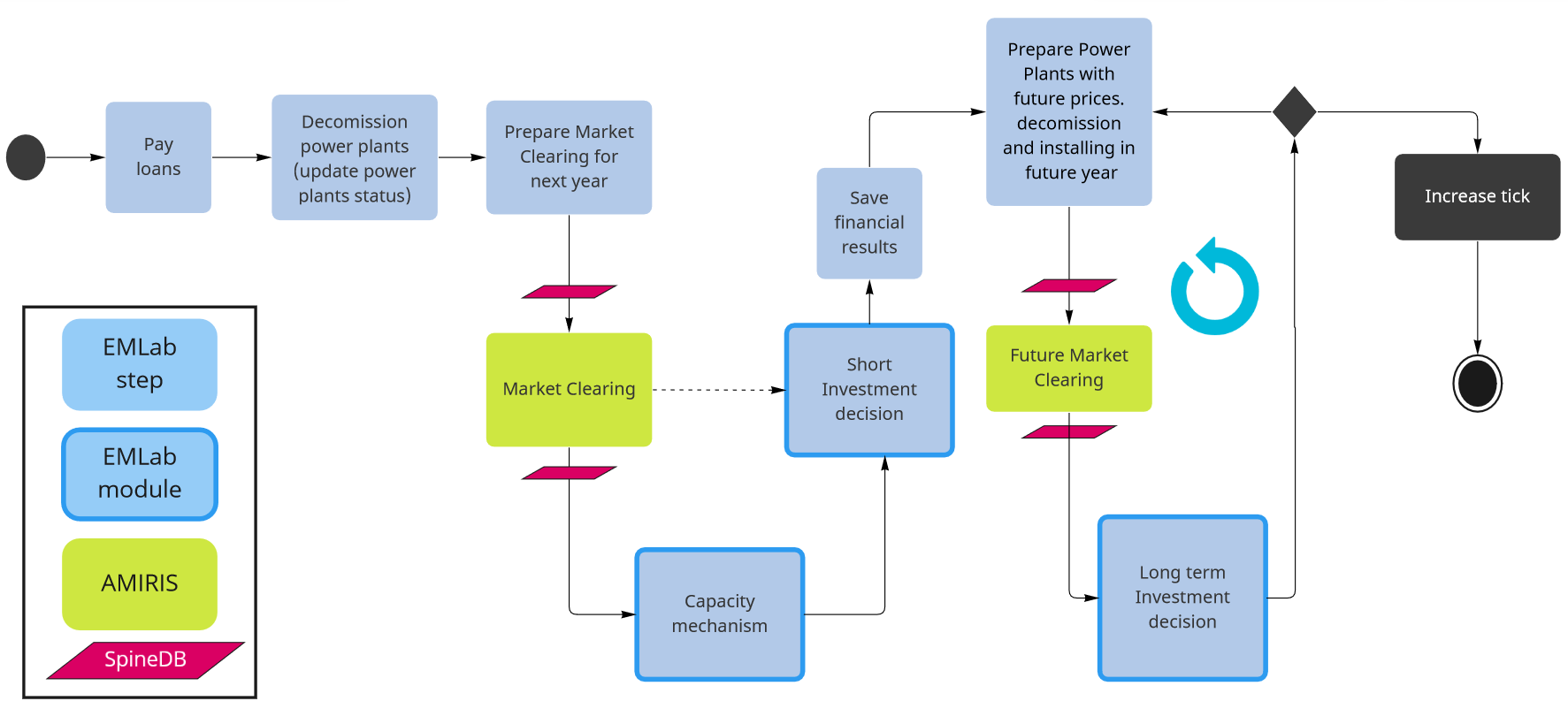

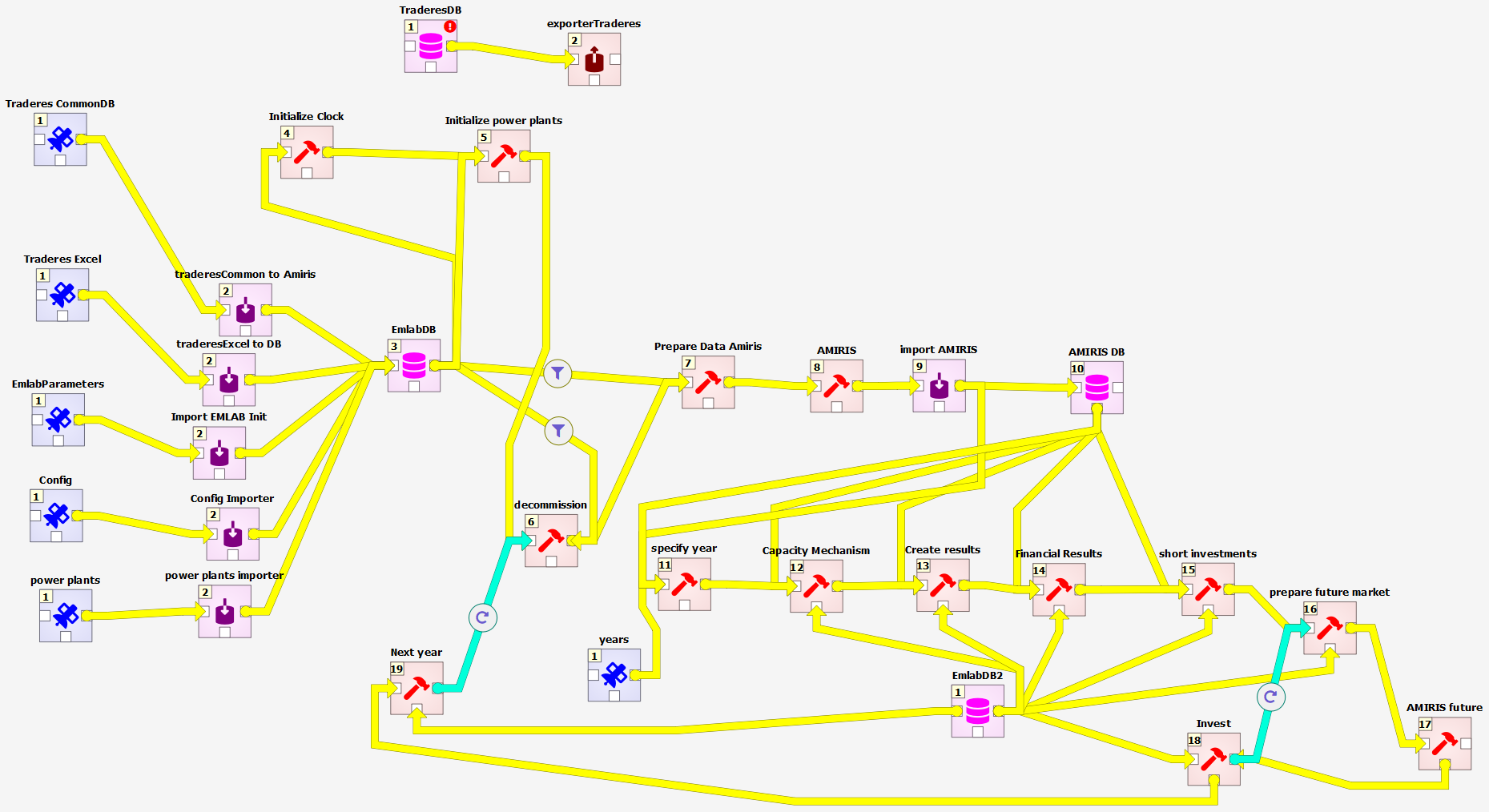

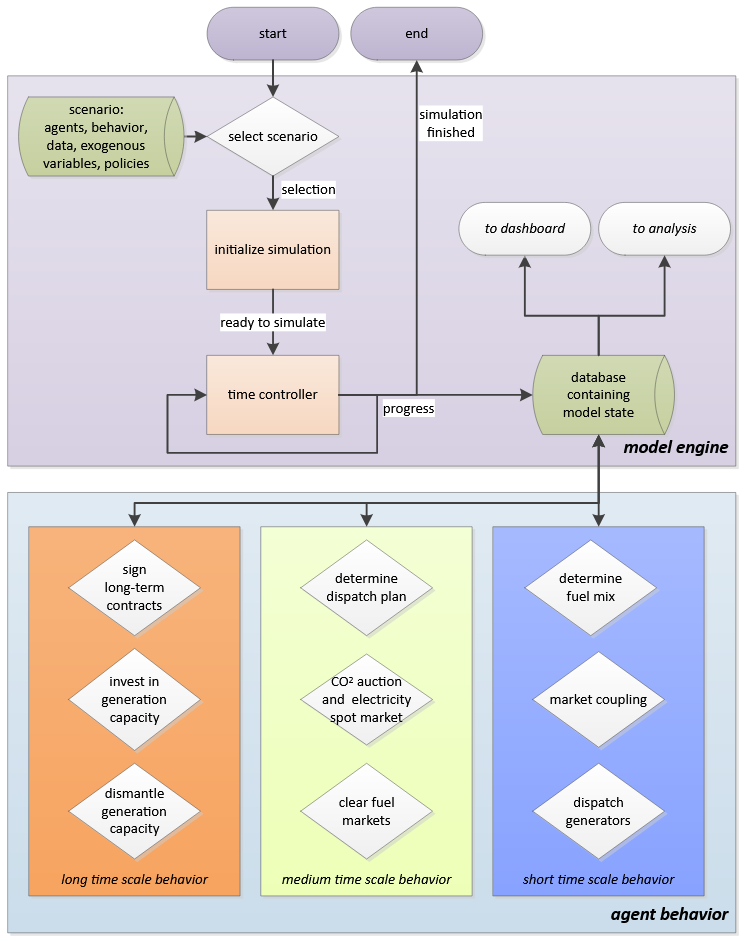

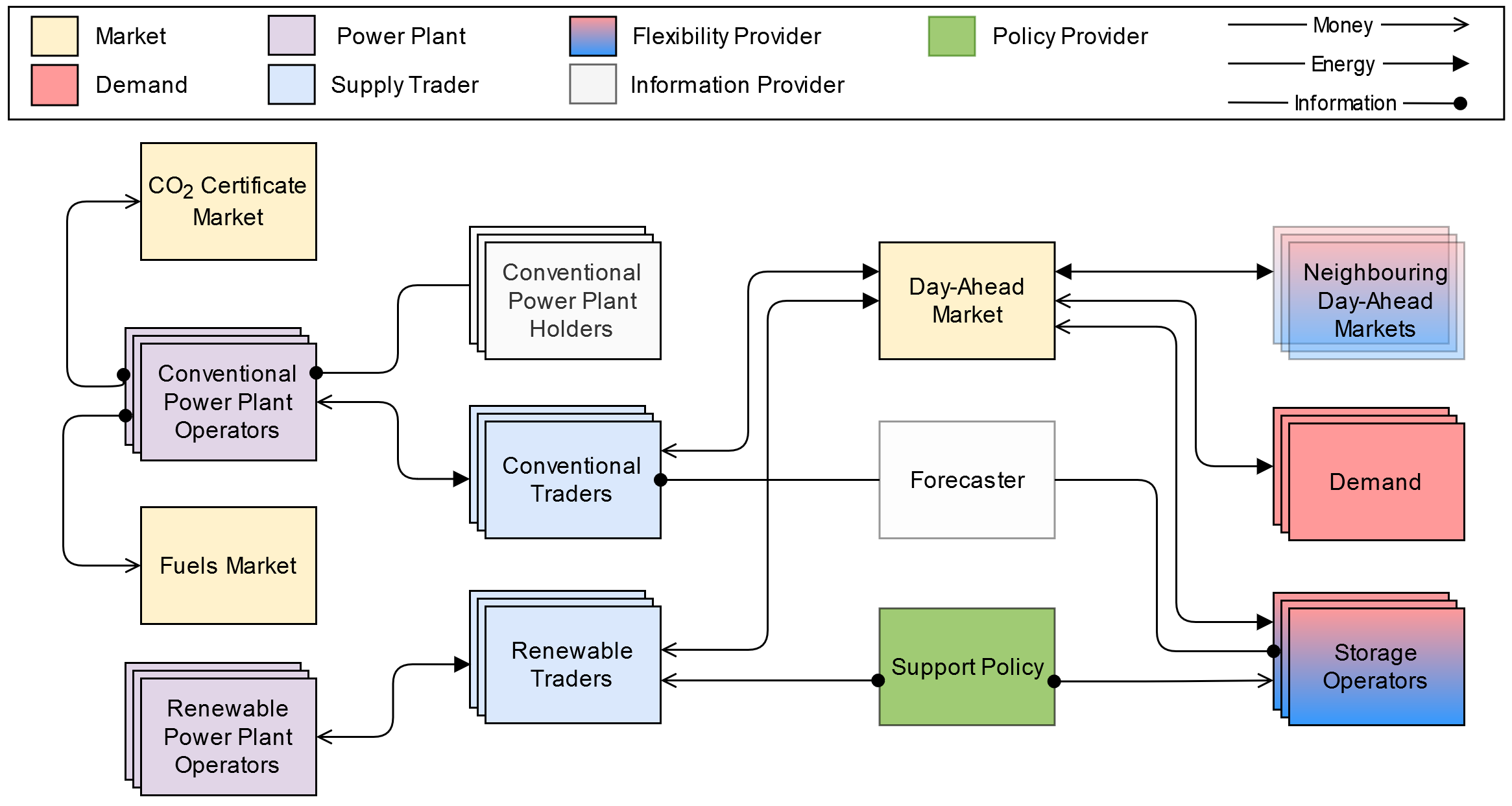

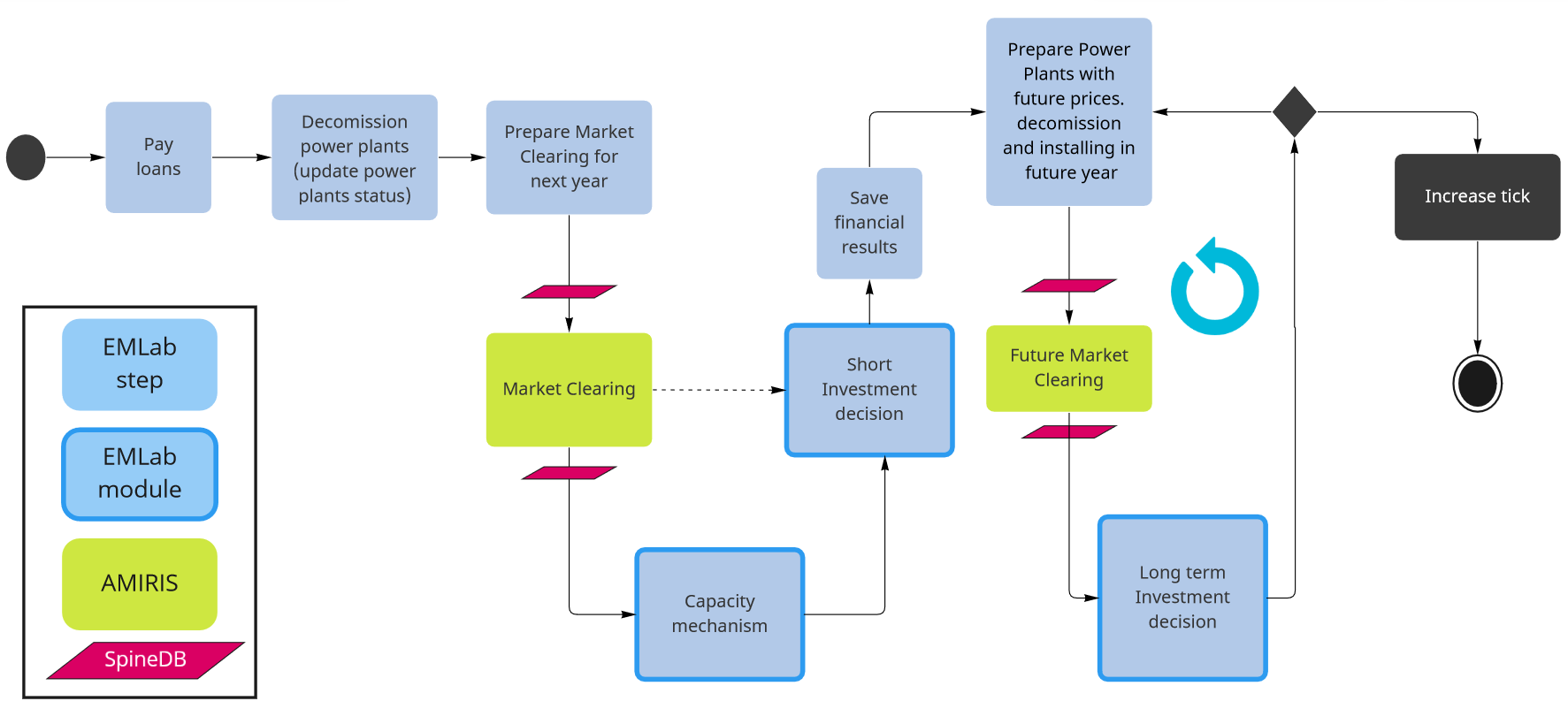

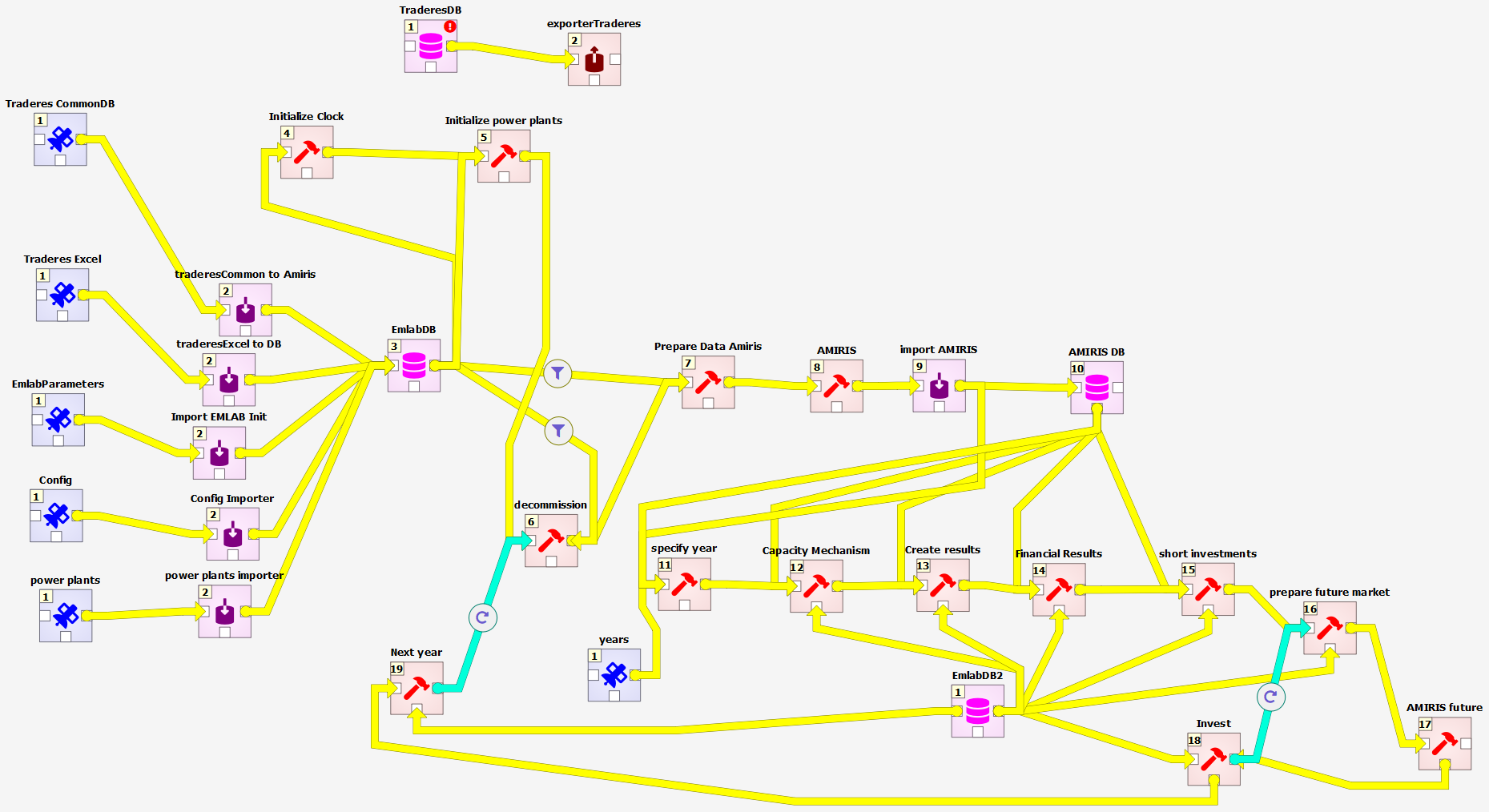

To determine which capacity remuneration mechanism would deliver the highest level of security of supply, simulations of the Dutch energy system are run. The simulations were done using the models AMIRIS and EMLab, which are coupled to give a more accurate representation of reality. The coupling takes place in the Spine Toolbox. The capacity remuneration mechanisms were created in Python and can be activated as modules in the Spine Toolbox.

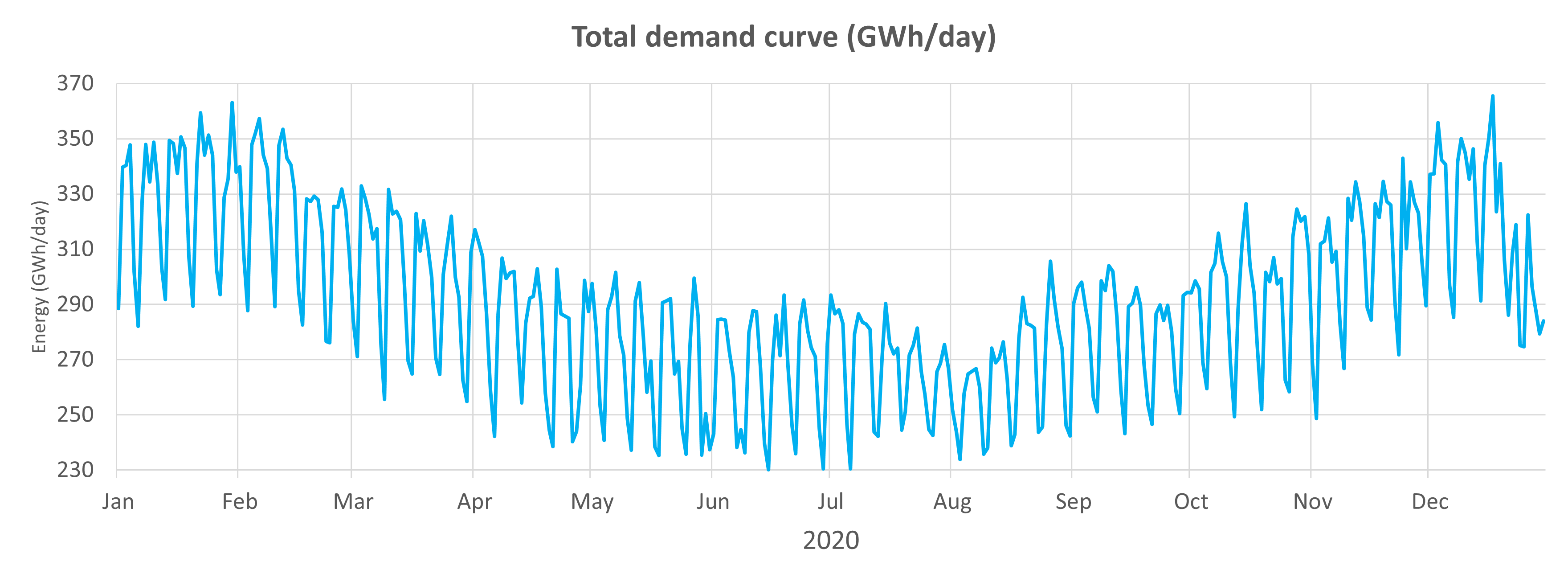

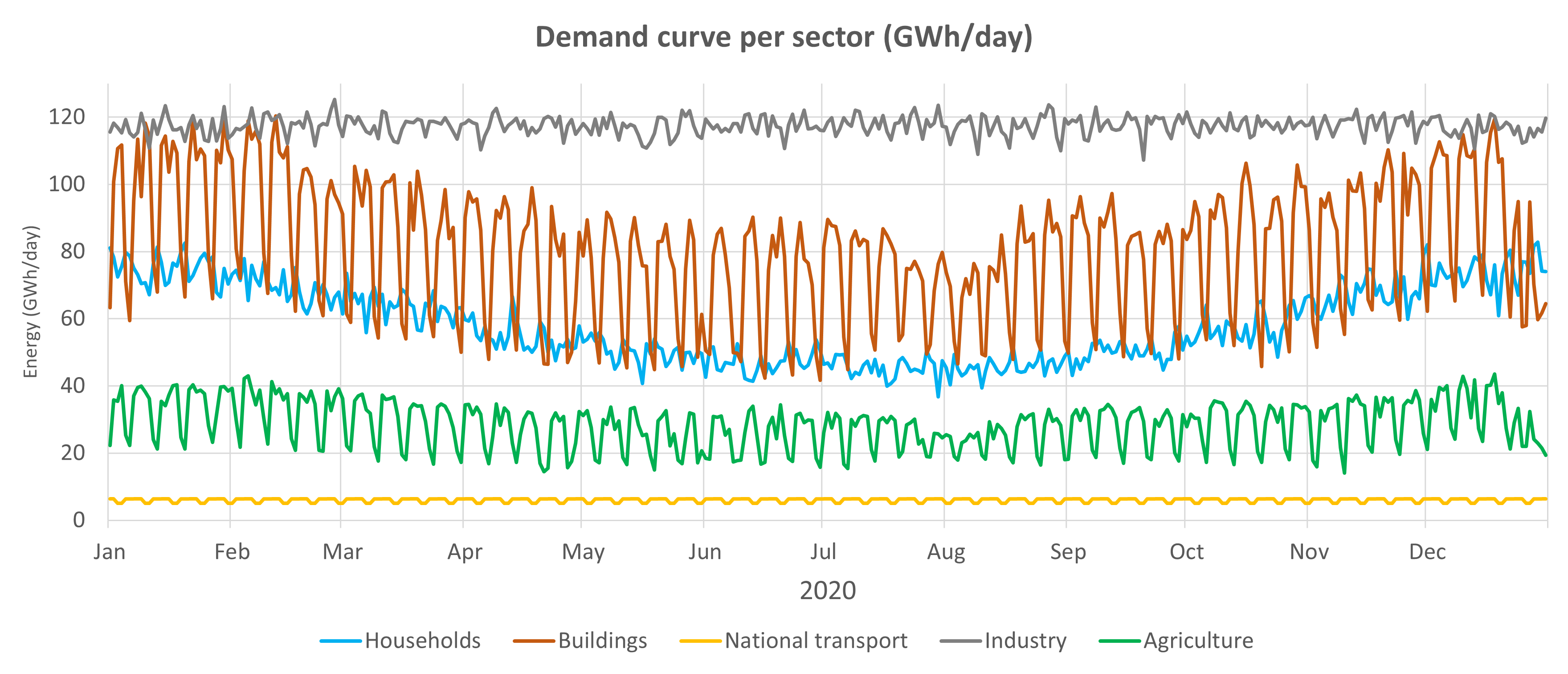

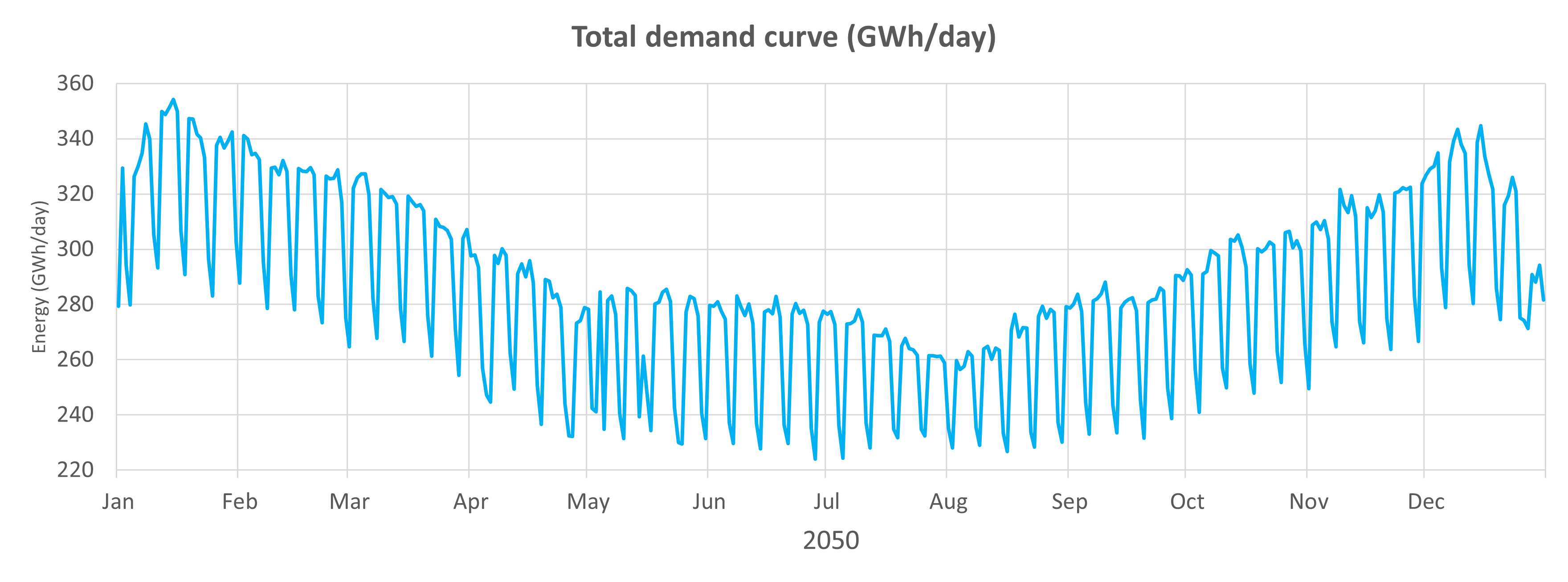

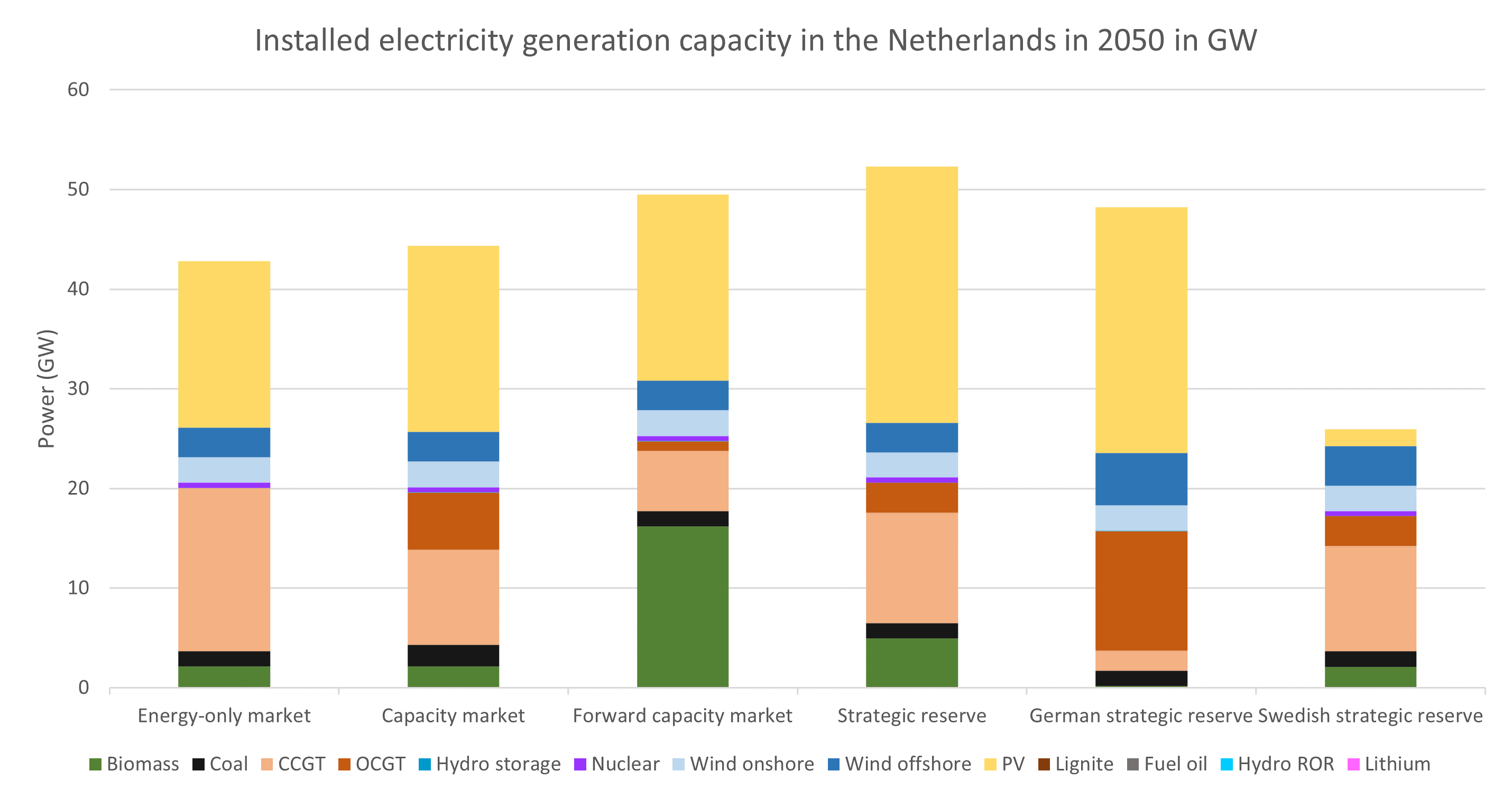

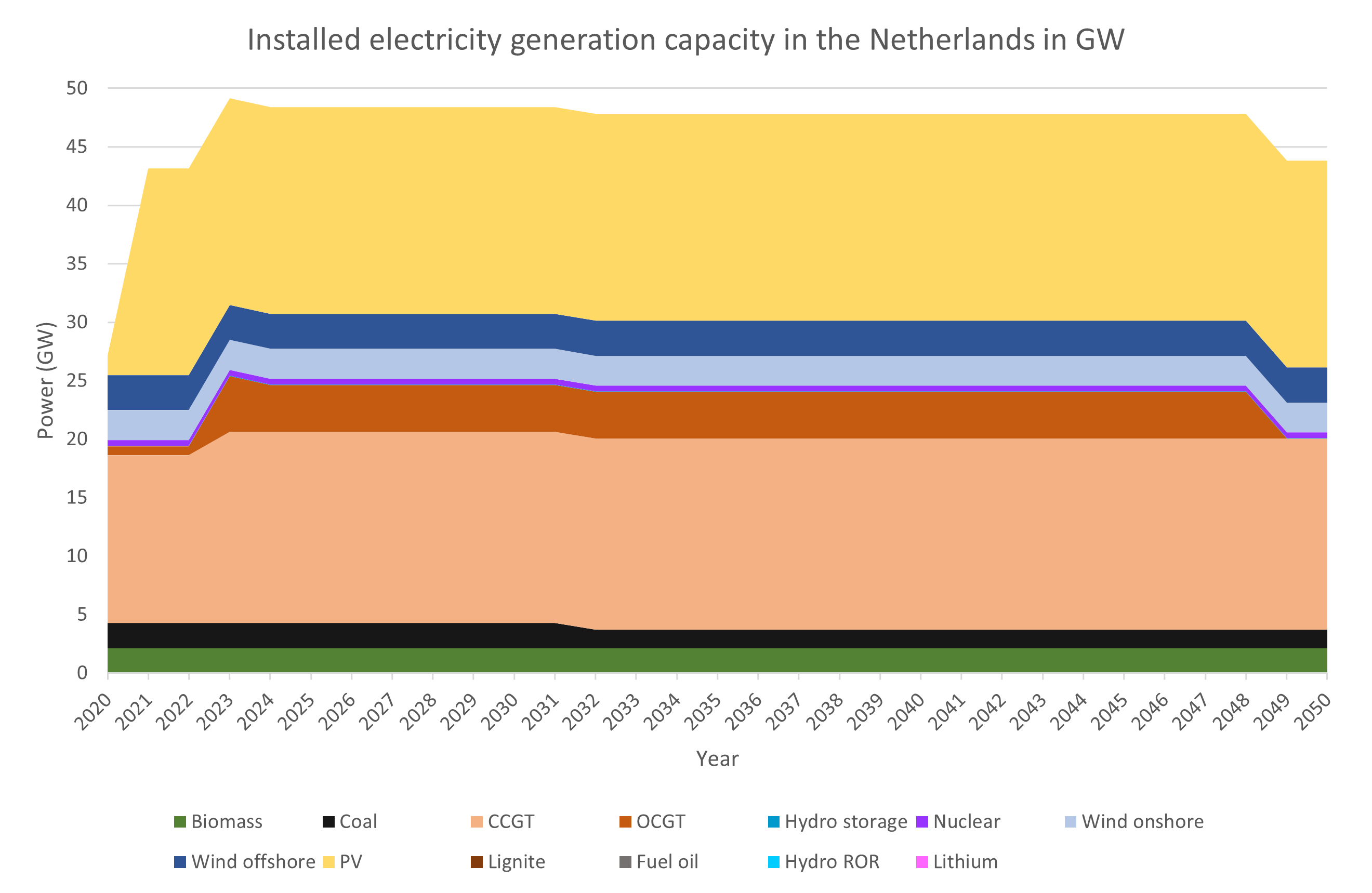

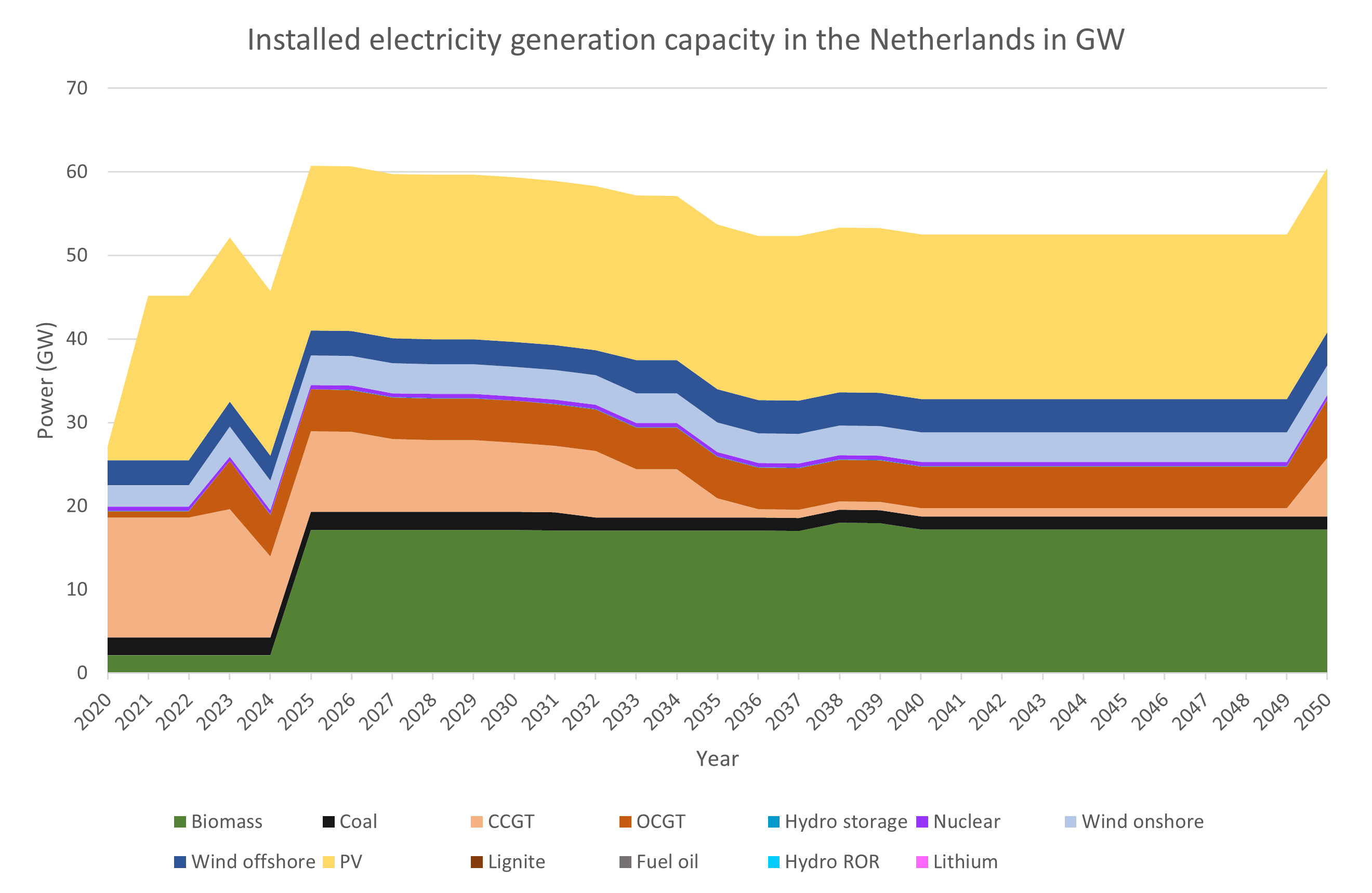

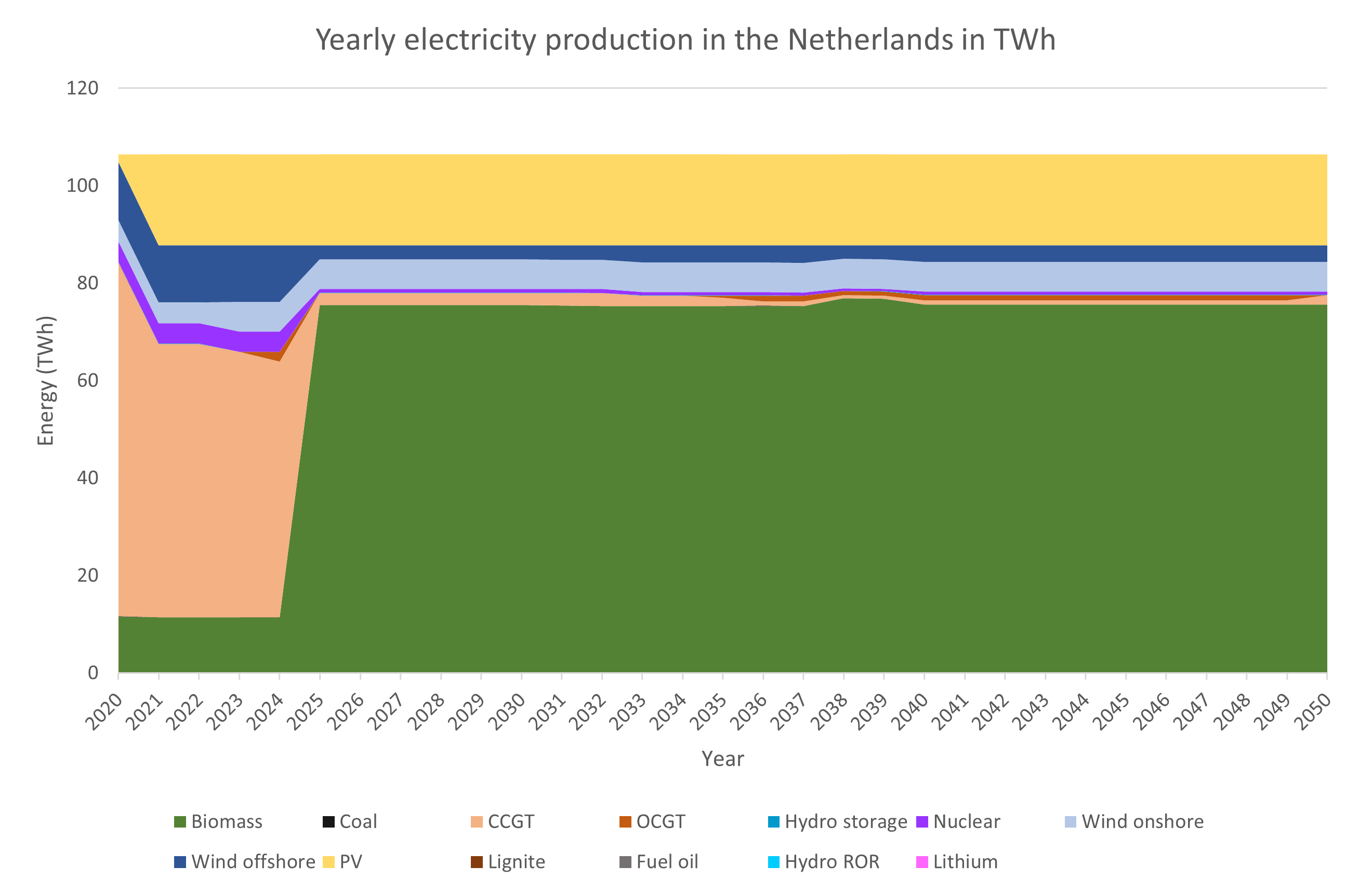

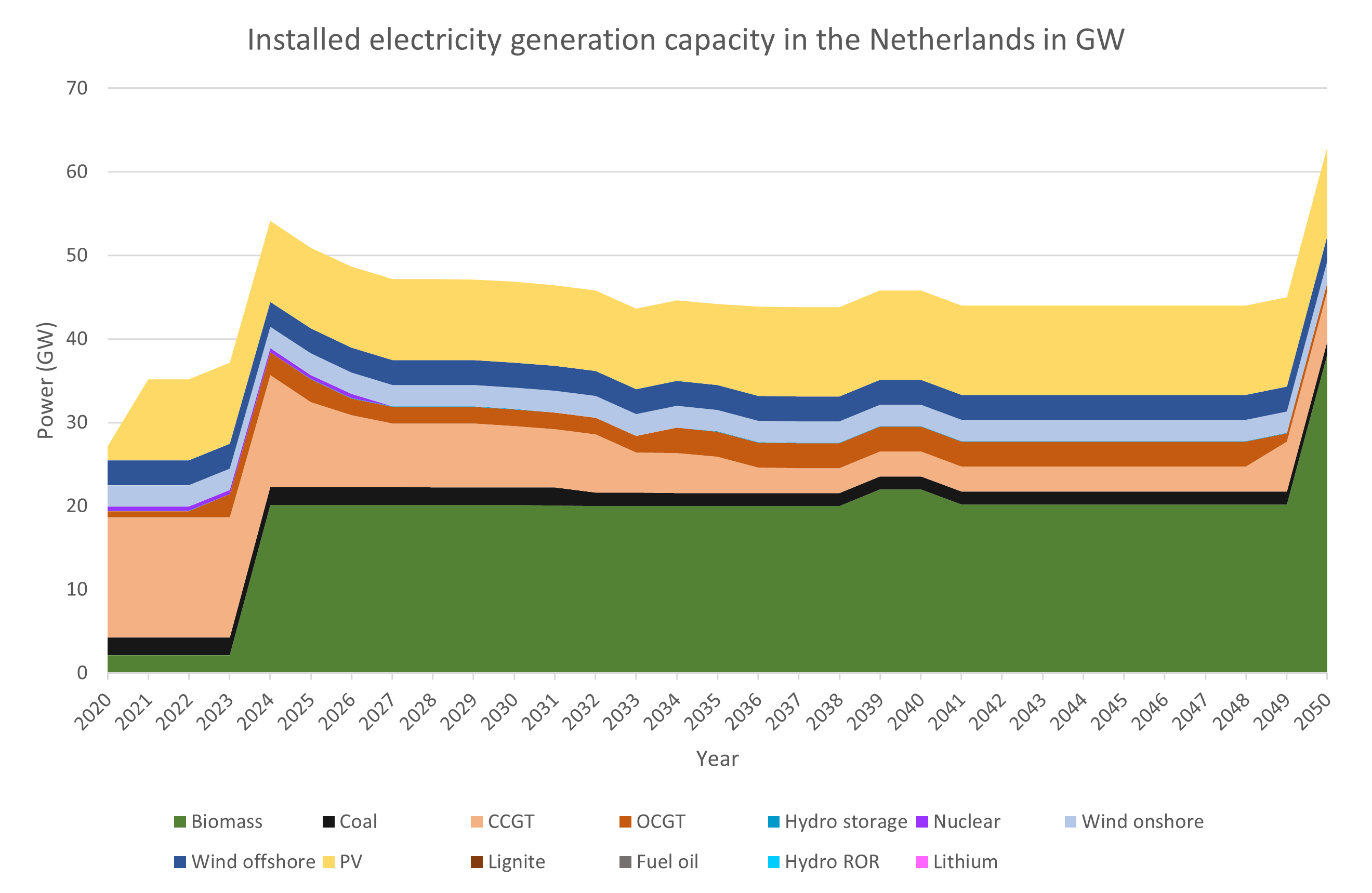

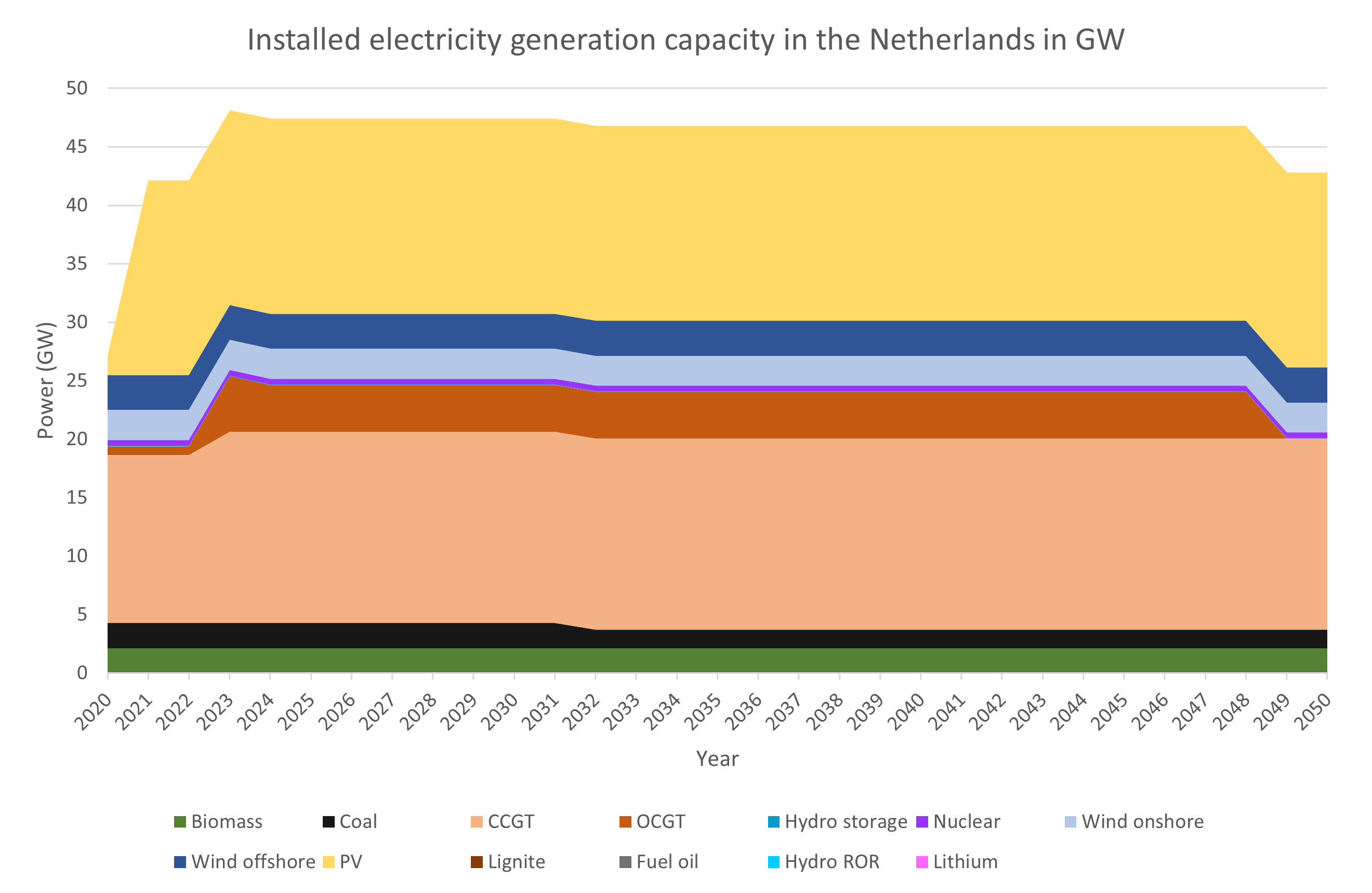

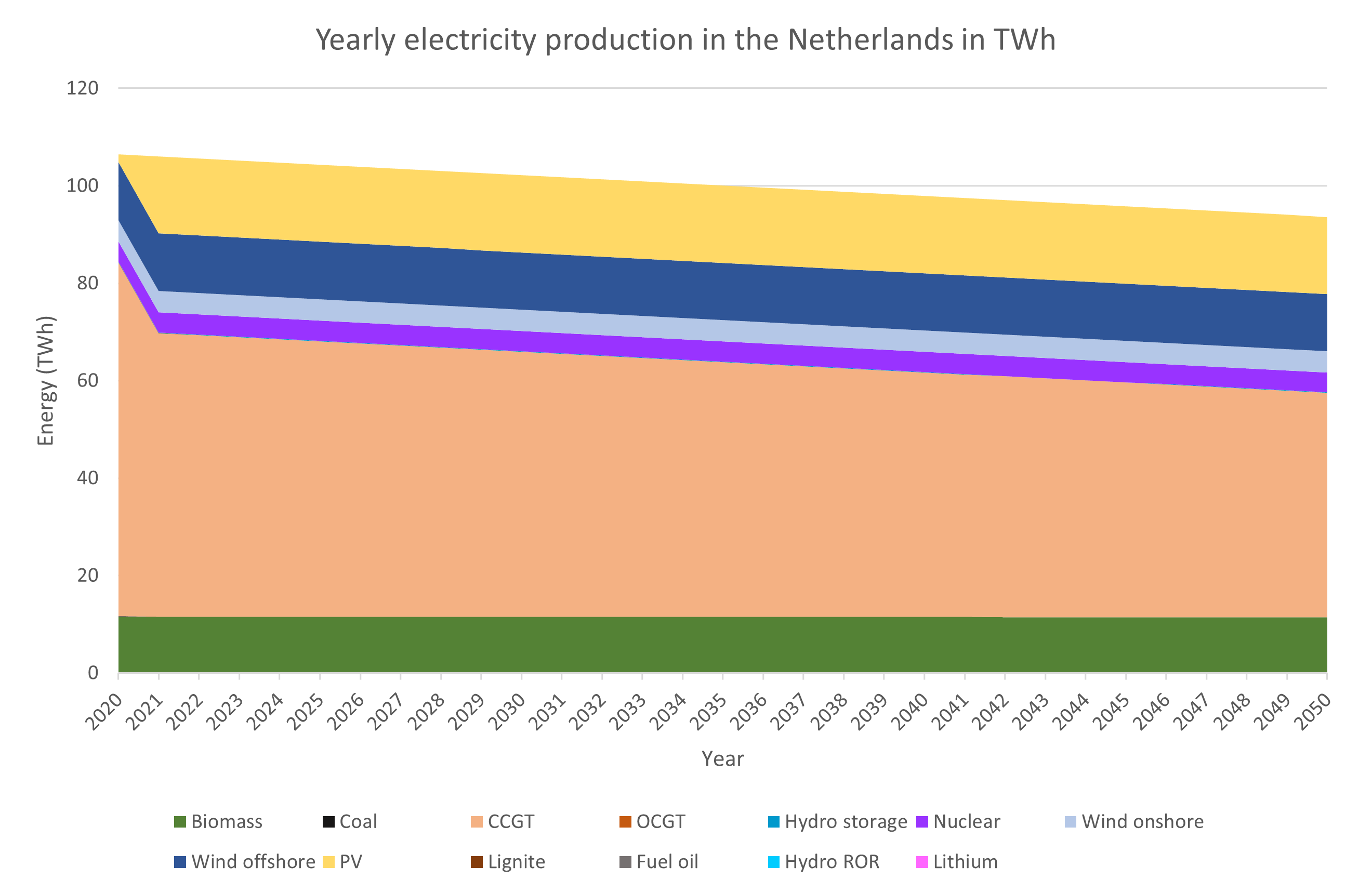

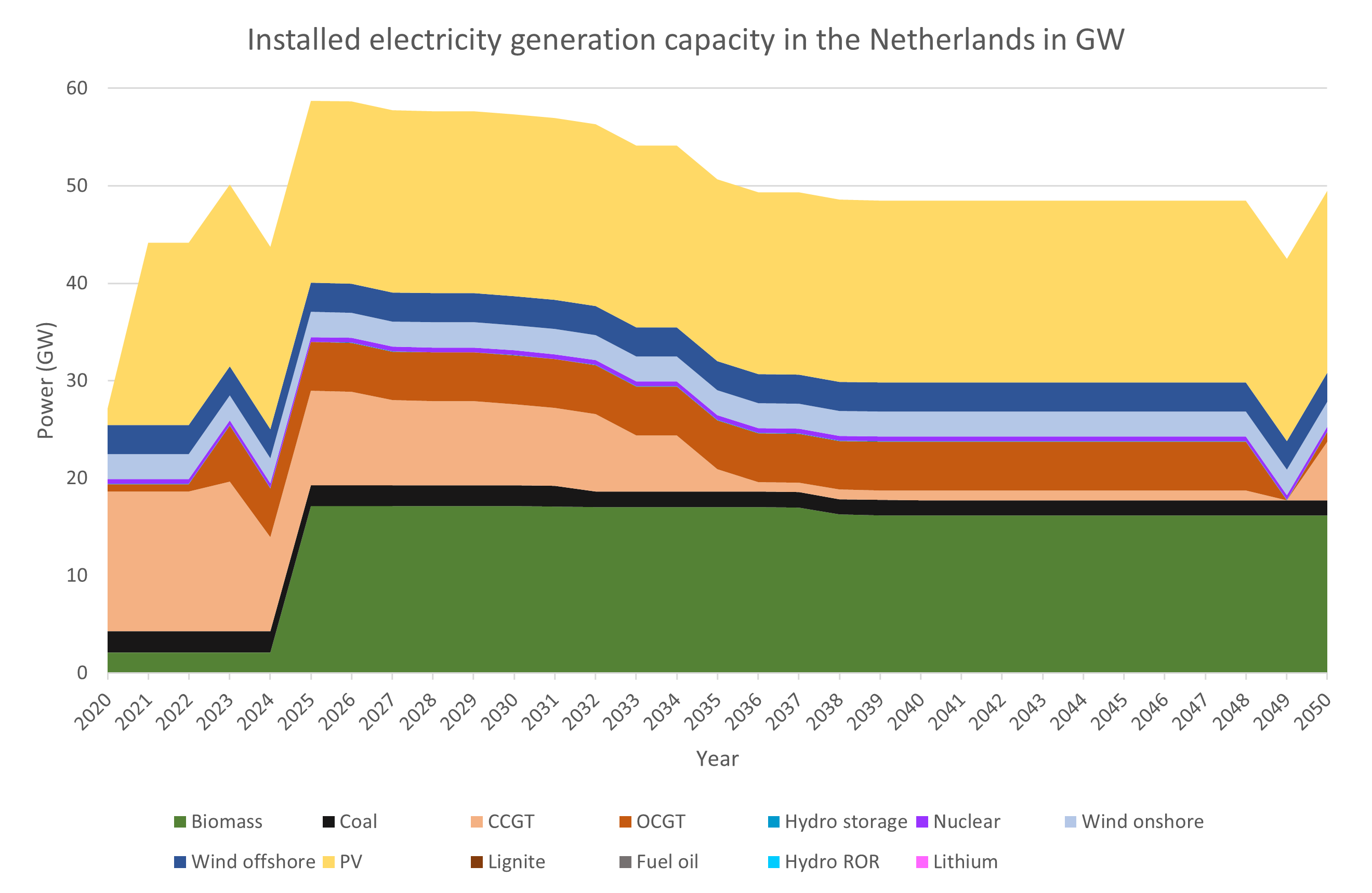

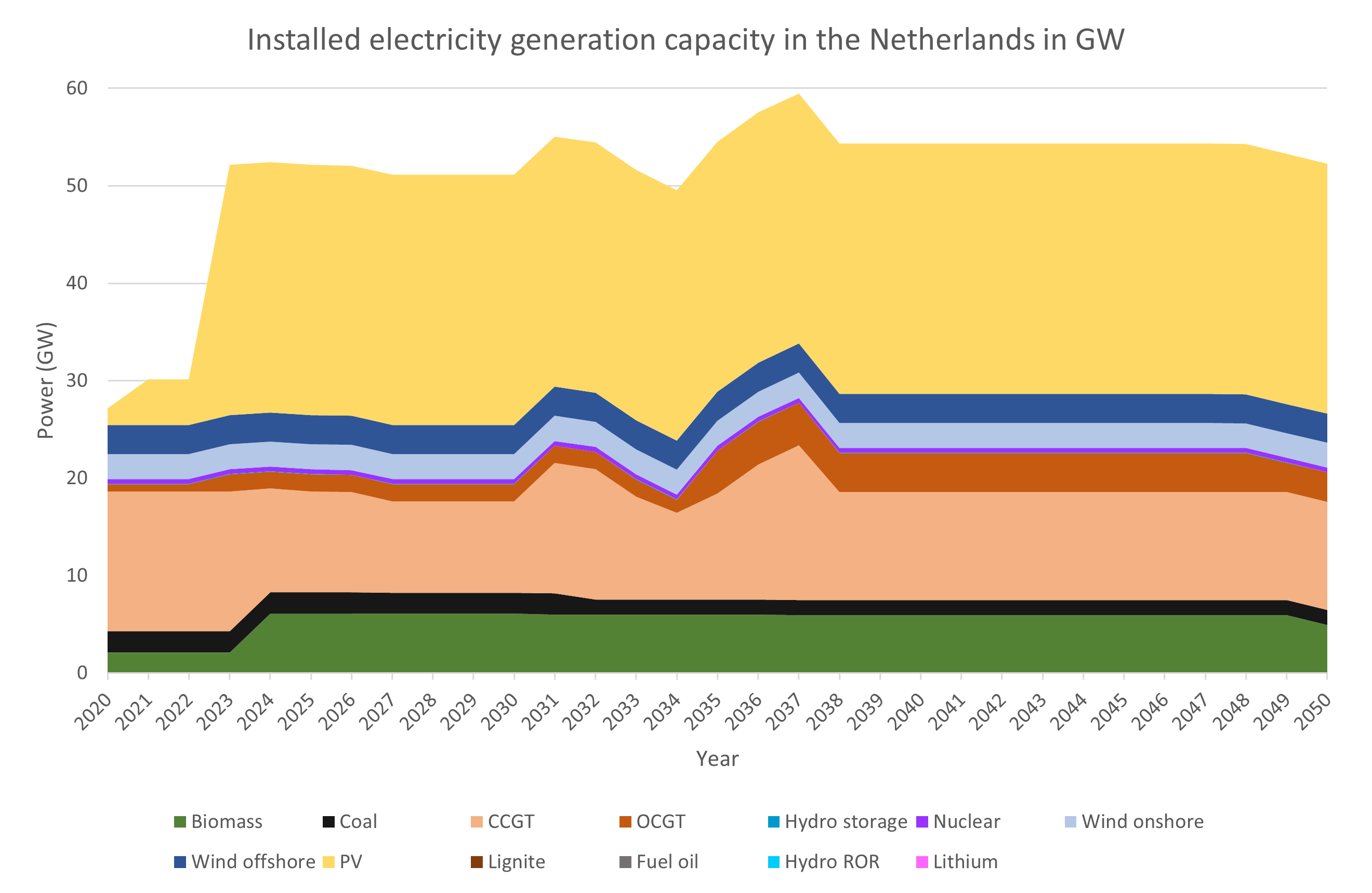

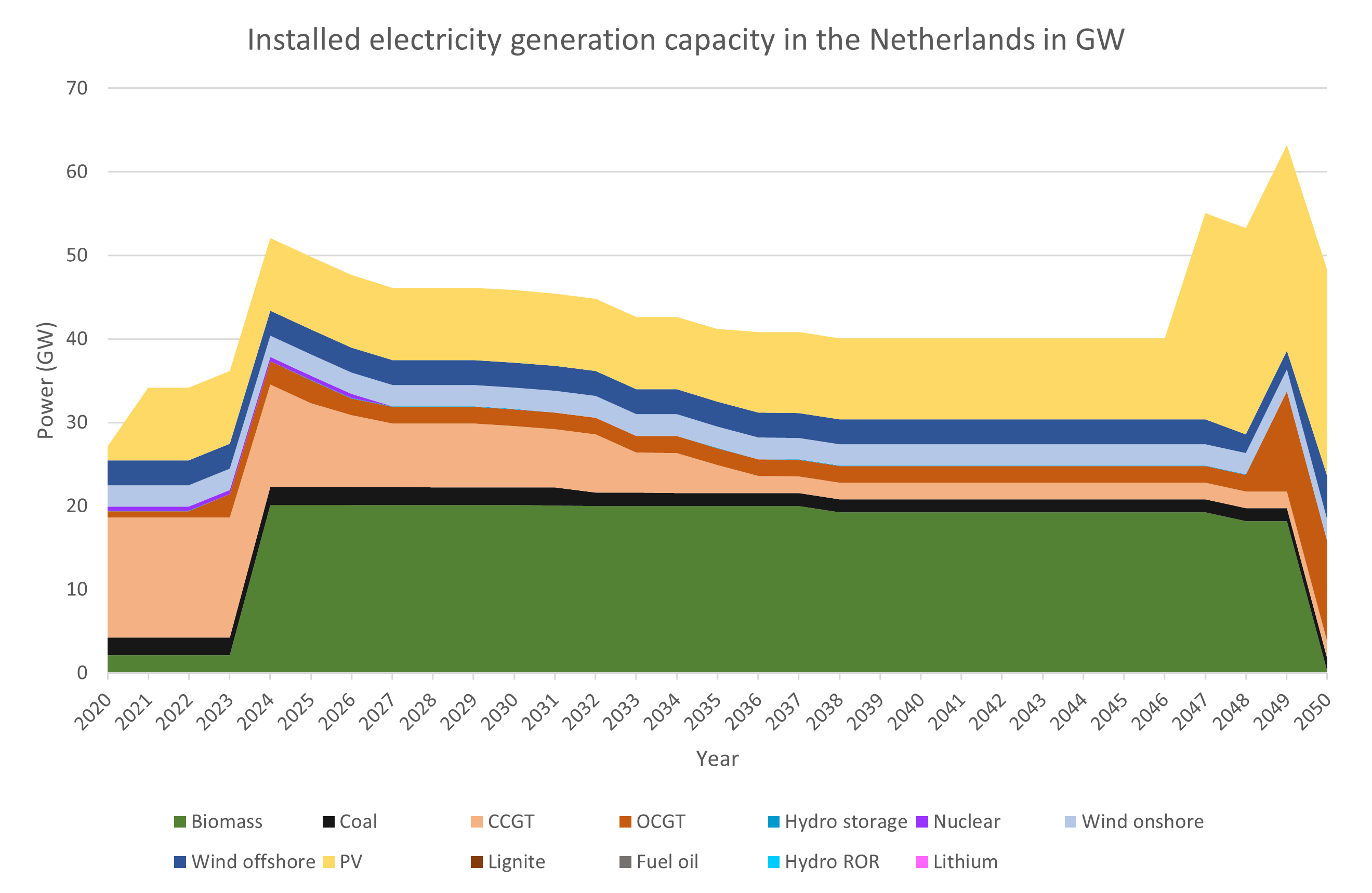

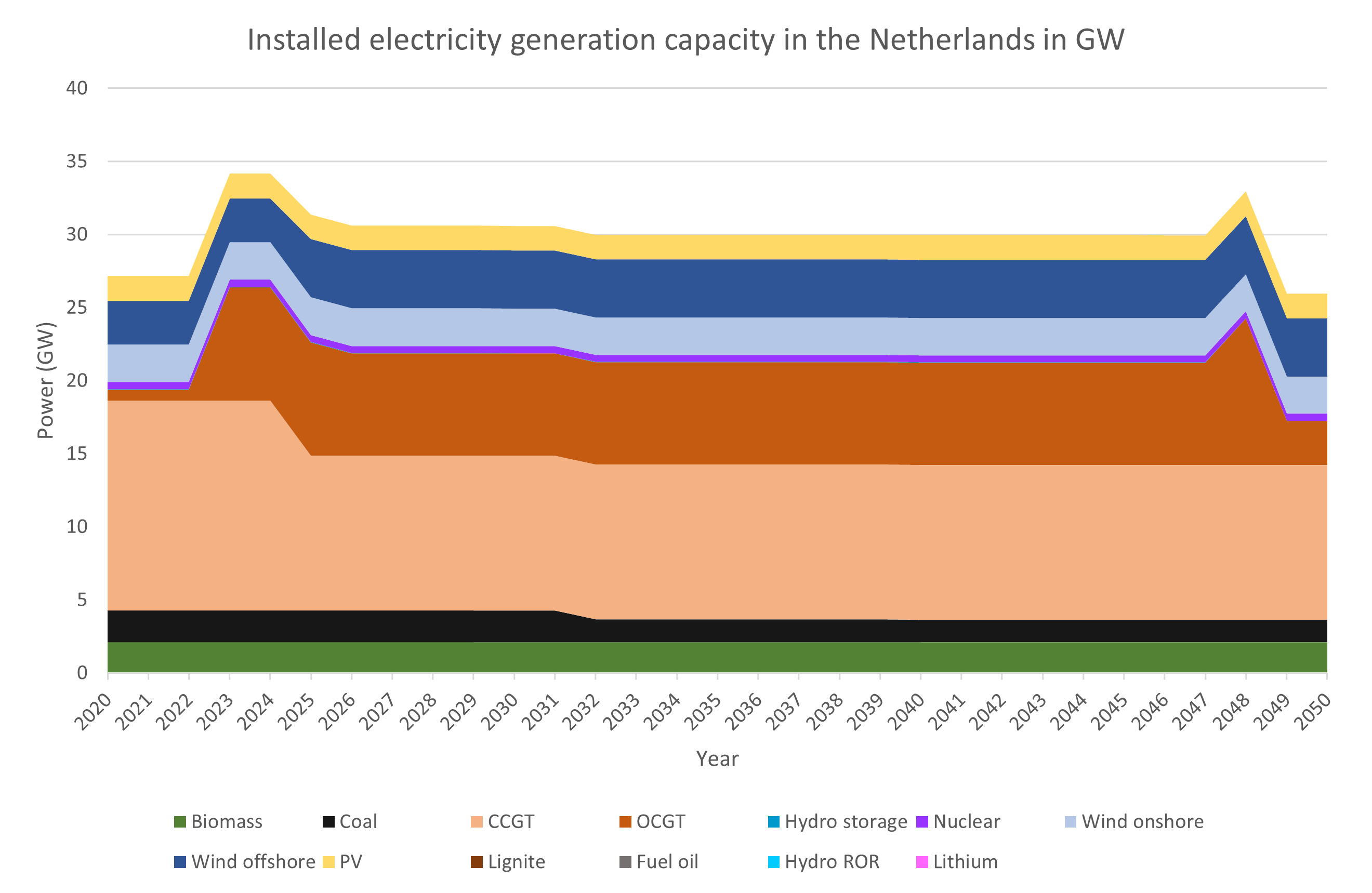

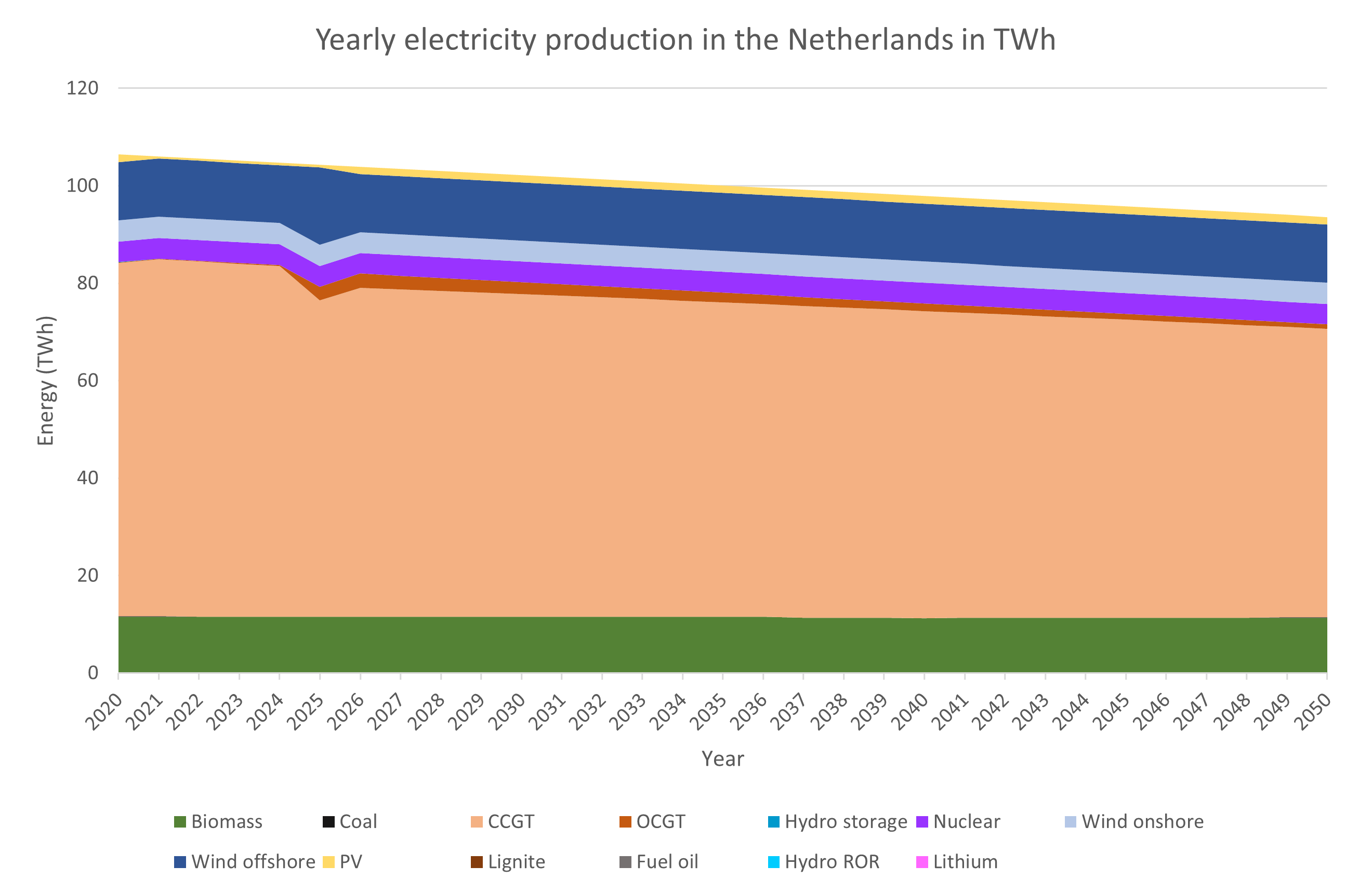

The vertices are sketched of the possible future energy scenario of the Netherlands in 2050. These vertices are the so called scenarios, regional governance, national governance, European CO2-governance and international governance. The simulations were run with a scenario in which the energy demand stays equal and with a scenario where the energy demand descends similar to the international governance scenario. The international governance scenario was chosen to base the simulations on, because the simulations make profit driven decisions, similar to the international governance scenario.

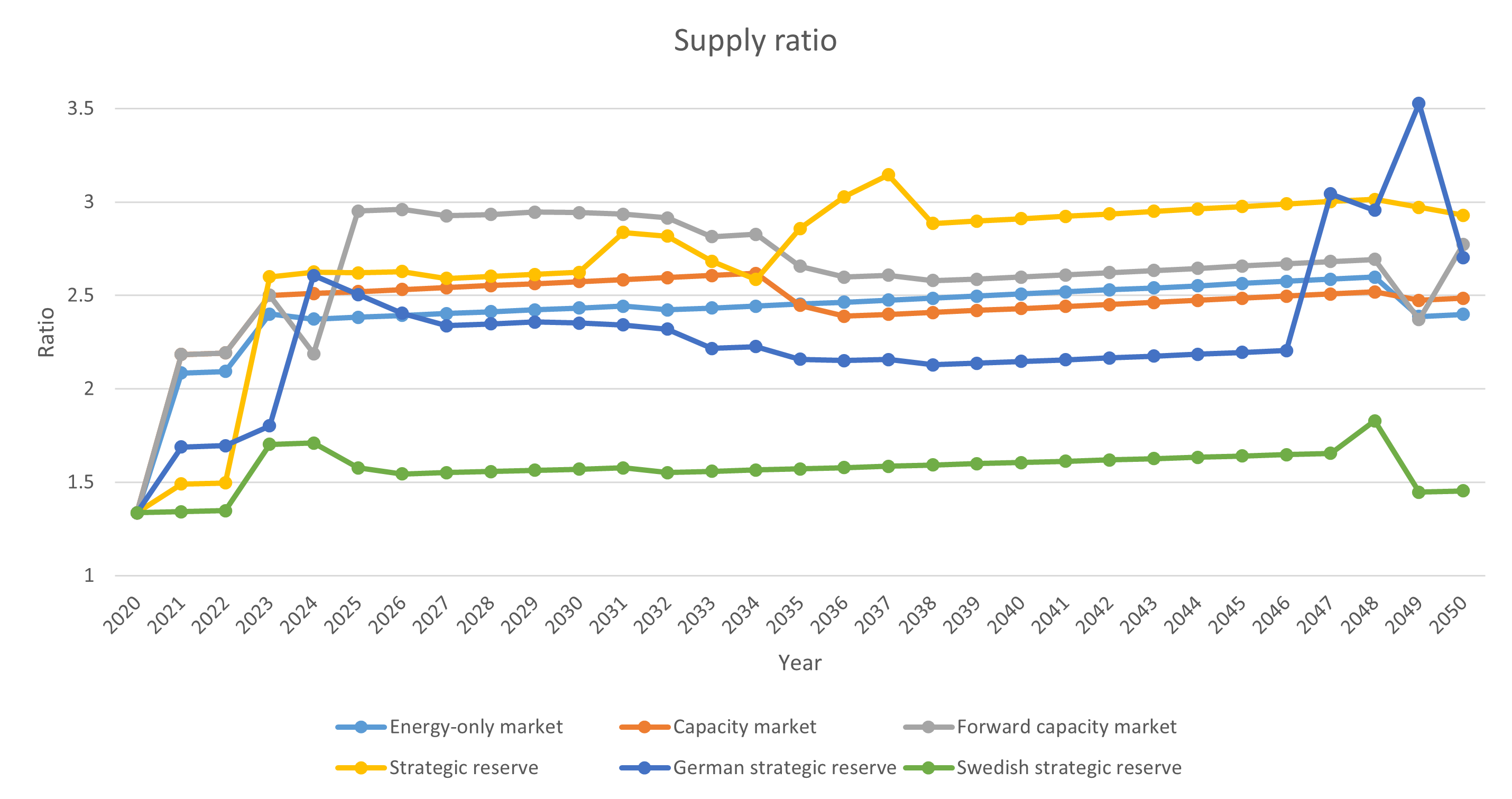

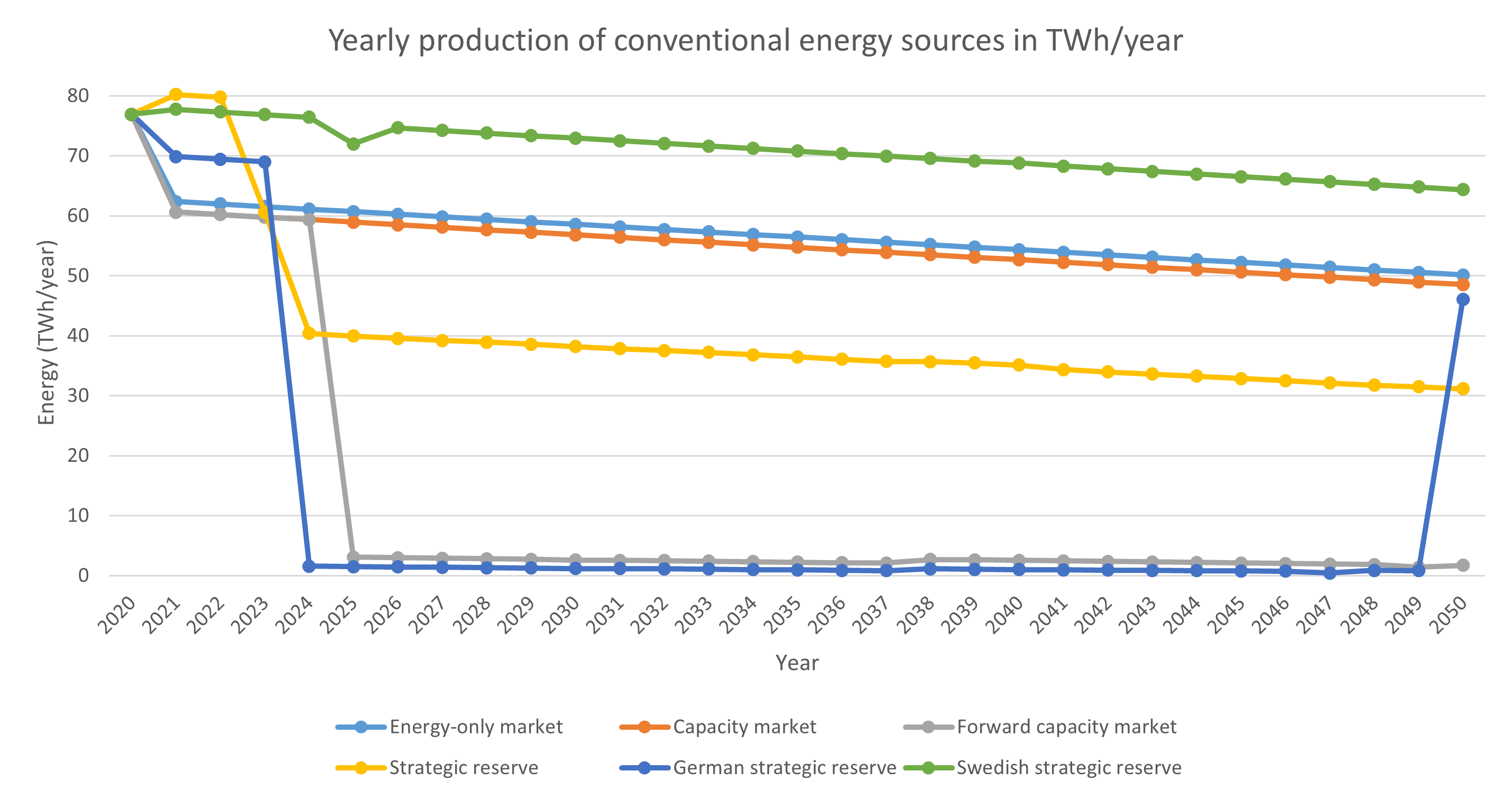

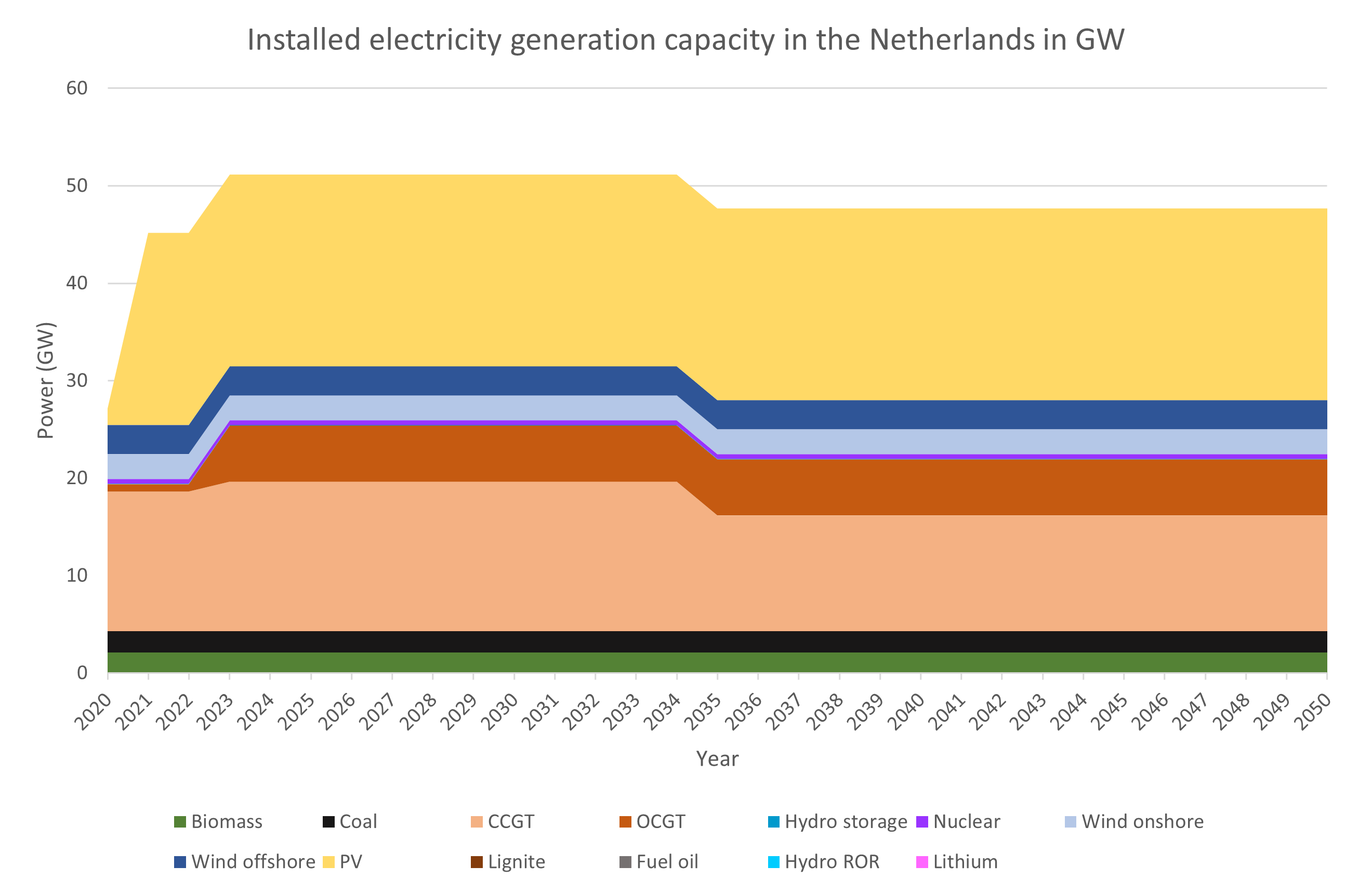

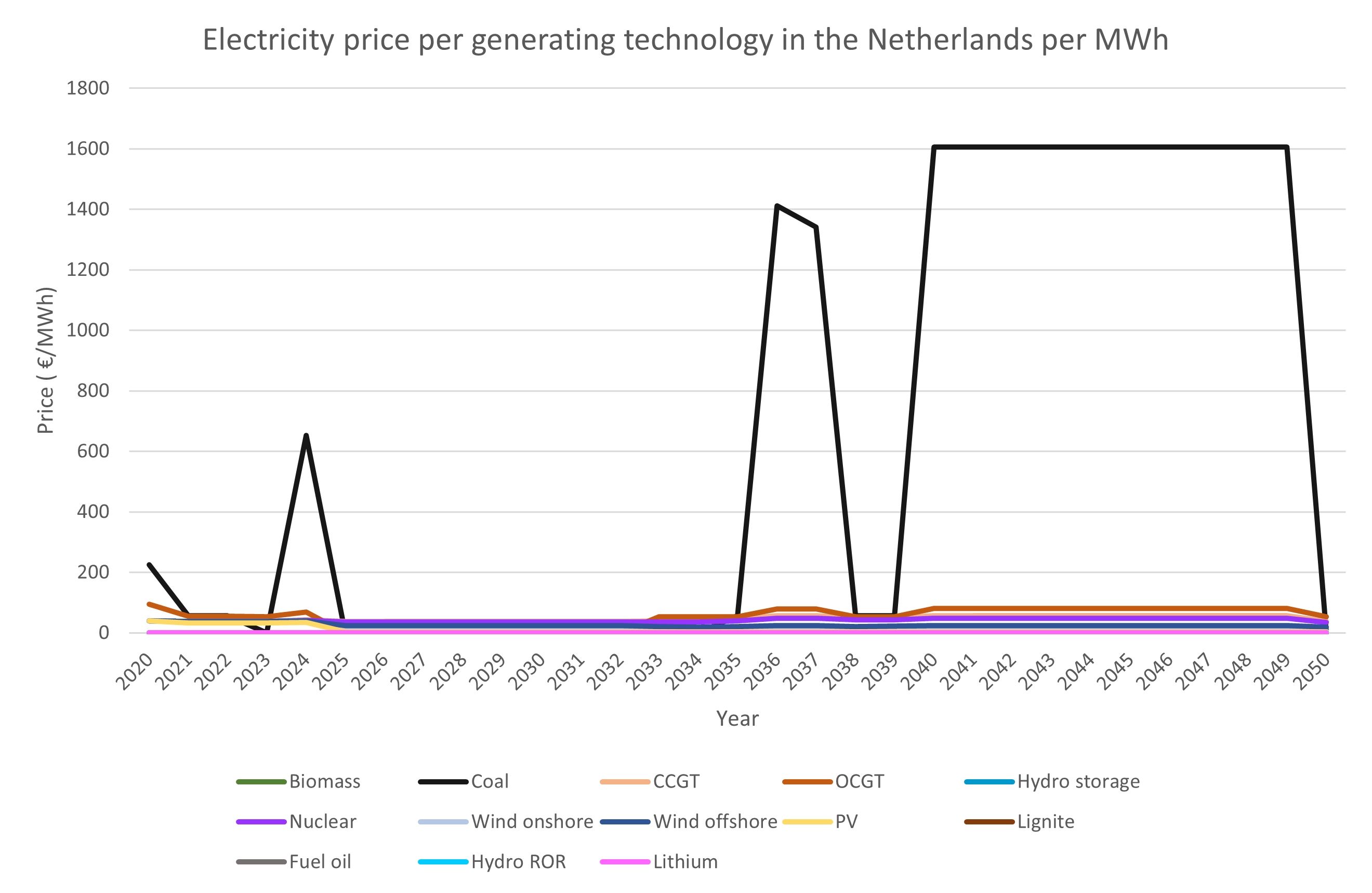

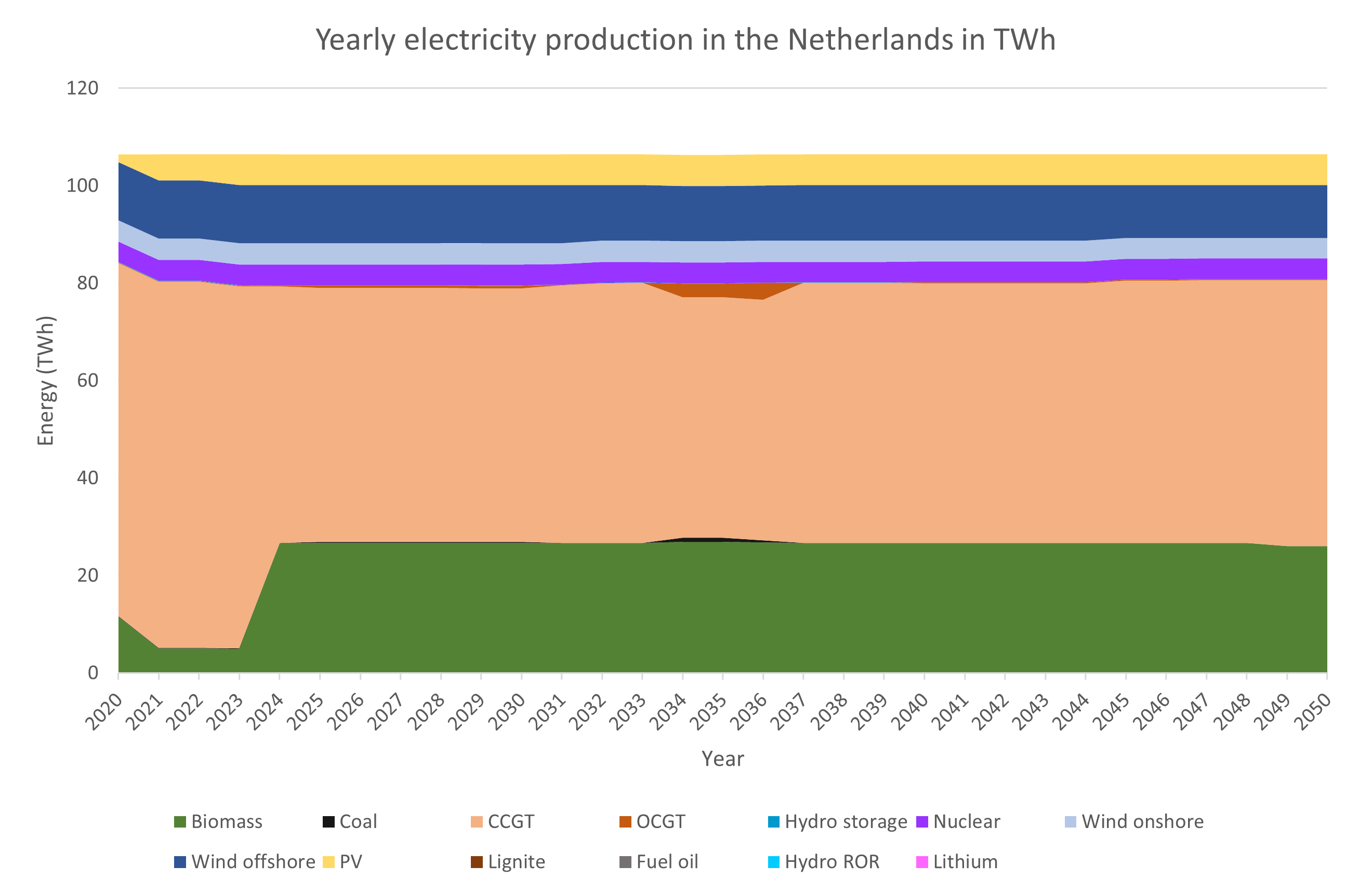

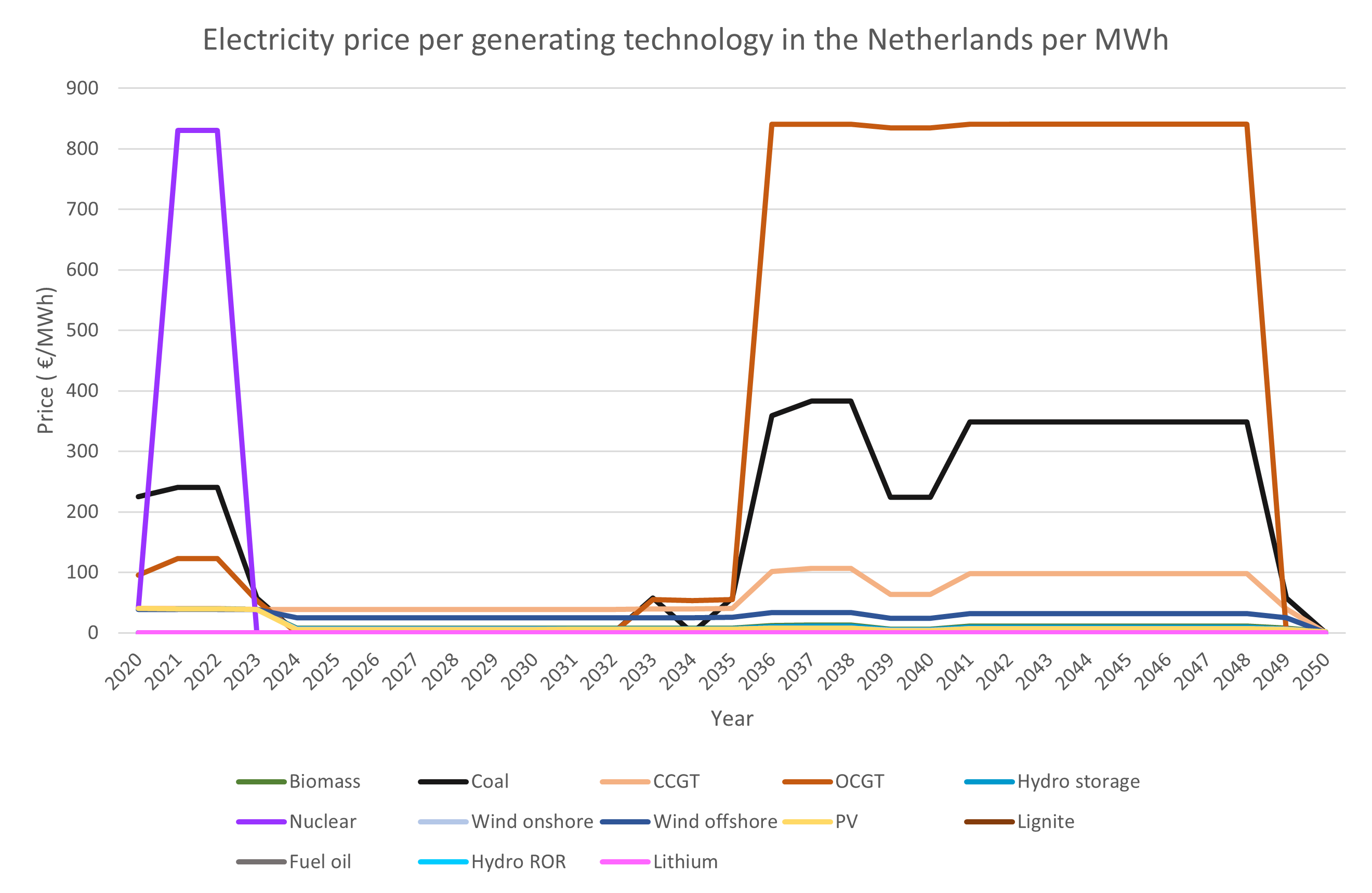

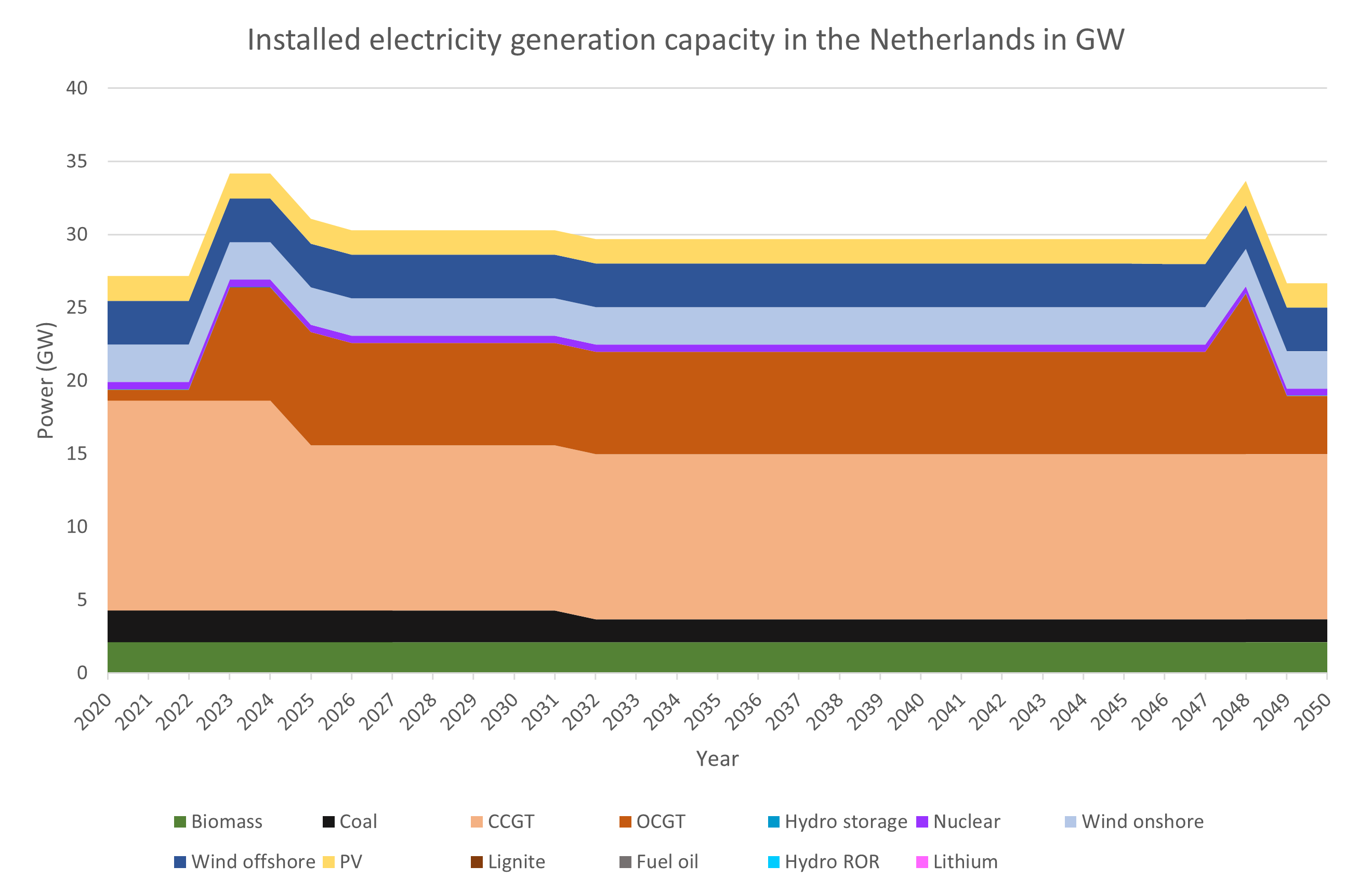

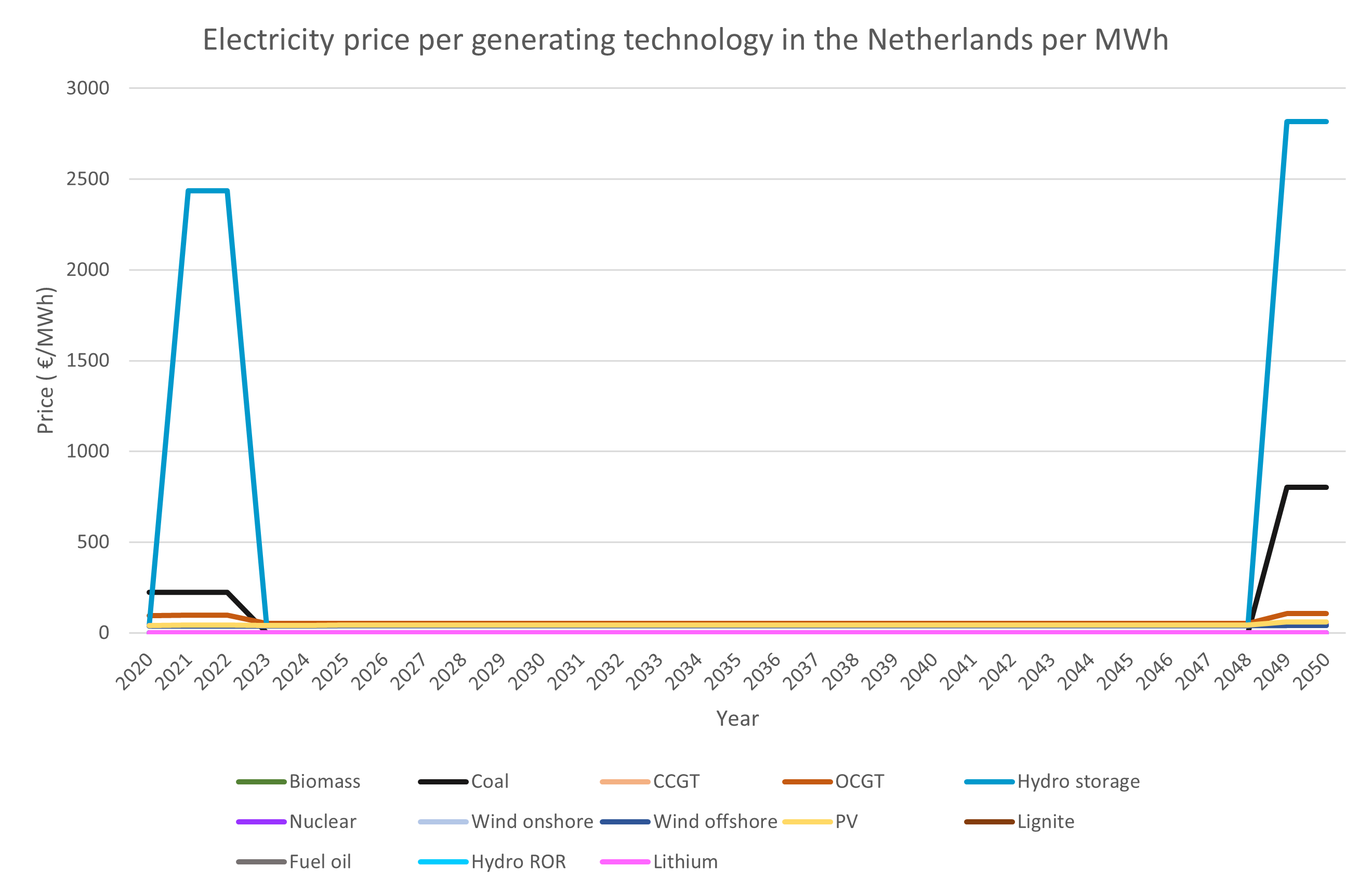

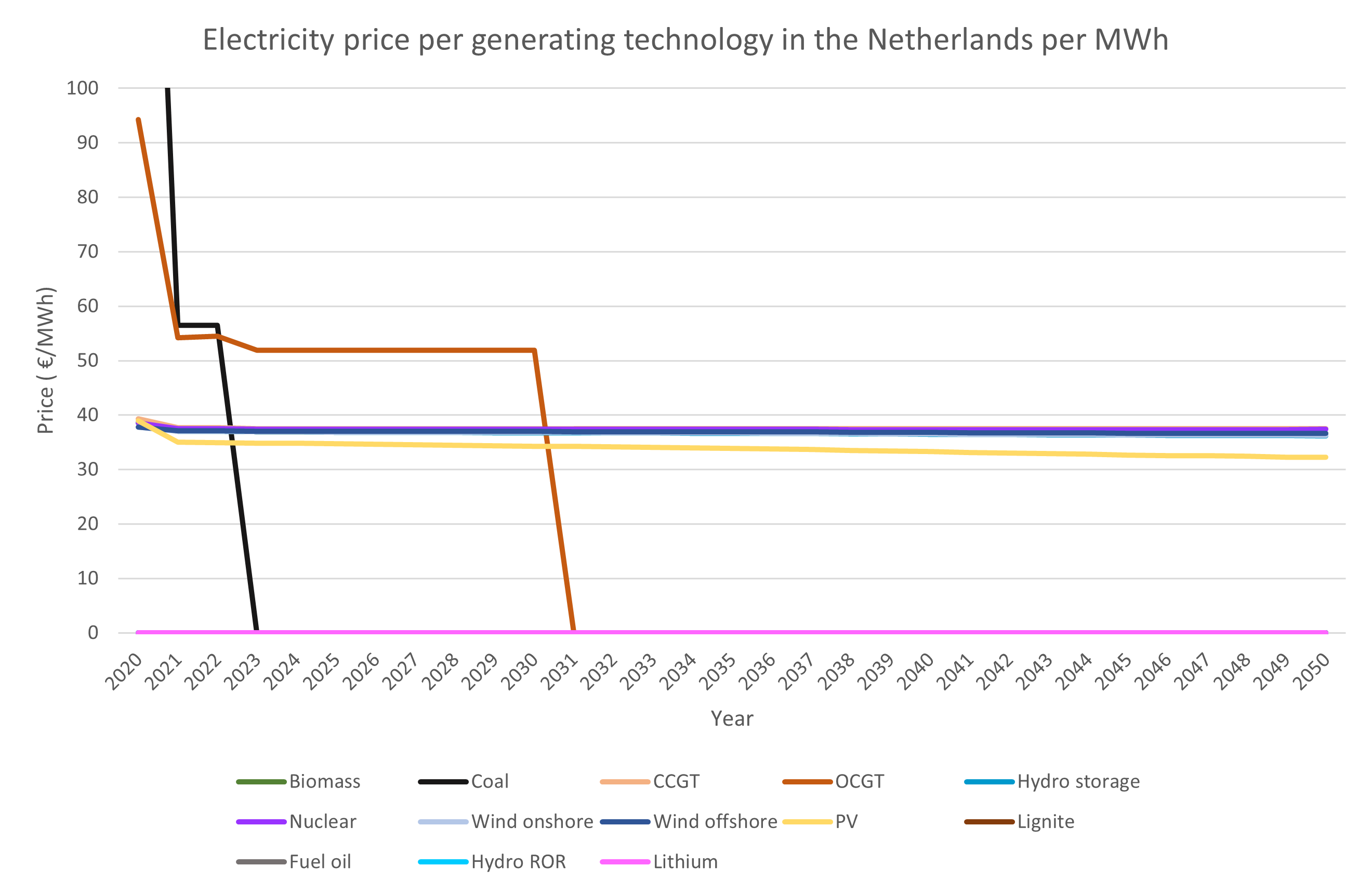

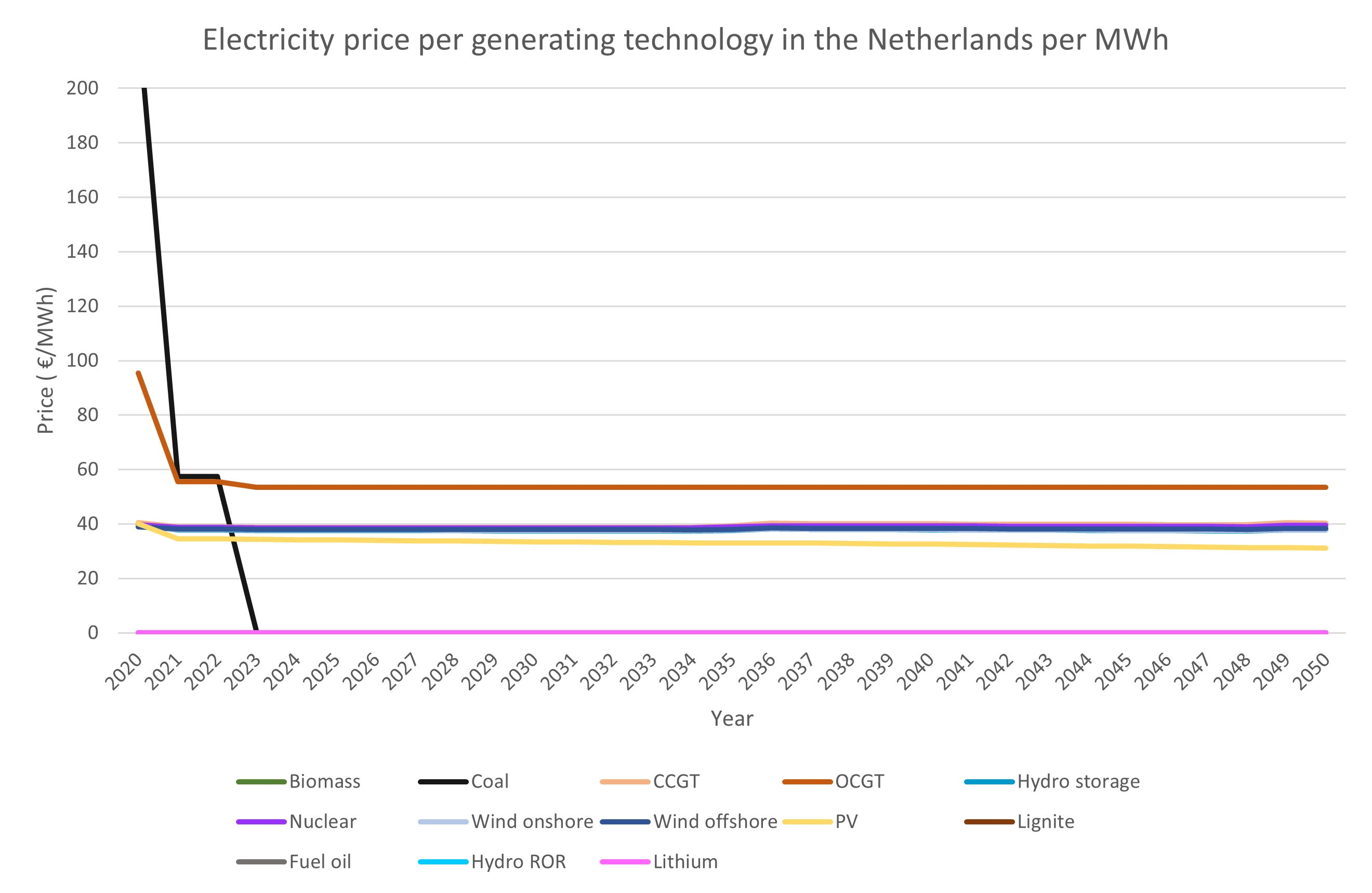

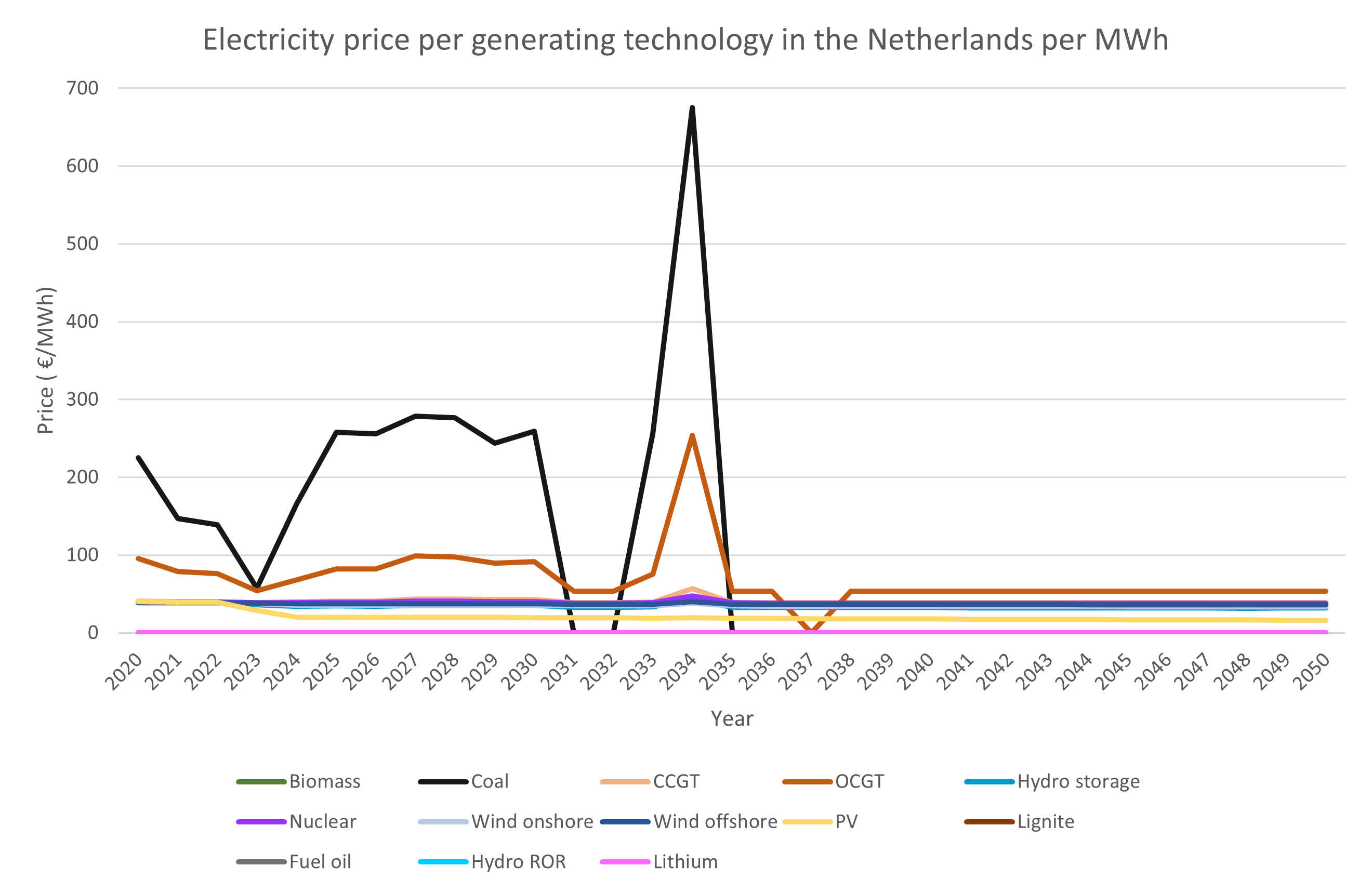

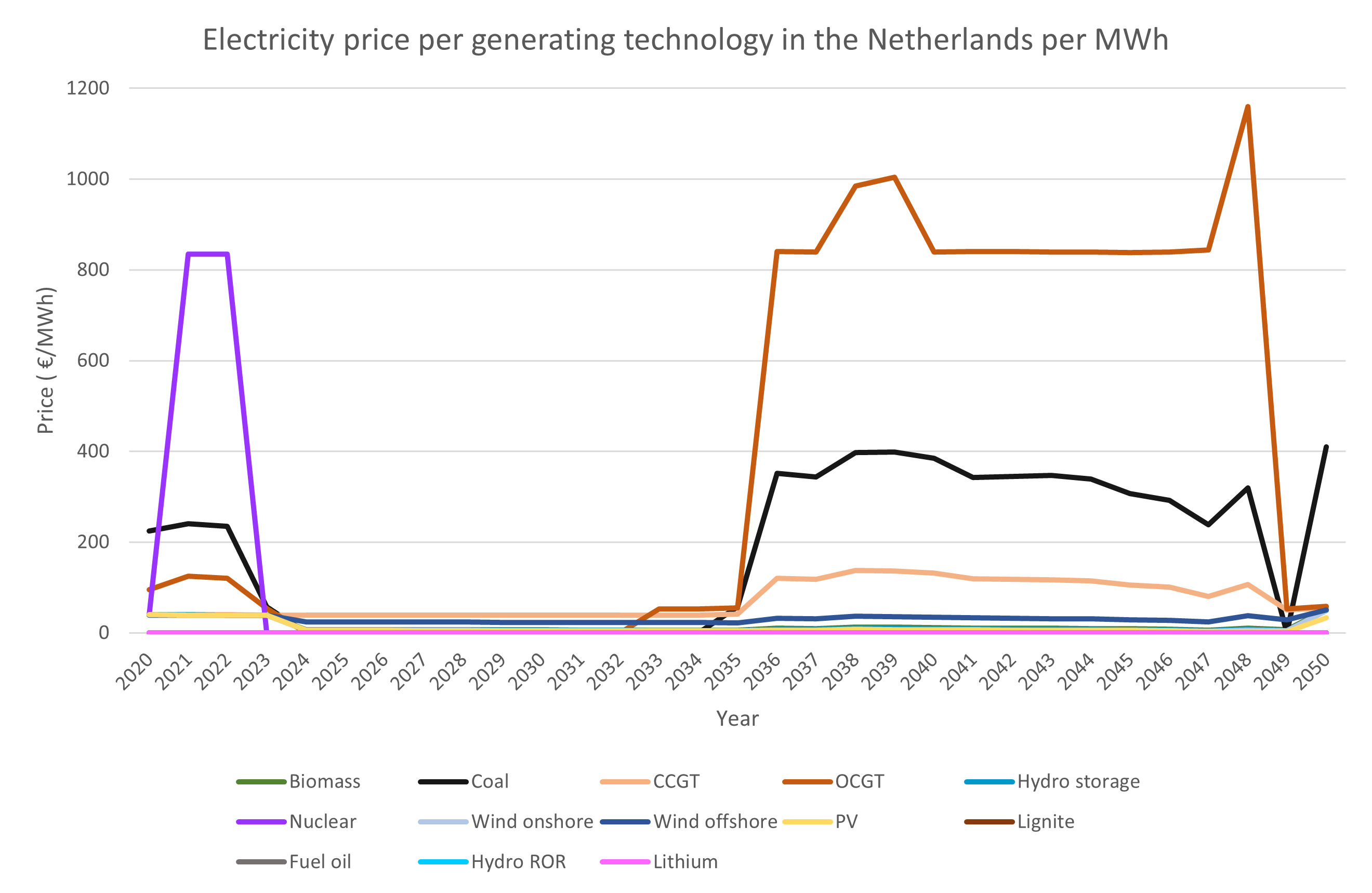

The results of the simulations show that, firstly, without any governmental interference, a (near) zero-carbon energy system will not be achieved in 2050. Secondly, when running the energy-only market in a realistic scenario, no shortage hours will occur and the system had sufficient generation capacity for supplying the demand, even in a "dunkelflaute" scenario. Thirdly, the basic version of the strategic reserve offered the least costly solution for society for providing sufficient security of supply, so no significant shortage periods will occur in a realistic scenario. Finally, the best option for maintaining security of supply in the Netherlands during the transition to a zero-carbon energy system is the implementation of the yearly capacity market.

Videos

Figures

Datasets

Report Word Cloud

Report file summary

Word count: 8451

Page count: 162

Sources cited: 84

Academic sources: 79

Table of Contents

-

tocSee Table of Contents

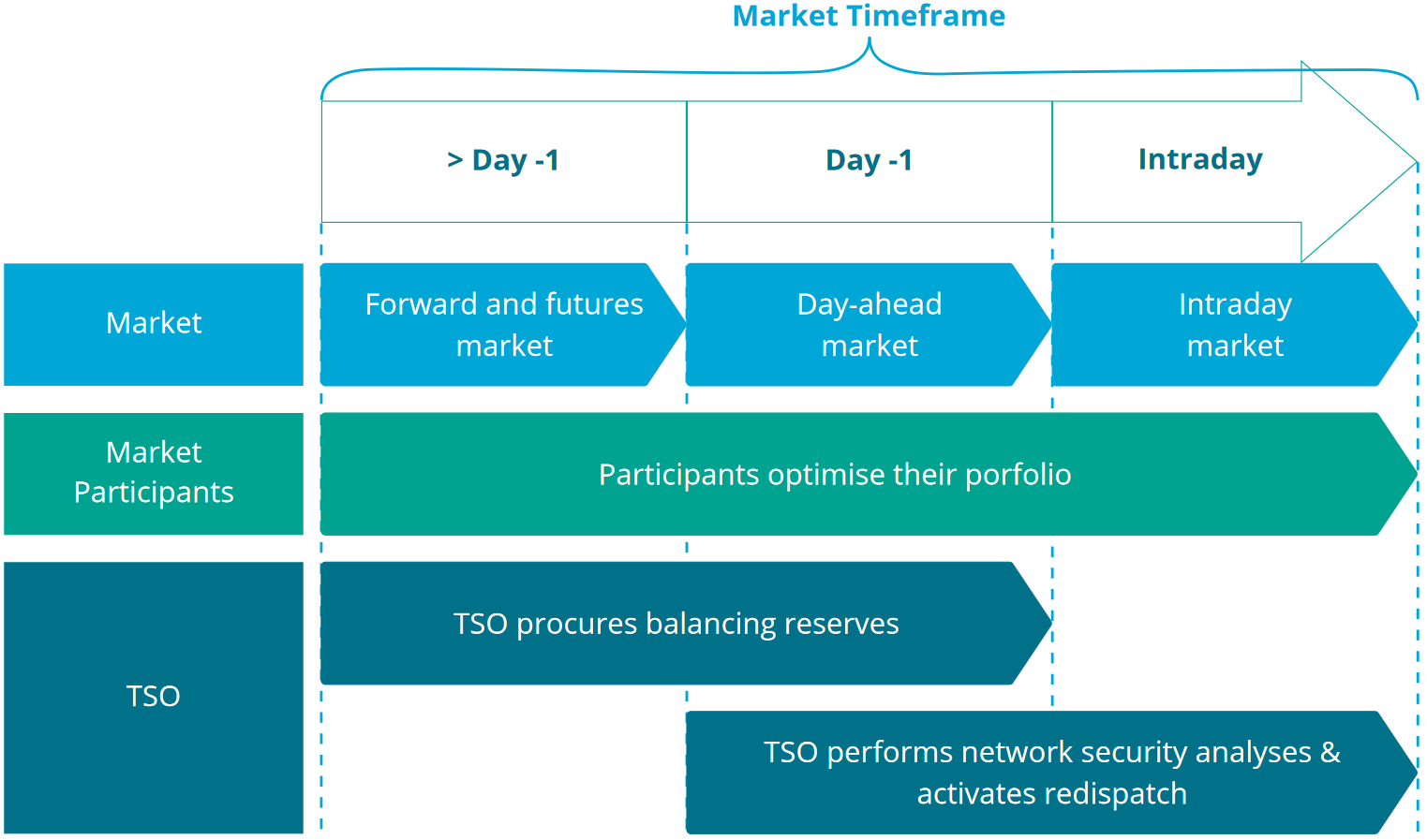

Abstract (3 pages) List of Figures (1 pages) List of Tables (1 pages) List of Abbreviations (1 pages) Introduction (18 pages) European electricity market design (6 pages) Wholesale market design (6 pages) Need for capacity mechanisms (6 pages) Context (8 pages) Research questions (8 pages) Outline of the thesis (7 pages) Dutch Electricity Market (6 pages) Wholesale electricity market (5 pages) Trading platforms (1 pages) Forward and futures market (4 pages) Day head market (6 pages) Intraday market (6 pages) Merit order curve. (6 pages) Capacity Remuneration Mechanisms (6 pages) Energy only market (6 pages) Strategic reserve. (6 pages) German strategic reserve (6 pages) Swedish strategic reserve (6 pages) Capacity market (6 pages) Yearly capacity market (6 pages) Forward capacity market. (6 pages) Capacity subscription (6 pages) Incentives versus control (6 pages) Models (6 pages) Energy Modelling Laboratory (EMLab) (6 pages) Model concept. (6 pages) Model overview (6 pages) Input (6 pages) Model mechanics (6 pages) AMIRIS (6 pages) Model concept. (6 pages) Model overview (6 pages) Input (6 pages) Model mechanics (6 pages) Future Dutch Electricity Mix 29 (6 pages) Regional governance (6 pages) National governance (6 pages) European CO2 governance (6 pages) International governance (6 pages) Feasibility of the scenarios (6 pages) Simulations (6 pages) Coupling of AMIRIS and EMLab. (6 pages) The Spine Toolbox (6 pages) Power plant database update (6 pages) Dutch power plants (6 pages) German power plants (6 pages) Grouping of power plants (6 pages) The baseline scenario. (6 pages) Load demand curve (6 pages) Implementation of the Capacity Mechanisms (6 pages) Strategic reserve. (6 pages) German strategic reserve (6 pages) Swedish strategic reserve (6 pages) Capacity market (6 pages) Yearly capacity market (6 pages) Forward capacity market. (6 pages) Capacity subscription (6 pages) Results (6 pages) Simulations without demand trend (6 pages) Security of supply (6 pages) Energy prices (6 pages) Closeness to reality. (6 pages) Simulations with descending demand trend (6 pages) Security of supply (6 pages) Energy prices (6 pages) Closeness to reality. (6 pages) Conclusion (6 pages) Discussion (6 pages) Future work (6 pages) Simulation Results (6 pages) Simulations without demand trend (6 pages) Energy only market. (6 pages) Yearly capacity market (6 pages) Forward capacity market. (6 pages) Strategic reserve (6 pages) German strategic reserve (6 pages) Swedish strategic reserve (6 pages) Simulations with descending demand trend (6 pages) Energy only market. (6 pages) Yearly capacity market (6 pages) Forward capacity market. (6 pages) Strategic reserve (6 pages) German strategic reserve (6 pages) Swedish strategic reserve (6 pages) Simulation Instructions (6 pages) Bibliography